- Italy

- /

- Telecom Services and Carriers

- /

- BIT:INW

Is The Market Rewarding Infrastrutture Wireless Italiane S.p.A. (BIT:INW) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

It is hard to get excited after looking at Infrastrutture Wireless Italiane's (BIT:INW) recent performance, when its stock has declined 8.9% over the past month. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Infrastrutture Wireless Italiane's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Infrastrutture Wireless Italiane

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Infrastrutture Wireless Italiane is:

3.4% = €152m ÷ €4.5b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Infrastrutture Wireless Italiane's Earnings Growth And 3.4% ROE

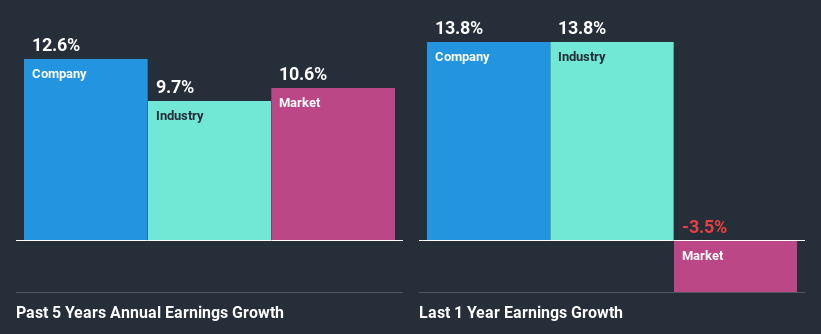

It is quite clear that Infrastrutture Wireless Italiane's ROE is rather low. Even when compared to the industry average of 6.4%, the ROE figure is pretty disappointing. Infrastrutture Wireless Italiane was still able to see a decent net income growth of 13% over the past five years. We believe that there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Infrastrutture Wireless Italiane's reported growth was lower than the industry growth of 20% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Infrastrutture Wireless Italiane fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Infrastrutture Wireless Italiane Using Its Retained Earnings Effectively?

Infrastrutture Wireless Italiane has a significant three-year median payout ratio of 83%, meaning that it is left with only 17% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Additionally, Infrastrutture Wireless Italiane has paid dividends over a period of five years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 126% over the next three years. However, Infrastrutture Wireless Italiane's future ROE is expected to rise to 7.2% despite the expected increase in the company's payout ratio. We infer that there could be other factors that could be driving the anticipated growth in the company's ROE.

Conclusion

In total, we're a bit ambivalent about Infrastrutture Wireless Italiane's performance. Although the company has shown a fair bit of growth in earnings, the reinvestment rate is low. Meaning, the earnings growth number could have been significantly higher had the company been retaining more of its profits and reinvesting that at a higher rate of return. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you’re looking to trade Infrastrutture Wireless Italiane, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:INW

Infrastrutture Wireless Italiane

Operates in the electronic communications infrastructure sector in Italy.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives