As European markets face renewed concerns over inflated AI stock valuations, the pan-European STOXX Europe 600 Index has seen a decline of 2.21%, with major indexes like Germany’s DAX and France’s CAC 40 also experiencing significant drops. In this environment, identifying high-growth tech stocks requires careful consideration of their potential to innovate and adapt amid evolving market sentiments and economic indicators, making them crucial players in the ever-changing tech landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Pexip Holding | 10.67% | 22.75% | ★★★★★☆ |

| Bonesupport Holding | 27.78% | 49.69% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| Comet Holding | 11.07% | 36.76% | ★★★★★☆ |

| CD Projekt | 35.29% | 50.71% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Growth Rating: ★★★★★☆

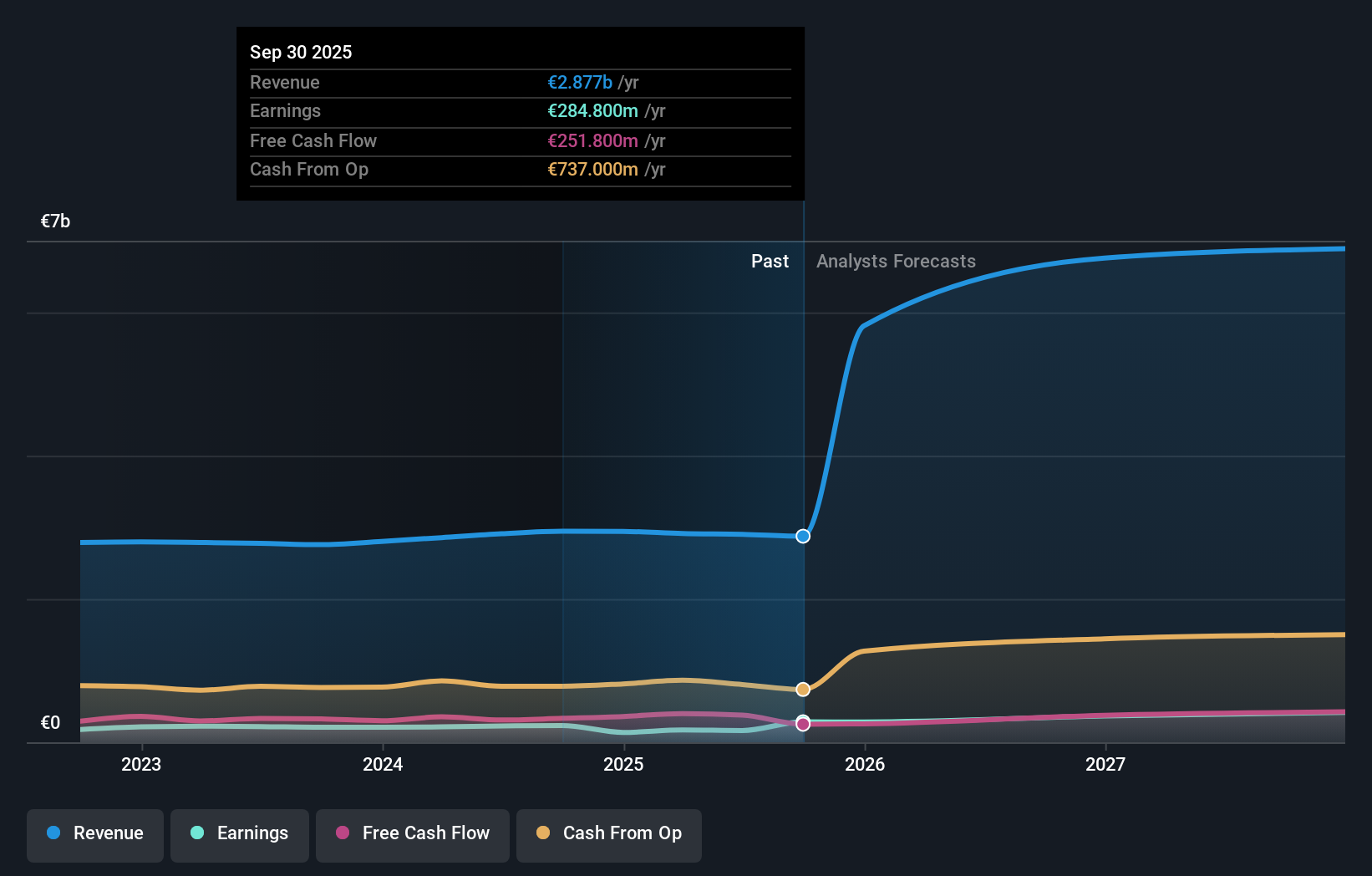

Overview: MFE-Mediaforeurope N.V. operates in the television industry across Italy and Spain, with a market capitalization of €2.42 billion.

Operations: MFE-Mediaforeurope focuses on the television sector in Italy and Spain, generating revenue through advertising and content distribution. The company has a market capitalization of €2.42 billion.

MFE-Mediaforeurope has demonstrated robust financial performance with a notable 28.8% annual revenue growth, outpacing the broader Italian market's 5.4%. This growth is complemented by an impressive forecast of earnings expansion at 31.2% per annum, significantly higher than the market average of 9.9%. Despite a challenging year with earnings declining by 28%, MFE's strategic focus on innovation and market adaptation is evident from its recent earnings reports, showing a substantial increase in net income from EUR 96.2 million to EUR 243.1 million over nine months. The company's commitment to leveraging technological advancements and enhancing shareholder value is clear, positioning it well for future scalability in the high-growth tech sector in Europe.

TomTom (ENXTAM:TOM2)

Simply Wall St Growth Rating: ★★★★☆☆

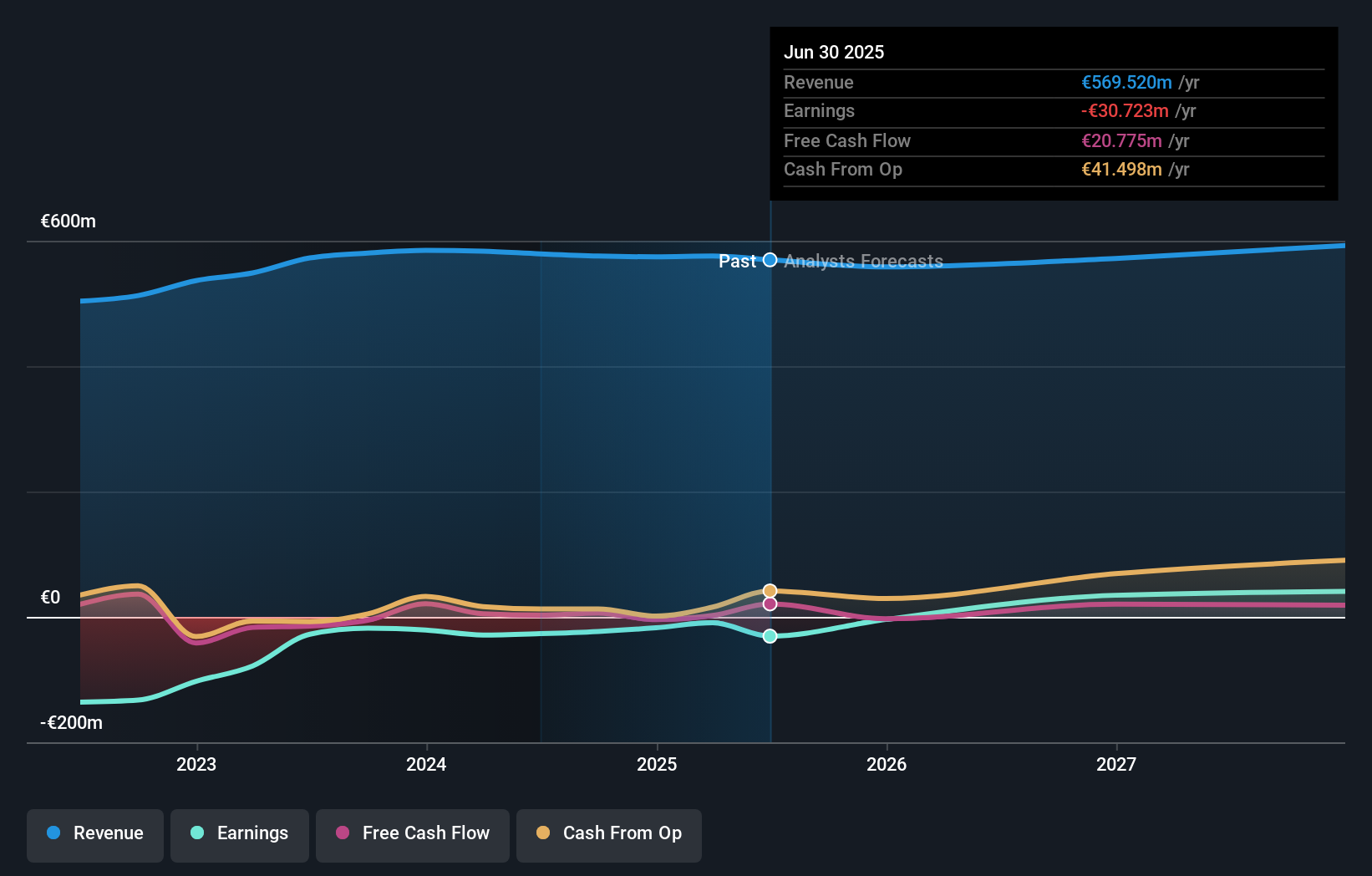

Overview: TomTom N.V. develops and sells navigation and location-based products and services globally, with a market capitalization of €652.65 million.

Operations: The company generates revenue primarily from its Location Technology segment, which accounts for €503.92 million, and the Consumer segment contributing €77.52 million. The Segment Adjustment reflects a deduction of €15.65 million from total revenues.

TomTom has recently upped its revenue guidance for 2025, reflecting confidence in its growth trajectory amidst a robust partnership with GeoInt and expanded collaboration with Hyundai AutoEver. These alliances leverage TomTom's cutting-edge APIs and real-time traffic services, enhancing fleet management and driving experiences across Europe. The firm's strategic focus on innovative mapping solutions is evident from its R&D investments, which have significantly contributed to a 108.6% forecasted annual earnings growth. This innovation-driven approach not only solidifies TomTom's market position but also aligns with the evolving needs of modern transportation and mobility sectors.

- Delve into the full analysis health report here for a deeper understanding of TomTom.

Evaluate TomTom's historical performance by accessing our past performance report.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

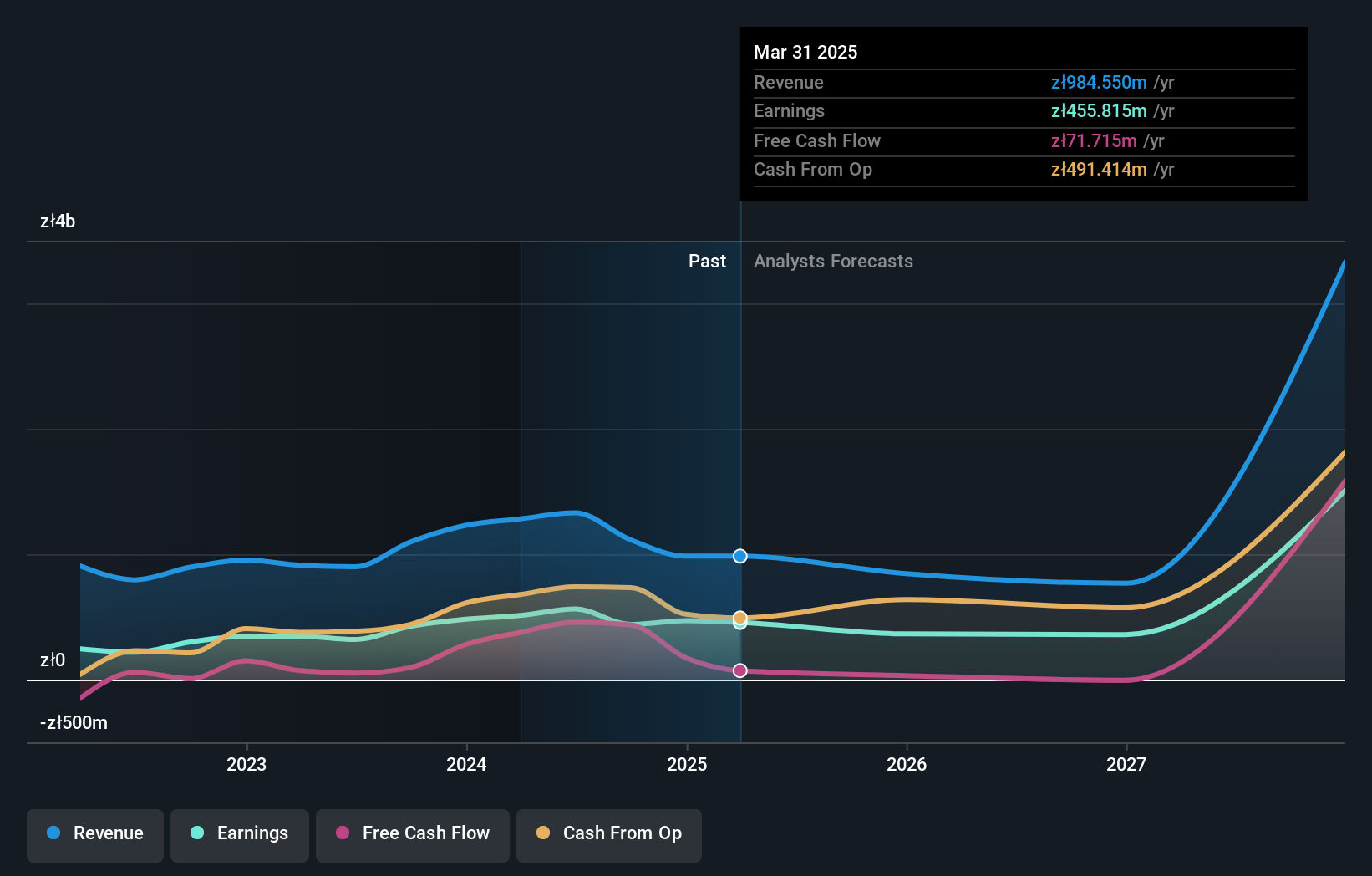

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market capitalization of PLN24.28 billion.

Operations: The company generates revenue primarily through its CD PROJEKT RED segment, contributing PLN 812.26 million, and GOG.Com, adding PLN 205.97 million. Gross profit margin trends indicate fluctuations over recent periods without a consistent pattern.

CD Projekt, a standout in the European tech landscape, has demonstrated robust financial performance with third-quarter revenue soaring to PLN 349.07 million from PLN 227.45 million year-over-year, underpinned by a striking increase in net income to PLN 193.49 million from PLN 78.11 million. This growth trajectory is further evidenced by an annual revenue forecast growth rate of 35.3% and earnings expansion at an impressive rate of 50.7% per year, significantly outpacing the broader Polish market's averages of 4.4% and 15.2%, respectively. These figures not only reflect CD Projekt's strong market position but also its potential to shape future trends in the entertainment and technology sectors through strategic initiatives like their recent presentations at global tech conferences.

- Unlock comprehensive insights into our analysis of CD Projekt stock in this health report.

Assess CD Projekt's past performance with our detailed historical performance reports.

Key Takeaways

- Click this link to deep-dive into the 51 companies within our European High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MFEB

MFE-Mediaforeurope

Operates in the television industry in Italy and Spain.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success