Digital Value (BIT:DGV) Has Announced That Its Dividend Will Be Reduced To €0.80

Digital Value S.p.A.'s (BIT:DGV) dividend is being reduced by 16% to €0.80 per share on 9th of July, in comparison to last year's comparable payment of €0.95. The dividend yield of 3.6% is still a nice boost to shareholder returns, despite the cut.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Digital Value's stock price has increased by 42% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

We've discovered 3 warning signs about Digital Value. View them for free.Digital Value's Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Digital Value was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

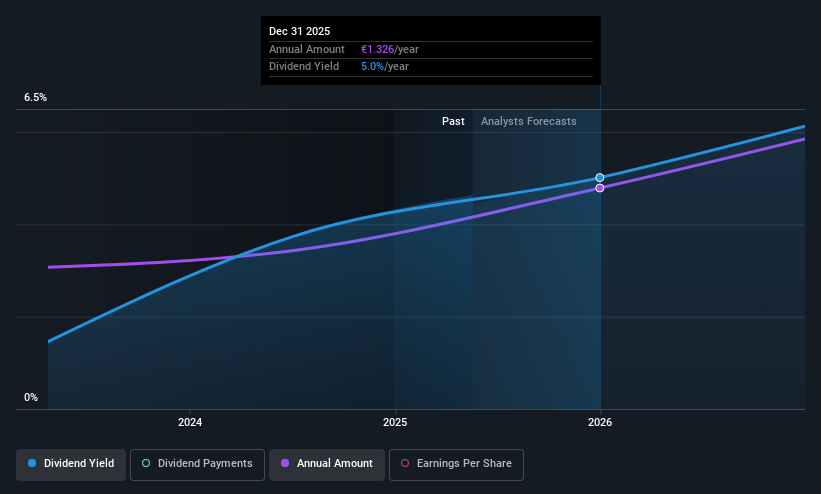

If the trend of the last few years continues, EPS will grow by 12.3% over the next 12 months. If the dividend continues on this path, the payout ratio could be 17% by next year, which we think can be pretty sustainable going forward.

Check out our latest analysis for Digital Value

Digital Value Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2023, the dividend has gone from €0.85 total annually to €0.95. This works out to be a compound annual growth rate (CAGR) of approximately 5.7% a year over that time. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider Digital Value to be a consistent dividend paying stock.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Digital Value has grown earnings per share at 12% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Digital Value's prospects of growing its dividend payments in the future.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 3 warning signs for Digital Value (2 are significant!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DGV

Digital Value

Provides information and communication technology (ICT) solutions and services in Italy.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion