SOL (BIT:SOL) Reports Strong Half-Year Earnings With 12% Sales Growth

Reviewed by Simply Wall St

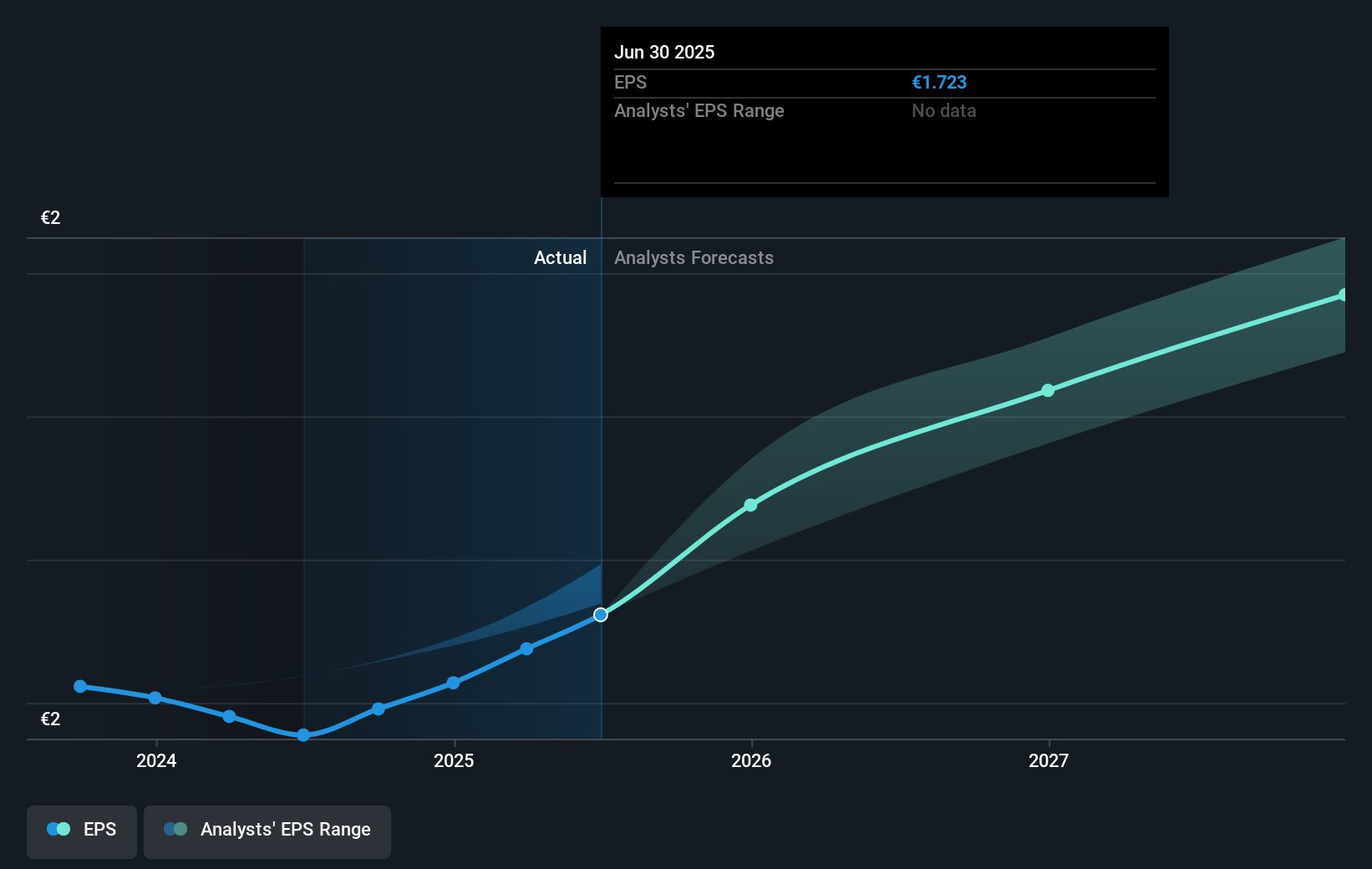

SOL (BIT:SOL) recently experienced a 10% increase in its share price over the past quarter, a movement that aligns with the company's strong earnings announcement on September 11, 2025. SOL reported significant growth across its sales, revenue, and net income for the half year ended June 30, 2025. These robust financial results likely provided an added boost to investor sentiment. Despite fluctuations in major U.S. stock indexes, with the Nasdaq hitting record highs and a mixed Dow, SOL's strong financial performance was a positive standalone factor in its price appreciation, in contrast to the broader market trends over the same period.

Buy, Hold or Sell SOL? View our complete analysis and fair value estimate and you decide.

Over the past five years, SOL's shares have delivered a total return of 365.06%, an impressive achievement indicative of the company's resilience and growth trajectory. This performance should be considered within the context of recent one-year returns, which surpass both the Italian Market and the Italian Chemicals industry, returning 24.7% and 42.2% respectively. Despite its long-term success, analysts have set a price target slightly below SOL's current share price, suggesting a potentially limited upside based on current valuation metrics.

The strong financial results announced on September 11, 2025, are likely to influence future revenue and earnings forecasts favorably. With sales and revenue showing noticeable increases, these developments could bolster investor confidence and maintain positive sentiment around the company's growth prospects. However, this is tempered by SOL's price target of €52.00, reflecting minimal expected share price movement beyond current levels. Investors may factor this into their assessment of SOL's valuation, especially considering its price-to-earnings ratio remains elevated compared to industry averages. As SOL continues to grow, its past performance can provide context, but ongoing market conditions and forecasts will play crucial roles in shaping its investment narrative.

Assess SOL's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SOL

SOL

Engages in the applied research, production, and marketing of technical and medical gases in Italy and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives