- Italy

- /

- Specialty Stores

- /

- BIT:BAN

We're Watching These Trends At BasicNet (BIT:BAN)

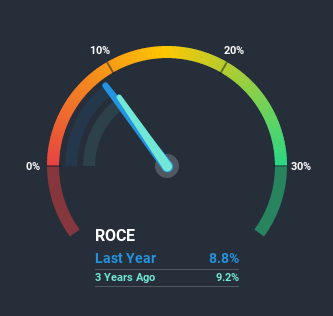

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after investigating BasicNet (BIT:BAN), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on BasicNet is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.088 = €14m ÷ (€314m - €151m) (Based on the trailing twelve months to June 2020).

Thus, BasicNet has an ROCE of 8.8%. On its own, that's a low figure but it's around the 10% average generated by the Specialty Retail industry.

View our latest analysis for BasicNet

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how BasicNet has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

When we looked at the ROCE trend at BasicNet, we didn't gain much confidence. Around five years ago the returns on capital were 19%, but since then they've fallen to 8.8%. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, BasicNet's current liabilities are still rather high at 48% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From BasicNet's ROCE

While returns have fallen for BasicNet in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. In light of this, the stock has only gained 18% over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

On a separate note, we've found 5 warning signs for BasicNet you'll probably want to know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading BasicNet or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BasicNet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BAN

BasicNet

Operates in the sports and casual clothing, footwear, and accessories sectors in Europe, the Americas, Asia, Oceania, the Middle East, and Africa.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion