DBA Group S.p.A. (BIT:DBA), is not the largest company out there, but it saw a significant share price rise of over 20% in the past couple of months on the BIT. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s take a look at DBA Group’s outlook and value based on the most recent financial data to see if the opportunity still exists.

Check out our latest analysis for DBA Group

What is DBA Group worth?

Great news for investors – DBA Group is still trading at a fairly cheap price. My valuation model shows that the intrinsic value for the stock is €1.37, but it is currently trading at €0.91 on the share market, meaning that there is still an opportunity to buy now. What’s more interesting is that, DBA Group’s share price is theoretically quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

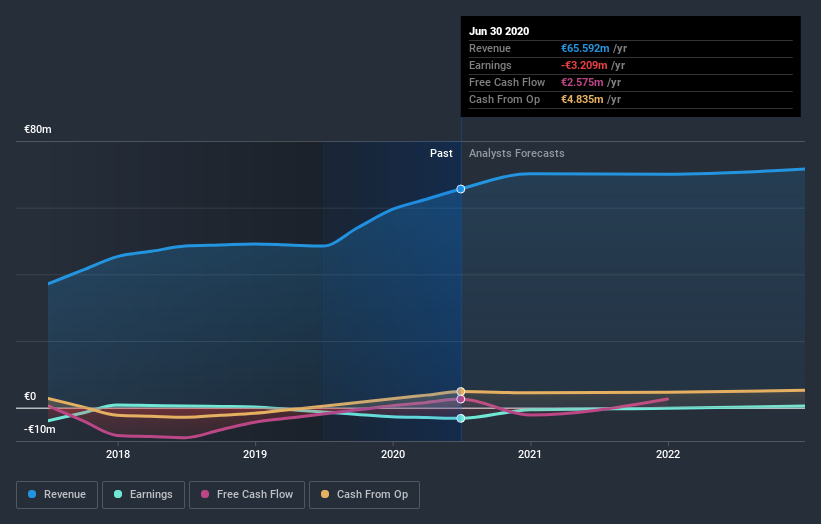

What kind of growth will DBA Group generate?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. In the upcoming year, DBA Group's earnings are expected to increase by 87%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? Since DBA is currently undervalued, it may be a great time to increase your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on DBA for a while, now might be the time to make a leap. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy DBA. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

So while earnings quality is important, it's equally important to consider the risks facing DBA Group at this point in time. In terms of investment risks, we've identified 1 warning sign with DBA Group, and understanding it should be part of your investment process.

If you are no longer interested in DBA Group, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you decide to trade DBA Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:DBA

DBA Group

Provides consultancy, architecture, engineering, and project management services.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale