- Italy

- /

- Telecom Services and Carriers

- /

- BIT:ITD

Is Intred (BIT:ITD) A Future Multi-bagger?

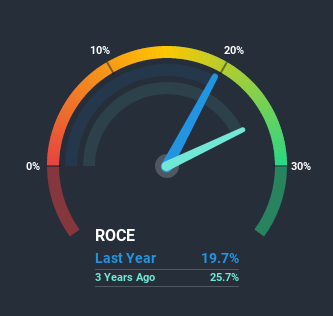

What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at Intred (BIT:ITD) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Intred:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = €6.8m ÷ (€50m - €16m) (Based on the trailing twelve months to June 2020).

Thus, Intred has an ROCE of 20%. On its own, that's a standard return, however it's much better than the 4.7% generated by the Telecom industry.

Check out our latest analysis for Intred

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Intred's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

The trends we've noticed at Intred are quite reassuring. The data shows that returns on capital have increased substantially over the last five years to 20%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 389%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

One more thing to note, Intred has decreased current liabilities to 31% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. This tells us that Intred has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.What We Can Learn From Intred's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Intred has. And with a respectable 72% awarded to those who held the stock over the last year, you could argue that these developments are starting to get the attention they deserve. In light of that, we think it's worth looking further into this stock because if Intred can keep these trends up, it could have a bright future ahead.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation on our platform that is definitely worth checking out.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Intred, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:ITD

Intred

A telecommunications operator, provides data and voice services in Italy.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

MongoDB Inc. (MDB): The Data Platform Pivot – Navigating the FY2027 Outlook in 2026.

Seagate Technology Holdings PLC (STX): The HAMR of AI – Forging the High-Capacity Storage Moat in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks