- Italy

- /

- Semiconductors

- /

- BIT:TPRO

Technoprobe (BIT:TPRO) Valuation in Focus After Upbeat Q4 Guidance and AI Opportunity Outlook

Reviewed by Simply Wall St

See our latest analysis for Technoprobe.

Technoprobe’s share price has caught fire lately, soaring nearly 21% over the past month and delivering a 66% gain in the last 90 days as upbeat guidance and AI-driven growth potential fuel optimism. Over the last year, shareholders enjoyed a robust 1-year total return of 71%, highlighting a powerful blend of momentum and longer-term gains.

Inspired by Technoprobe’s rally and the buzz in semiconductors, now is a perfect moment to expand your search for high-potential tech stories. See the full list for free with See the full list for free.

With shares climbing so swiftly on bullish forecasts and AI optimism, investors are left wondering: is Technoprobe still trading at an attractive entry point, or is future growth already fully reflected in the price?

Price-to-Earnings of 98.8x: Is it justified?

Technoprobe’s current share price reflects a lofty price-to-earnings multiple of 98.8x, which stands out sharply compared to both peers and the broader market. At this level, investors are paying a significant premium for each euro of earnings relative to other semiconductor companies.

The price-to-earnings ratio (P/E) measures what investors are willing to pay today for one unit of a company’s current earnings. In fast-growing, innovation-driven sectors like semiconductors, higher P/E multiples can sometimes be justified by expectations of substantial profit expansion or a long runway of opportunity. However, such a steep multiple could indicate that the market is already pricing in robust growth or even stretching beyond what fundamentals currently support.

Technoprobe’s P/E of 98.8x is not just high in isolation; it is also well above the peer average of 65.1x and the European semiconductor industry average of 33.6x. This highlights a significant premium and suggests that buyers may be paying for future growth potential or optimism that surpasses even what is seen elsewhere in the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 98.8x (OVERVALUED)

However, risks remain. Lofty valuations and any slowdown in AI or chip demand could potentially challenge the bullish outlook driving Technoprobe’s recent surge.

Find out about the key risks to this Technoprobe narrative.

Another View: Discounted Cash Flow Tells a Different Story

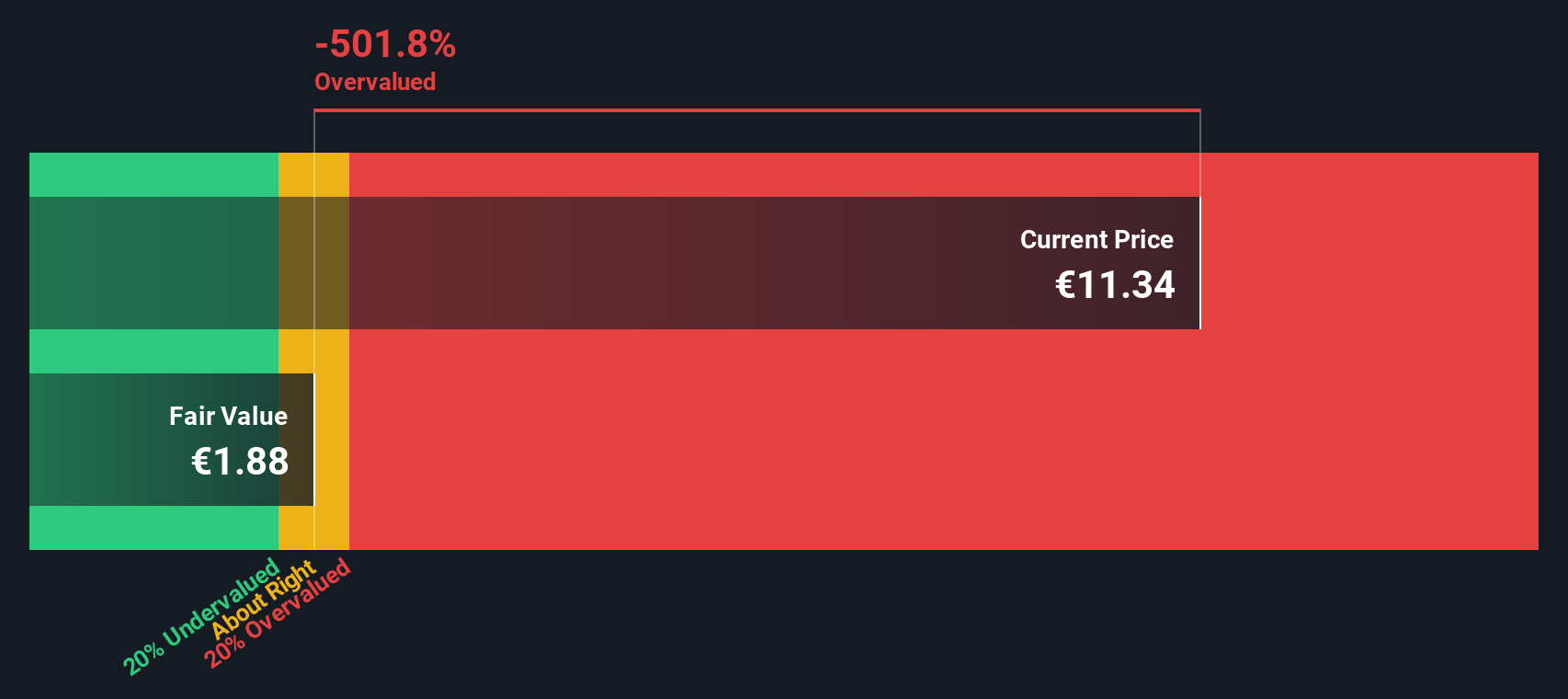

While the price-to-earnings ratio paints Technoprobe as richly valued versus peers, our DCF model suggests the stock is even further above its fair value. Based on these cash flow projections, Technoprobe’s shares trade well above our estimate, which may indicate a potential valuation disconnect. Which approach will prove closer to reality as AI prospects unfold?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Technoprobe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Technoprobe Narrative

If you’d rather explore the data directly or put together your own story, you can quickly create a personal view in just minutes with Do it your way

A great starting point for your Technoprobe research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Opportunities do not wait. Expand your search beyond Technoprobe and get ahead by tracking powerful trends and hidden value the market often overlooks.

- Catch the potential for breakout gains by starting with these 3575 penny stocks with strong financials with strong financials supporting their rise.

- Maximize income potential today and in the future through these 14 dividend stocks with yields > 3% offering attractive yields above 3%.

- Ride the AI growth wave and position yourself with these 25 AI penny stocks before the next surge in market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technoprobe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TPRO

Technoprobe

Produces and sells electronic circuits in Italy, Asia, the United States, and rest of Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives