The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Pierrel S.p.A. (BIT:PRL) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Pierrel

How Much Debt Does Pierrel Carry?

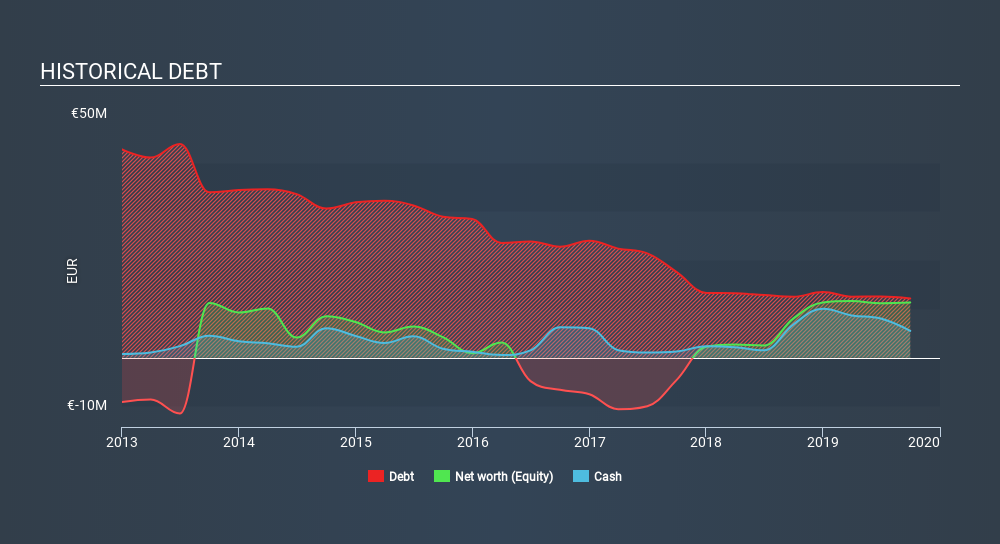

As you can see below, Pierrel had €12.1m of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of €5.50m, its net debt is less, at about €6.65m.

How Strong Is Pierrel's Balance Sheet?

We can see from the most recent balance sheet that Pierrel had liabilities of €8.27m falling due within a year, and liabilities of €11.4m due beyond that. Offsetting this, it had €5.50m in cash and €2.12m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €12.1m.

This deficit isn't so bad because Pierrel is worth €39.4m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Pierrel's net debt is sitting at a very reasonable 1.7 times its EBITDA, while its EBIT covered its interest expense just 5.1 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Sadly, Pierrel's EBIT actually dropped 8.1% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pierrel's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, Pierrel recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for and improvement.

Our View

Mulling over Pierrel's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Pierrel stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Over time, share prices tend to follow earnings per share, so if you're interested in Pierrel, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:PRL

Pierrel

Pierrel S.p.A. engages in the development, production, registration, and licensing of synthetic drugs and medical devices for the oral health sector worldwide.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives