Solid World Group S.p.A. (BIT:S3D) Might Not Be As Mispriced As It Looks

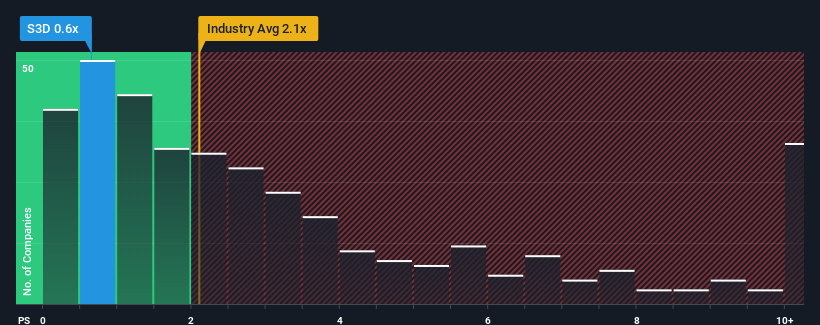

When you see that almost half of the companies in the Software industry in Italy have price-to-sales ratios (or "P/S") above 1.2x, Solid World Group S.p.A. (BIT:S3D) looks to be giving off some buy signals with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Solid World Group

What Does Solid World Group's P/S Mean For Shareholders?

There hasn't been much to differentiate Solid World Group's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Solid World Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Solid World Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 9.1% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 31% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 12% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 14% each year, which is not materially different.

With this information, we find it odd that Solid World Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Solid World Group remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks. Case in point, we've spotted 3 warning signs for Solid World Group you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:S3D

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

Unique One, Retail Sector, but Short Time Investmentnya Almost 2,5 kali Persediaan

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion