- Italy

- /

- Basic Materials

- /

- BIT:CEM

Analyst Estimates: Here's What Brokers Think Of Cementir Holding N.V. (BIT:CEM) After Its First-Quarter Report

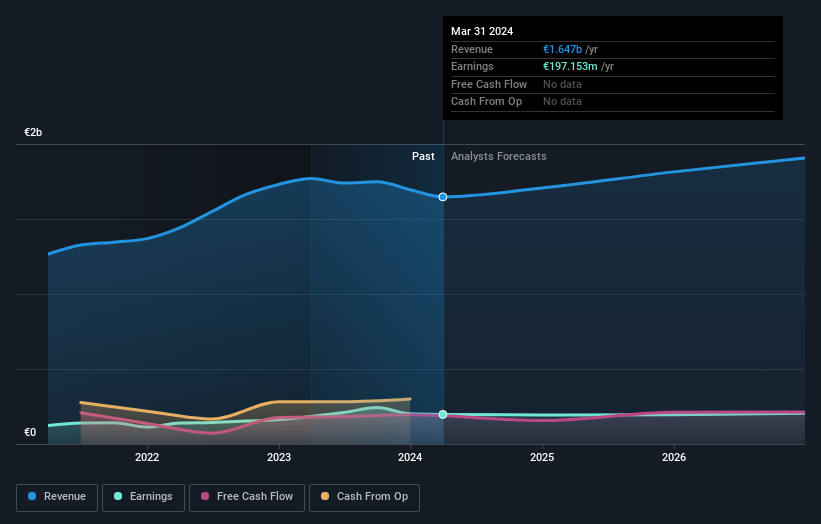

As you might know, Cementir Holding N.V. (BIT:CEM) recently reported its first-quarter numbers. Results look mixed - while revenue fell marginally short of analyst estimates at €368m, statutory earnings were in line with expectations, at €1.30 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Cementir Holding after the latest results.

Check out our latest analysis for Cementir Holding

Taking into account the latest results, the consensus forecast from Cementir Holding's six analysts is for revenues of €1.71b in 2024. This reflects a credible 3.6% improvement in revenue compared to the last 12 months. Statutory earnings per share are forecast to reduce 8.3% to €1.16 in the same period. Before this earnings report, the analysts had been forecasting revenues of €1.72b and earnings per share (EPS) of €1.14 in 2024. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at €12.02. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Cementir Holding at €13.50 per share, while the most bearish prices it at €10.10. This is a very narrow spread of estimates, implying either that Cementir Holding is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Cementir Holding's revenue growth is expected to slow, with the forecast 4.8% annualised growth rate until the end of 2024 being well below the historical 9.4% p.a. growth over the last five years. Compare this to the 43 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 4.1% per year. Factoring in the forecast slowdown in growth, it looks like Cementir Holding is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. The consensus price target held steady at €12.02, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Cementir Holding going out to 2026, and you can see them free on our platform here..

We also provide an overview of the Cementir Holding Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CEM

Cementir Holding

Operates in the building materials sector in Italy, Nordic and Baltic, Belgium, North America, Türkiye, Egypt, and the Asia Pacific.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success