As European markets experience a mix of relief from the reopening of the U.S. federal government and tempered enthusiasm due to cooling sentiment on artificial intelligence, investors are keenly evaluating opportunities across various sectors. Penny stocks, though often associated with speculative trading, can still offer substantial value when underpinned by robust financials. These smaller or newer companies present a unique blend of affordability and growth potential that can be particularly appealing in times of economic uncertainty.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.89 | €1.35B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.70 | €83.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €241.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.12 | €66.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.315 | €381.38M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.99 | €78.05M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €295.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.86 | €28.8M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Enervit (BIT:ENV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Enervit S.p.A. focuses on the research, development, production, marketing, and distribution of sports food supplements and functional nutrition products in Italy with a market cap of €68.71 million.

Operations: The company's revenue is primarily derived from its Vitamins & Nutrition Products segment, totaling €100.21 million.

Market Cap: €68.71M

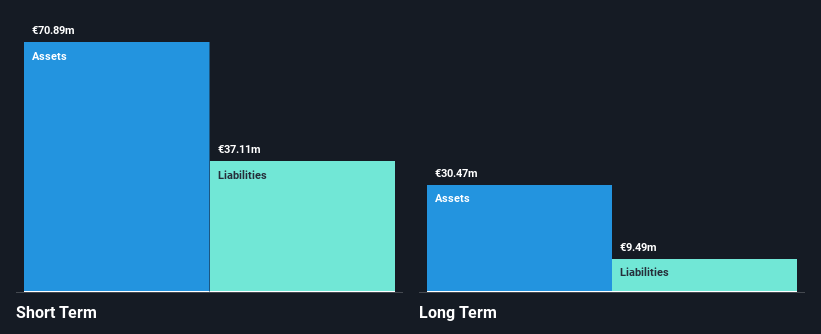

Enervit S.p.A. has demonstrated solid financial growth, with earnings increasing by 25.4% over the past year, surpassing the Personal Products industry average. Despite a highly volatile share price recently, Enervit's debt management is commendable; its debt to equity ratio has significantly decreased over five years, and interest payments are well-covered by EBIT. The company's net profit margins have improved slightly from last year, though its Return on Equity remains low at 13.6%. While trading below estimated fair value and maintaining stable weekly volatility, its dividend sustainability poses concerns due to insufficient free cash flow coverage.

- Get an in-depth perspective on Enervit's performance by reading our balance sheet health report here.

- Evaluate Enervit's prospects by accessing our earnings growth report.

Componenta (HLSE:CTH1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Componenta Corporation, with a market cap of €42.79 million, operates in Finland and specializes in providing cast iron components through its subsidiaries.

Operations: The company generates its revenue primarily from the Contract Workshop Business, which accounts for €109.99 million.

Market Cap: €42.79M

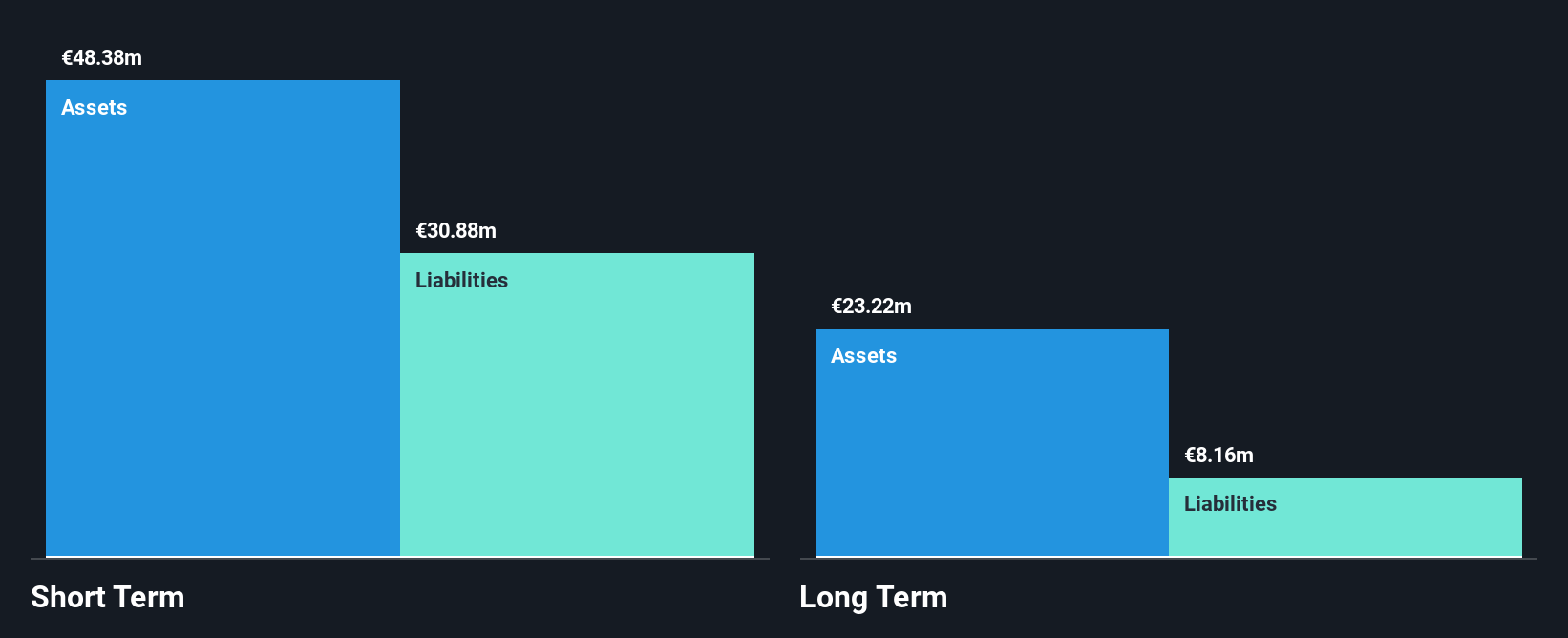

Componenta Corporation has shown promising financial development, becoming profitable this year with earnings forecasted to grow at 23.91% annually. The company's recent order from the Finnish Defence Forces, valued at €10.4 million, underscores its operational momentum without affecting profit guidance for 2025-2028. Despite a large one-off gain of €2.9 million impacting recent results, Componenta's short-term assets cover both short and long-term liabilities effectively. While interest payments on debt are not well covered by EBIT (1.3x), operating cash flow adequately covers debt obligations (273.8%). Trading below estimated fair value enhances its appeal among penny stocks in Europe.

- Unlock comprehensive insights into our analysis of Componenta stock in this financial health report.

- Examine Componenta's earnings growth report to understand how analysts expect it to perform.

Viscom (XTRA:V6C)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscom SE develops, manufactures, and sells inspection systems for industrial production applications across Europe, the Americas, and Asia with a market cap of €44.25 million.

Operations: The company's revenue is derived from various regions, with €29.91 million from Asia, €23.62 million in Germany, €10.86 million across the Americas, and €36.95 million from other European countries excluding Germany.

Market Cap: €44.25M

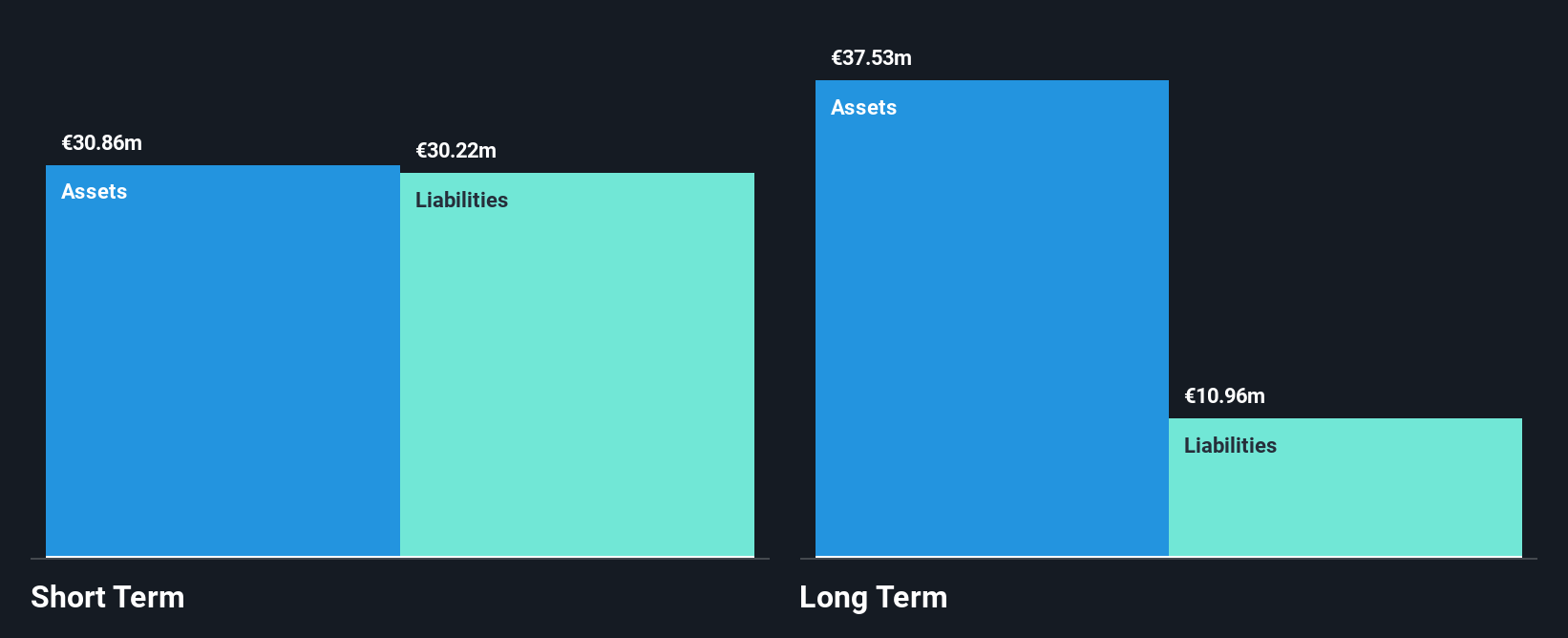

Viscom SE, despite being unprofitable with a negative return on equity of -14.77%, shows potential in the penny stock landscape. The company maintains robust short-term assets (€59.4M) covering both short and long-term liabilities, which provides financial stability amidst volatility. Its debt is well-managed with operating cash flow covering 24.5% of it, though the debt-to-equity ratio has increased over five years to 47.1%. Viscom's earnings guidance for 2025 remains optimistic, targeting revenue between €80 million and €90 million with an EBIT margin of 2% to 5%. Analyst consensus suggests potential price appreciation by approximately 25.8%.

- Click here to discover the nuances of Viscom with our detailed analytical financial health report.

- Learn about Viscom's future growth trajectory here.

Where To Now?

- Click this link to deep-dive into the 278 companies within our European Penny Stocks screener.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:CTH1V

Undervalued with excellent balance sheet.

Market Insights

Community Narratives