- Italy

- /

- Capital Markets

- /

- BIT:EQUI

European Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of U.S. trade tariffs and uncertain monetary policies, investors are keenly observing potential opportunities amidst these challenges. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those looking to uncover hidden value. Despite being an outdated term, penny stocks continue to attract attention due to their potential for growth and financial resilience in a shifting economic landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.07 | SEK1.98B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.29 | SEK220.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.79 | SEK284.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.98 | SEK242.14M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.71 | PLN125.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.62 | €55.17M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.37 | €23.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.49M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.14 | €61.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €307.24M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 429 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cybersecurity services in Italy, with a market cap of €73.58 million.

Operations: The company generates revenue through Managed Services (€4.53 million), Digital Transformation (€0.15 million), and Cyber Security & Device Security (€16.60 million).

Market Cap: €73.58M

Cyberoo S.p.A. demonstrates a solid financial foundation for a penny stock, with its market cap at €73.58 million and diverse revenue streams from Managed Services (€4.53 million) and Cyber Security & Device Security (€16.60 million). The company's debt management is robust, with interest payments well covered by EBIT (16.3x coverage) and operating cash flow covering debt effectively (35.4%). Despite a low Return on Equity of 17.2%, Cyberoo's earnings have shown significant growth over the past five years at 58% annually, though recent growth has slowed to 6%. Its experienced management team further supports its stability in the volatile penny stock market.

- Dive into the specifics of Cyberoo here with our thorough balance sheet health report.

- Examine Cyberoo's earnings growth report to understand how analysts expect it to perform.

Equita Group (BIT:EQUI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Equita Group S.p.A. offers sales and trading, investment banking, and alternative asset management services to investors, financial institutions, corporates, and entrepreneurs both in Italy and internationally with a market cap of €220.47 million.

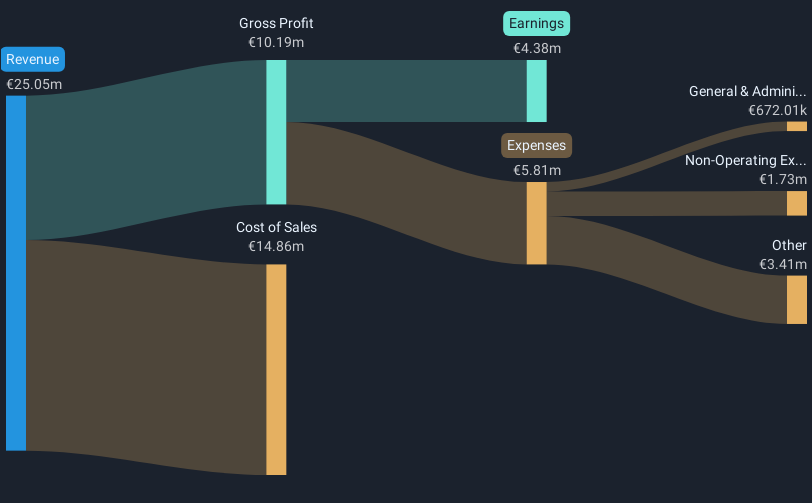

Operations: Equita Group's revenue is primarily derived from Global Markets (€41.78 million), Investment Banking (€32.08 million), and Other Asset Management (€9.87 million).

Market Cap: €220.47M

Equita Group S.p.A. presents a mixed picture in the European penny stock landscape, with a market cap of €220.47 million and diverse revenue streams from Global Markets (€41.78 million), Investment Banking (€32.08 million), and Other Asset Management (€9.87 million). The company maintains more cash than its total debt, yet its operating cash flow does not adequately cover debt obligations (8.9%). While earnings have grown 7.9% annually over five years, recent growth accelerated to 36.5%. However, the dividend yield of 7.94% is not well covered by earnings or free cash flows, indicating potential sustainability issues.

- Jump into the full analysis health report here for a deeper understanding of Equita Group.

- Gain insights into Equita Group's outlook and expected performance with our report on the company's earnings estimates.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, trading under the ticker WSE:PRA, is a publicly owned investment manager with a market capitalization of PLN170.55 million.

Operations: No revenue segments have been reported for this publicly owned investment manager.

Market Cap: PLN170.55M

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, with a market cap of PLN170.55 million, operates as a pre-revenue entity in the investment management sector. The company reported a net loss of PLN0.89 million for Q4 2024, an increase from the previous year's loss. Despite being debt-free and having short-term assets exceeding liabilities, it faces challenges with less than one year of cash runway and high share price volatility over recent months. The board's average tenure is 1.5 years, indicating relative inexperience, while shareholders have not faced significant dilution recently despite ongoing unprofitability.

- Navigate through the intricacies of Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's track record.

Taking Advantage

- Unlock more gems! Our European Penny Stocks screener has unearthed 426 more companies for you to explore.Click here to unveil our expertly curated list of 429 European Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equita Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:EQUI

Equita Group

Engages in providing sales and trading, investment banking, and alternative asset management services for investors, financial institution, corporates, and entrepreneurs in Italy and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives