- Italy

- /

- Telecom Services and Carriers

- /

- BIT:TIT

Telecom Italia S.p.A.'s (BIT:TIT) Price Is Right But Growth Is Lacking

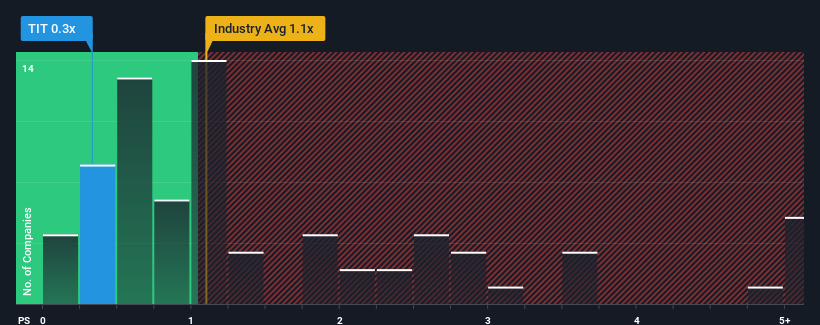

With a price-to-sales (or "P/S") ratio of 0.3x Telecom Italia S.p.A. (BIT:TIT) may be sending bullish signals at the moment, given that almost half of all the Telecom companies in Italy have P/S ratios greater than 1x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Telecom Italia

What Does Telecom Italia's P/S Mean For Shareholders?

There hasn't been much to differentiate Telecom Italia's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Telecom Italia will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Telecom Italia.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Telecom Italia's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. The latest three year period has also seen a 5.9% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 10% as estimated by the six analysts watching the company. Meanwhile, the broader industry is forecast to expand by 1.9%, which paints a poor picture.

With this information, we are not surprised that Telecom Italia is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Telecom Italia's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Telecom Italia maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Telecom Italia with six simple checks.

If you're unsure about the strength of Telecom Italia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Telecom Italia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TIT

Telecom Italia

Engages in the fixed and mobile telecommunications services in Italy and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives