- Italy

- /

- Infrastructure

- /

- BIT:ATL

Can You Imagine How Atlantia's (BIT:ATL) Shareholders Feel About The 11% Share Price Increase?

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Over the last year the Atlantia S.p.A. (BIT:ATL) share price is up 11%, but that's less than the broader market return. In contrast, the longer term returns are negative, since the share price is 3.2% lower than it was three years ago.

View our latest analysis for Atlantia

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

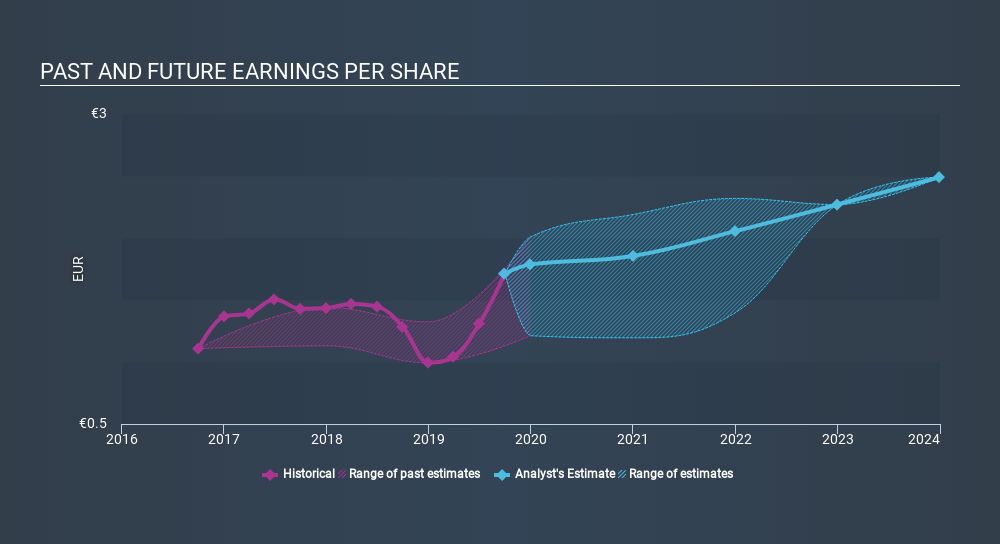

During the last year Atlantia grew its earnings per share (EPS) by 33%. This EPS growth is significantly higher than the 11% increase in the share price. So it seems like the market has cooled on Atlantia, despite the growth. Interesting.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Atlantia has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Atlantia will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Atlantia's TSR for the last year was 15%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Atlantia shareholders gained a total return of 15% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 3.5% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Atlantia (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

We will like Atlantia better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:ATL

Atlantia

Atlantia SpA, through its subsidiaries, engages in the construction and operation of motorways, airports and transport infrastructure, parking areas, and intermodal systems worldwide.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives