- Switzerland

- /

- Specialty Stores

- /

- SWX:AVOL

European Market Gems 3 Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index and major stock indexes like Germany’s DAX and the UK’s FTSE 100 showing strong gains, investors are increasingly interested in identifying stocks that may be trading below their intrinsic value. In this environment of rising business activity and improving consumer confidence, finding undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK29.20 | SEK56.88 | 48.7% |

| Stratec (XTRA:SBS) | €22.60 | €45.19 | 50% |

| STEICO (XTRA:ST5) | €20.60 | €40.79 | 49.5% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.90 | SEK23.59 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.55 | €11.03 | 49.7% |

| GomSpace Group (OM:GOMX) | SEK16.66 | SEK32.65 | 49% |

| Axfood (OM:AXFO) | SEK259.20 | SEK507.86 | 49% |

| Atea (OB:ATEA) | NOK151.20 | NOK296.06 | 48.9% |

| Aquafil (BIT:ECNL) | €1.936 | €3.85 | 49.7% |

| Absolent Air Care Group (OM:ABSO) | SEK240.00 | SEK473.04 | 49.3% |

Here's a peek at a few of the choices from the screener.

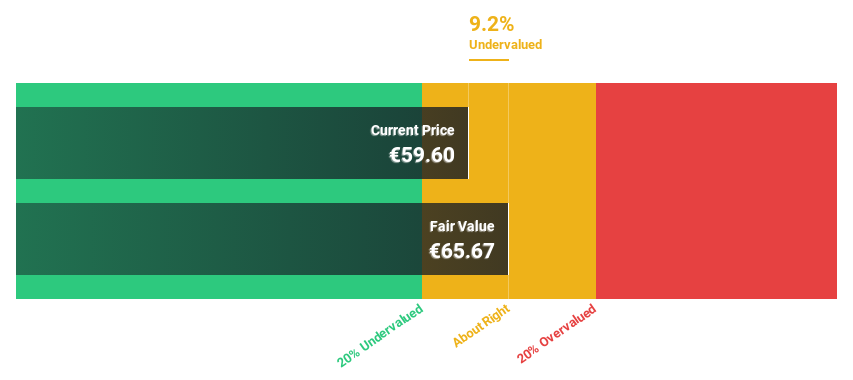

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that researches, develops, produces, and sells drugs across various countries including Italy, the United States, and several European nations with a market capitalization of approximately €10.63 billion.

Operations: Recordati's revenue is primarily derived from two segments: Rare Diseases, contributing €950.29 million, and Specialty & Primary Care, generating €1.53 billion.

Estimated Discount To Fair Value: 22.9%

Recordati Industria Chimica e Farmaceutica is trading 22.9% below its estimated fair value of €66.82, with the current price at €51.55, making it potentially undervalued based on cash flows. Despite a high level of debt and a dividend yield of 2.46% not well covered by free cash flows, the company's earnings are forecast to grow faster than the Italian market at 14.2% annually, supported by a very high expected return on equity of 41.5%. Recent buybacks totaling €104.7 million may further enhance shareholder value, while incoming CFO Mike McClellan's extensive industry experience could bolster financial strategy and growth initiatives from January 2026 onward.

- Insights from our recent growth report point to a promising forecast for Recordati Industria Chimica e Farmaceutica's business outlook.

- Unlock comprehensive insights into our analysis of Recordati Industria Chimica e Farmaceutica stock in this financial health report.

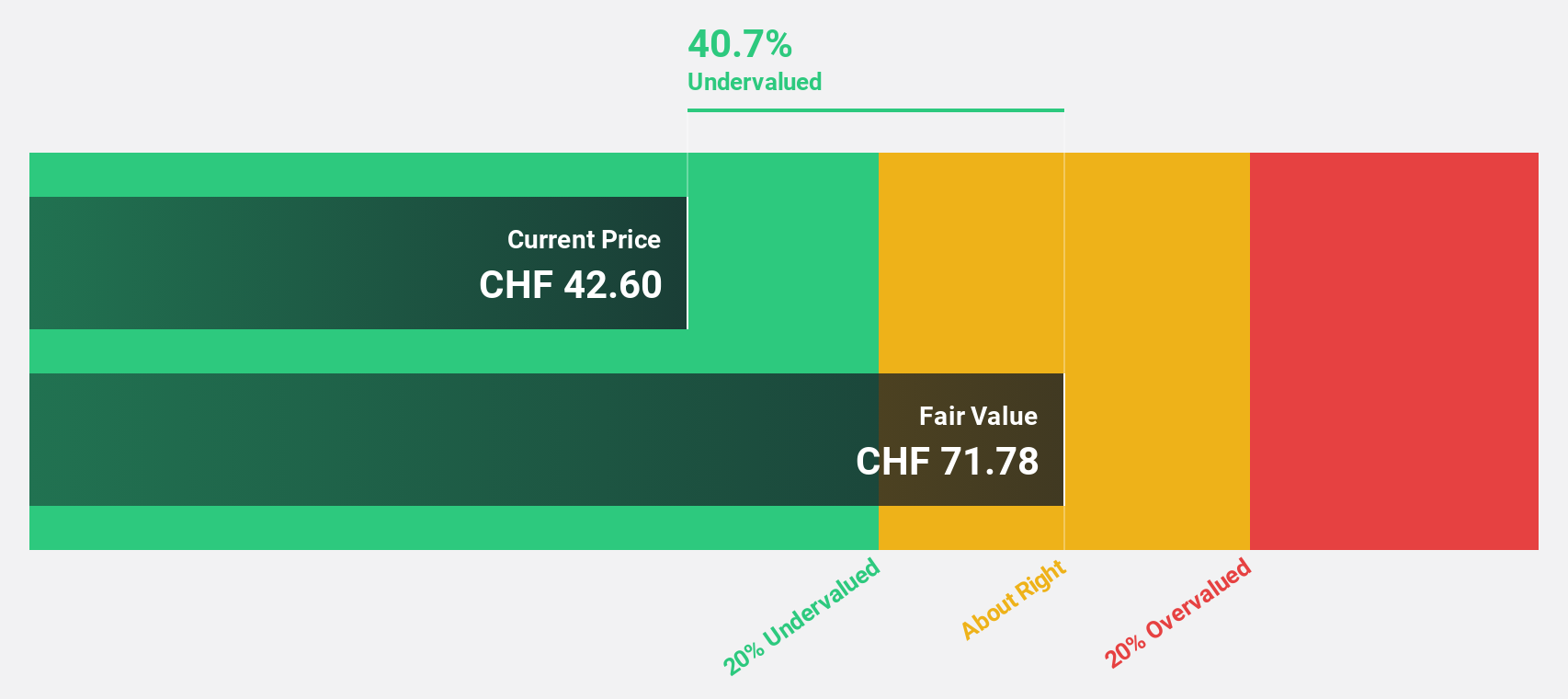

Avolta (SWX:AVOL)

Overview: Avolta AG operates as a travel retailer company with a market cap of CHF6.15 billion.

Operations: The company's revenue segments are distributed as follows: North America contributes CHF4.21 billion, Asia Pacific (APAC) adds CHF725 million, Latin America (LATAM) provides CHF1.61 billion, and Europe, Middle East and Africa (EMEA) accounts for CHF7.35 billion.

Estimated Discount To Fair Value: 40.9%

Avolta AG is trading at CHF42.4, significantly below its estimated fair value of CHF71.77, suggesting it may be undervalued based on cash flows. While earnings are forecast to grow 23.9% annually, surpassing the Swiss market's growth rate, interest payments remain a concern as they are not well covered by earnings. Recent strategic expansions in Japan and Atlanta International Airport could enhance revenue streams despite a dividend yield of 2.36% not being well supported by profits.

- Our comprehensive growth report raises the possibility that Avolta is poised for substantial financial growth.

- Get an in-depth perspective on Avolta's balance sheet by reading our health report here.

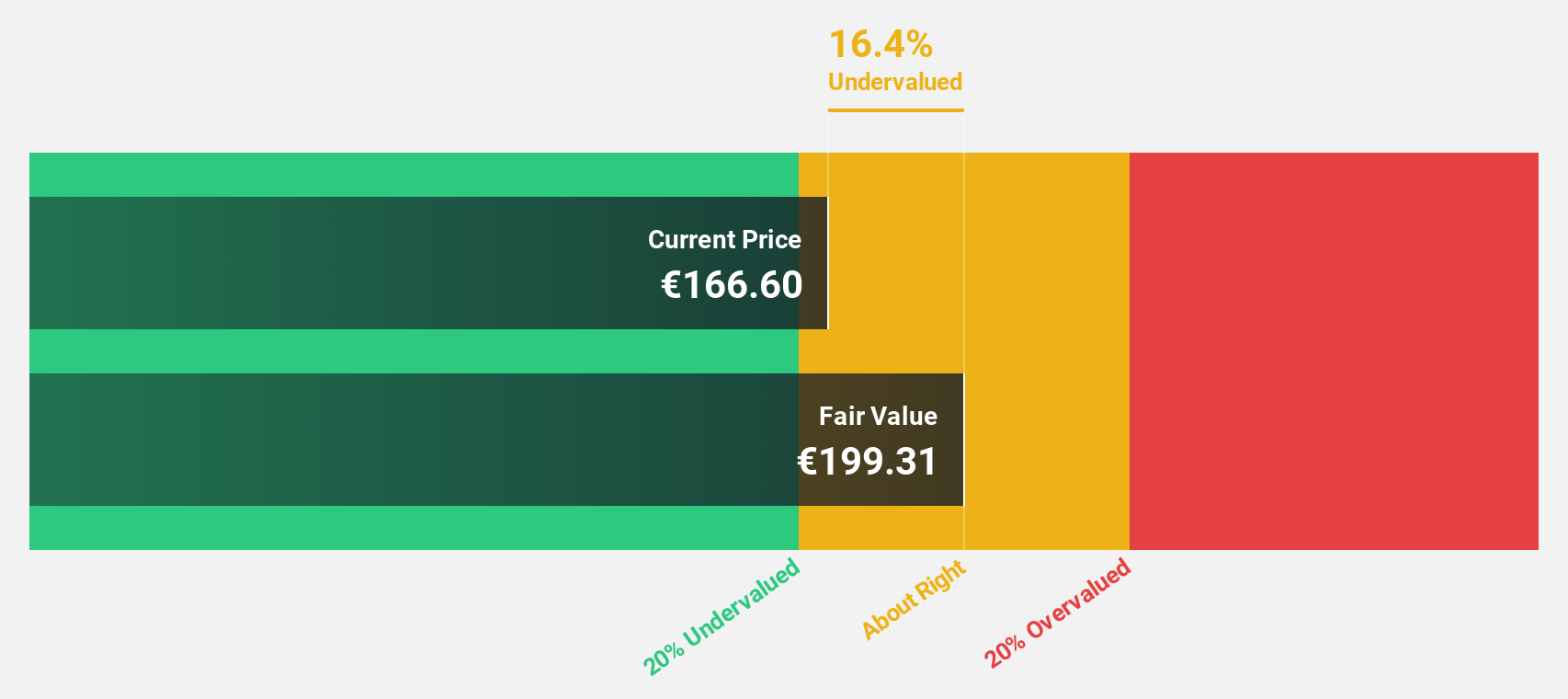

AlzChem Group (XTRA:ACT)

Overview: AlzChem Group AG, with a market cap of €1.64 billion, develops, produces, and markets a variety of chemical specialties across Germany, the European Union, other parts of Europe, Asia, the NAFTA region, and internationally.

Operations: The company's revenue primarily comes from its Specialty Chemicals segment, which generated €363.96 million, and its Basics & Intermediates segment, which contributed €161.10 million.

Estimated Discount To Fair Value: 31.3%

AlzChem Group AG, trading at €162, is undervalued relative to its estimated fair value of €235.94. The company's earnings are forecast to grow at 17.38% annually, outpacing the German market's growth rate of 16.6%. Despite slower revenue growth projections of 8.5% per year compared to a significant benchmark, recent product launches with Ehrmann could bolster future cash flows. A high return on equity forecasted in three years further supports its potential as an undervalued opportunity based on cash flows.

- The growth report we've compiled suggests that AlzChem Group's future prospects could be on the up.

- Click here to discover the nuances of AlzChem Group with our detailed financial health report.

Summing It All Up

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 205 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AVOL

High growth potential and slightly overvalued.

Market Insights

Community Narratives