- Italy

- /

- Infrastructure

- /

- BIT:ADB

Is Aeroporto Guglielmo Marconi di Bologna (BIT:ADB) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Aeroporto Guglielmo Marconi di Bologna S.p.A. (BIT:ADB) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Aeroporto Guglielmo Marconi di Bologna

What Is Aeroporto Guglielmo Marconi di Bologna's Net Debt?

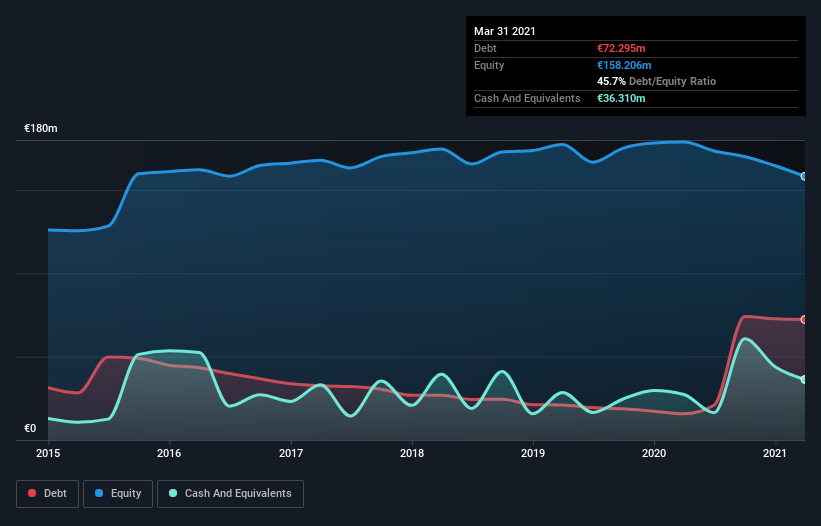

The image below, which you can click on for greater detail, shows that at March 2021 Aeroporto Guglielmo Marconi di Bologna had debt of €72.3m, up from €15.8m in one year. However, it does have €36.3m in cash offsetting this, leading to net debt of about €36.0m.

A Look At Aeroporto Guglielmo Marconi di Bologna's Liabilities

Zooming in on the latest balance sheet data, we can see that Aeroporto Guglielmo Marconi di Bologna had liabilities of €43.2m due within 12 months and liabilities of €88.6m due beyond that. Offsetting this, it had €36.3m in cash and €8.57m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €86.9m.

Aeroporto Guglielmo Marconi di Bologna has a market capitalization of €379.3m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Aeroporto Guglielmo Marconi di Bologna's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Aeroporto Guglielmo Marconi di Bologna had a loss before interest and tax, and actually shrunk its revenue by 55%, to €53m. That makes us nervous, to say the least.

Caveat Emptor

While Aeroporto Guglielmo Marconi di Bologna's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost €27m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through €48m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Aeroporto Guglielmo Marconi di Bologna is showing 1 warning sign in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Aeroporto Guglielmo Marconi di Bologna or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:ADB

Aeroporto Guglielmo Marconi di Bologna

Develops, manages, and maintains an airport in Italy and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026