- Italy

- /

- Personal Products

- /

- BIT:PHN

These 4 Measures Indicate That Pharmanutra (BIT:PHN) Is Using Debt Safely

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Pharmanutra S.p.A. (BIT:PHN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Pharmanutra

What Is Pharmanutra's Net Debt?

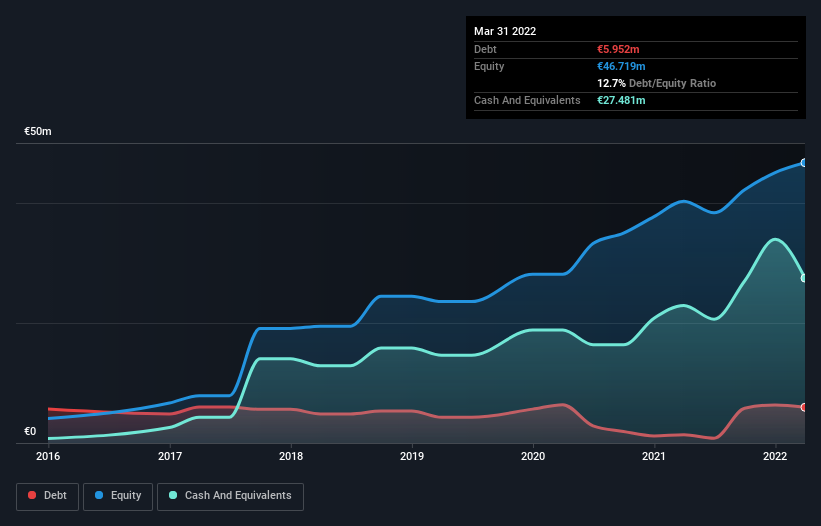

As you can see below, at the end of March 2022, Pharmanutra had €5.95m of debt, up from €1.37m a year ago. Click the image for more detail. However, its balance sheet shows it holds €27.5m in cash, so it actually has €21.5m net cash.

A Look At Pharmanutra's Liabilities

We can see from the most recent balance sheet that Pharmanutra had liabilities of €18.5m falling due within a year, and liabilities of €9.33m due beyond that. Offsetting this, it had €27.5m in cash and €19.9m in receivables that were due within 12 months. So it can boast €19.5m more liquid assets than total liabilities.

This surplus suggests that Pharmanutra has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Pharmanutra boasts net cash, so it's fair to say it does not have a heavy debt load!

Also positive, Pharmanutra grew its EBIT by 29% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pharmanutra's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Pharmanutra has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Pharmanutra produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case Pharmanutra has €21.5m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 29% over the last year. So we don't think Pharmanutra's use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Pharmanutra's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:PHN

Pharmanutra

A pharmaceutical and nutraceutical company, researches, designs, develops, and markets nutritional supplements and medical devices in Italy, Europe, the Middle East, South America, Far East, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.