- Spain

- /

- Hospitality

- /

- BME:HBX

European Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The European stock market has recently experienced a modest recovery, with the pan-European STOXX Europe 600 Index ending slightly higher after two weeks of losses. Despite ongoing concerns about U.S. tariffs and inflation, there is cautious optimism fueled by potential government spending boosts. In this context, identifying stocks that might be trading below their estimated value can provide investors with opportunities to capitalize on potential growth while navigating the current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Absolent Air Care Group (OM:ABSO) | SEK260.00 | SEK511.61 | 49.2% |

| Somec (BIT:SOM) | €10.30 | €20.55 | 49.9% |

| Romsdal Sparebank (OB:ROMSB) | NOK130.30 | NOK259.95 | 49.9% |

| Vimi Fasteners (BIT:VIM) | €0.97 | €1.91 | 49.2% |

| Gesco (XTRA:GSC1) | €15.60 | €31.15 | 49.9% |

| Deutsche Beteiligungs (XTRA:DBAN) | €26.60 | €53.06 | 49.9% |

| dormakaba Holding (SWX:DOKA) | CHF682.00 | CHF1357.16 | 49.7% |

| Carasent (OM:CARA) | SEK20.70 | SEK41.06 | 49.6% |

| Komplett (OB:KOMPL) | NOK11.05 | NOK21.97 | 49.7% |

| Xplora Technologies (OB:XPLRA) | NOK27.50 | NOK53.55 | 48.6% |

Here's a peek at a few of the choices from the screener.

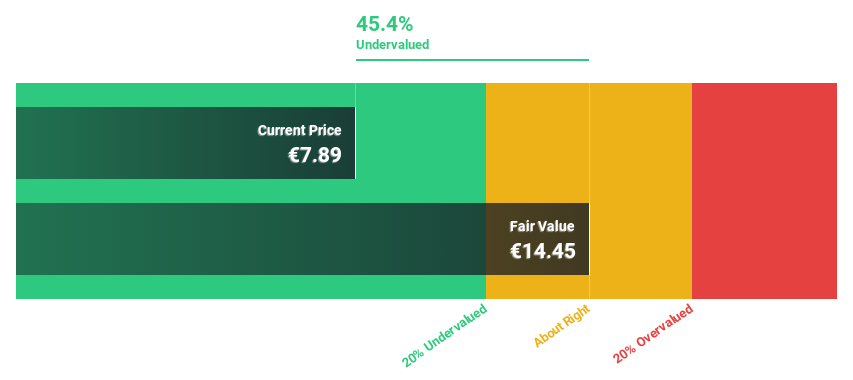

A.L.A. società per azioni (BIT:ALA)

Overview: A.L.A. società per azioni is a supply chain solutions provider serving the aerospace and defense, rail, and high-tech sectors, with a market cap of €283.54 million.

Operations: A.L.A. società per azioni generates revenue through its supply chain solutions in the aerospace and defense, rail, and high-tech industries.

Estimated Discount To Fair Value: 24.4%

A.L.A. società per azioni is trading at €31.4, significantly below its estimated fair value of €41.55, indicating it is undervalued based on cash flow analysis. Despite a high forecasted return on equity of 25.8% in three years and earnings growth expected to outpace the Italian market, concerns exist as operating cash flow does not adequately cover debt and dividends are not well supported by free cash flows.

- Our growth report here indicates A.L.A. società per azioni may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of A.L.A. società per azioni stock in this financial health report.

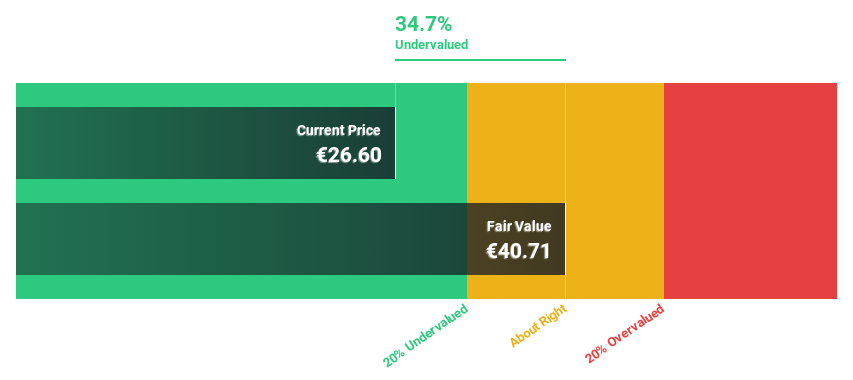

Arteche Lantegi Elkartea (BME:ART)

Overview: Arteche Lantegi Elkartea, S.A. designs, manufactures, integrates, and supplies electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market cap of €444.50 million.

Operations: Arteche Lantegi Elkartea generates revenue through its design, manufacturing, integration, and supply of electrical equipment and solutions targeting renewable energy sectors and smart grid systems across Spain and global markets.

Estimated Discount To Fair Value: 26.6%

Arteche Lantegi Elkartea is trading at €7.8, below its estimated fair value of €10.62, highlighting undervaluation based on cash flows. The company reported a net income increase to €18.9 million from €12.06 million year-over-year and anticipates earnings growth of 20.84% annually, surpassing the Spanish market's forecasted growth rate of 5.8%. Despite high volatility in share price, Arteche's revenue growth outpaces the domestic market average at 8.7% per year.

- The growth report we've compiled suggests that Arteche Lantegi Elkartea's future prospects could be on the up.

- Take a closer look at Arteche Lantegi Elkartea's balance sheet health here in our report.

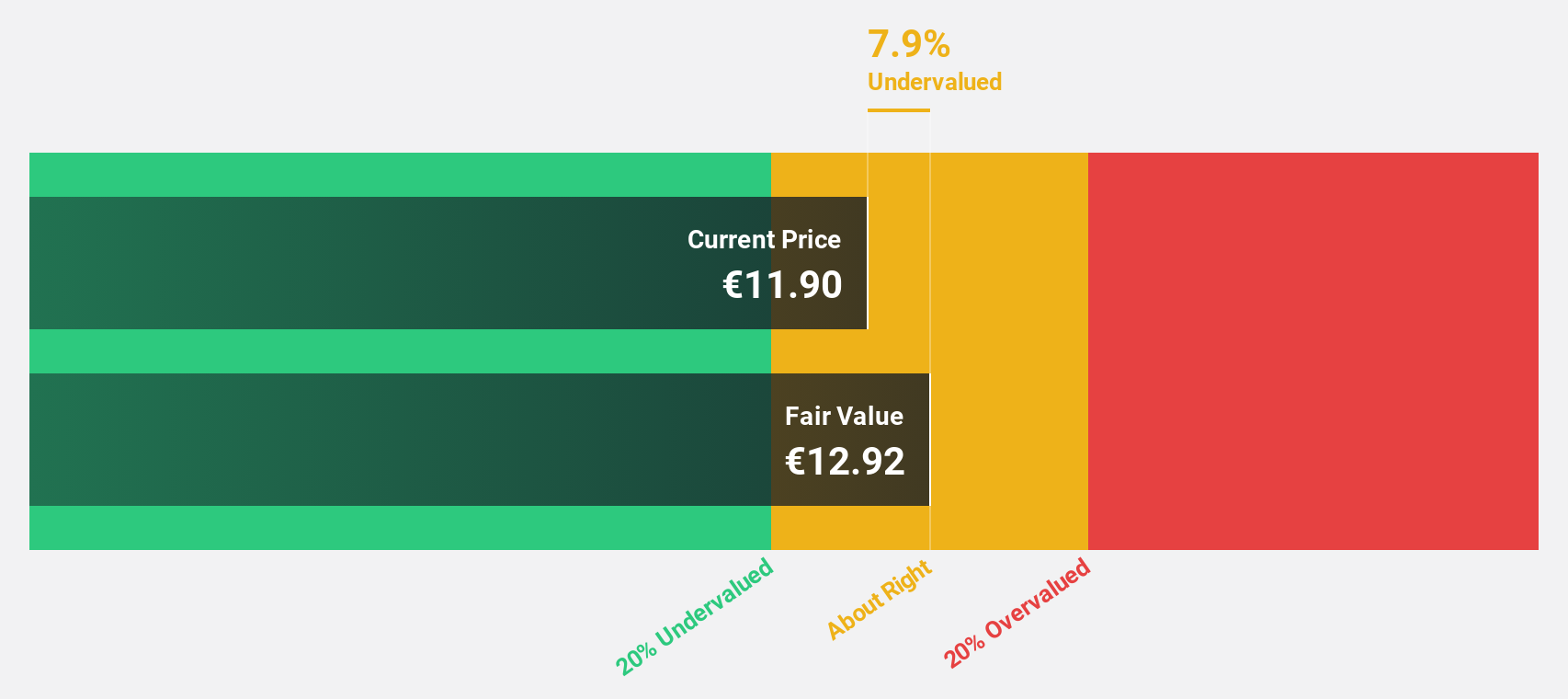

HBX Group International (BME:HBX)

Overview: HBX Group International plc specializes in the intermediation of hotel accommodation and has a market cap of €2.78 billion.

Operations: The company's revenue is derived from three main segments: €30 million from Hoteltech, €611 million from Accommodation, and €52 million from Mobility & Experience.

Estimated Discount To Fair Value: 38.9%

HBX Group International, trading at €11.26, is significantly undervalued compared to its estimated fair value of €18.43. The company recently completed a €748 million IPO and anticipates revenue growth of 8.5% annually, above the Spanish market average of 5.1%. Earnings are projected to grow by 45.29% per year, with profitability expected in three years, despite negative shareholders' equity and illiquid shares that may affect investor sentiment.

- According our earnings growth report, there's an indication that HBX Group International might be ready to expand.

- Navigate through the intricacies of HBX Group International with our comprehensive financial health report here.

Next Steps

- Access the full spectrum of 209 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HBX Group International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:HBX

HBX Group International

Engages in the intermediation of hotel accommodation.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives