- Italy

- /

- Telecom Services and Carriers

- /

- BIT:TIT

A Fresh Look at Telecom Italia (BIT:TIT): Is the Recent Rally Justified by Valuation?

Reviewed by Simply Wall St

Telecom Italia (BIT:TIT) is back in the limelight, and investors might be scratching their heads about what’s fueling the action. Without a headline-grabbing announcement, sometimes it is the quiet shifts in sentiment or subtle moves in the market that set the stage for a new story. Whether you already own the stock or are scanning for overlooked opportunities, you might be wondering what’s really going on beneath the surface right now.

Looking at share price momentum, Telecom Italia has made steady gains over the past year, including a significant 90% total return for shareholders. The past three months alone have seen a sharp upswing, hinting at changing sentiment or renewed optimism despite the company’s ongoing challenges. This is all unfolding as Telekom Italia continues navigating a tough competitive landscape, with annual net income growth helping some investors justify a fresh look at the stock.

So the real question is, after this year’s big run, is Telecom Italia undervalued, or has the market already priced in all that future growth?

Most Popular Narrative: Fairly Valued

The most widely followed narrative calls Telecom Italia fairly valued, with only a small difference between the current share price and analysts’ price target. This view is shaped by expectations for digital expansion, efficiency gains, and moderate earnings recovery in the years ahead.

The rollout of higher-value digital and cloud services is accelerating. TIM Enterprise is demonstrating strong double-digit growth in cloud (+25%) and continued leadership in secure, sovereign digital services. This positions the company to capture a larger share of high-margin B2B and public sector demand, which could drive revenue growth and margin expansion in the coming years.

Curious how analysts arrive at this valuation target? The secret lies in precise forward-looking assumptions and a big swing in profitability. Want to know which financial leaps underpin this so-called fair value, and what must go right to reach it? The full narrative reveals the analyst playbook behind these projections. Explore the calculations and surprises shaping the price target.

Result: Fair Value of €0.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, intense competition and heavy reliance on ongoing cost reductions could present challenges for Telecom Italia’s ability to deliver the growth needed to justify its valuation.

Find out about the key risks to this Telecom Italia narrative.Another View: Discounted Cash Flow Tells a Different Story

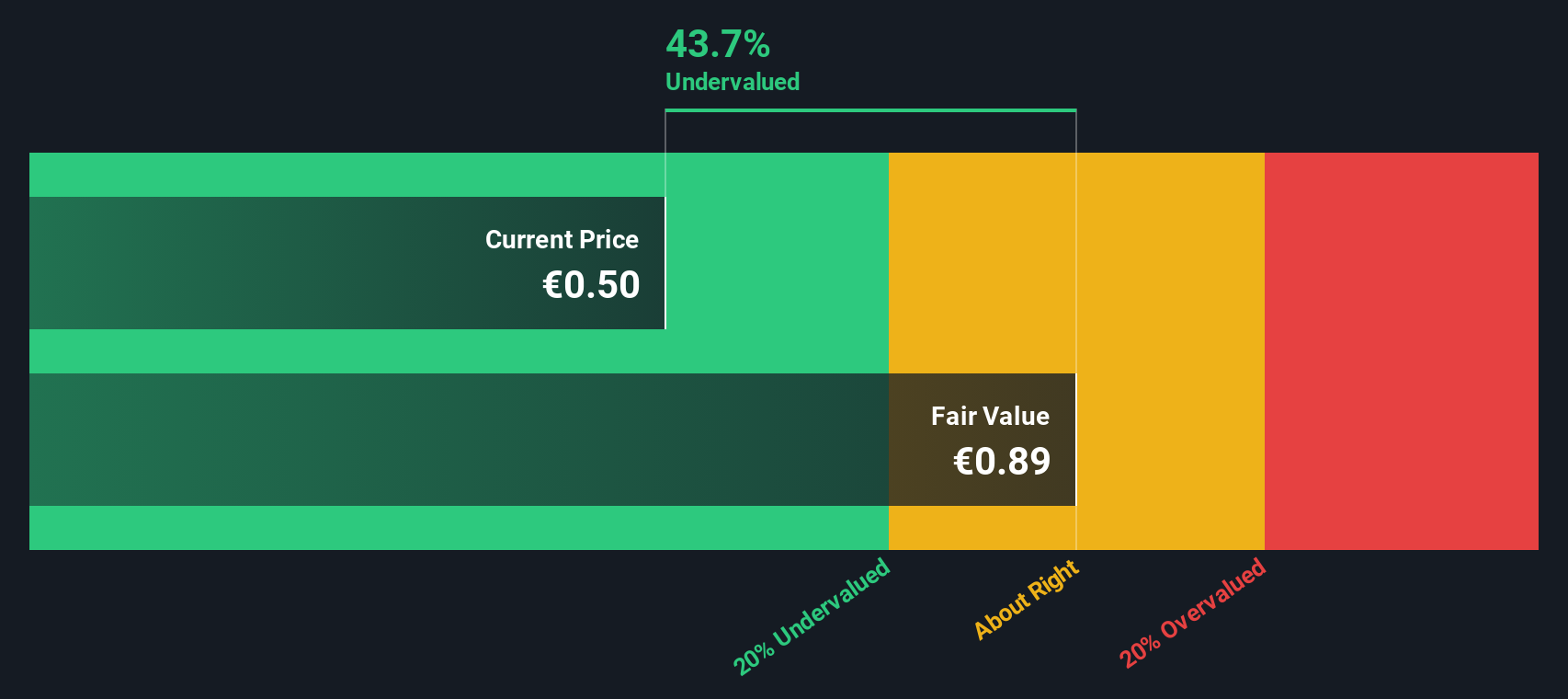

Taking a look through the lens of our DCF model, Telecom Italia appears significantly undervalued. This challenges the earlier fair value assessment based on analyst targets. Can the cash flow method reveal hidden long-term upside for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Telecom Italia Narrative

If you see things differently or want to dig deeper into the data, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Telecom Italia.

Looking for More Investment Ideas?

Smart investors never limit themselves to a single story. Step into new opportunities by targeting sectors and strategies poised for growth and staying ahead of the crowd.

- Spot income powerhouses that consistently deliver above-average yields by tapping into dividend stocks with yields > 3% to help secure your portfolio’s steady cash flow.

- Ride the AI momentum by tracking the next generation of innovators with AI penny stocks as they lead breakthroughs in data, automation, and intelligent solutions.

- Capitalize on under-the-radar gems positioned for strong returns through undervalued stocks based on cash flows for a head start on value opportunities before markets catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telecom Italia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:TIT

Telecom Italia

Engages in the fixed and mobile telecommunications services in Italy and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives