- Italy

- /

- Medical Equipment

- /

- BIT:ELN

EL.En (BIT:ELN) Reports Revenue Increase But Net Income Declines

Reviewed by Simply Wall St

EL.En (BIT:ELN) announced its earnings for the half year ended June 30, 2025, reporting a rise in sales and revenue but a significant decline in net income, possibly reflecting increased costs or operational challenges. Over the last quarter, the company's share price increased by 8.2%, a move broadly consistent with the overall market trend, where major U.S. stock indexes reached record highs amid expectations of Federal Reserve rate cuts. While EL.En's financial results might have added weight to its share price movement, they did not significantly diverge from the broader market performance.

Be aware that EL.En is showing 1 warning sign in our investment analysis.

EL.En’s recent earnings announcement revealing increased sales and revenue aligns with its ongoing narrative of focusing on divestments and new product development. However, the reported decline in net income underscores existing challenges, such as higher operational costs and market-specific setbacks, particularly in China. The recent share price movement, posting an 8.2% increase over the last quarter, complements a broader market trend driven by anticipated Federal Reserve rate cuts. Over a five-year period, EL.En’s long-term total return, including dividends, was an impressive 128.70%, reflecting its ability to progress despite short-term volatility.

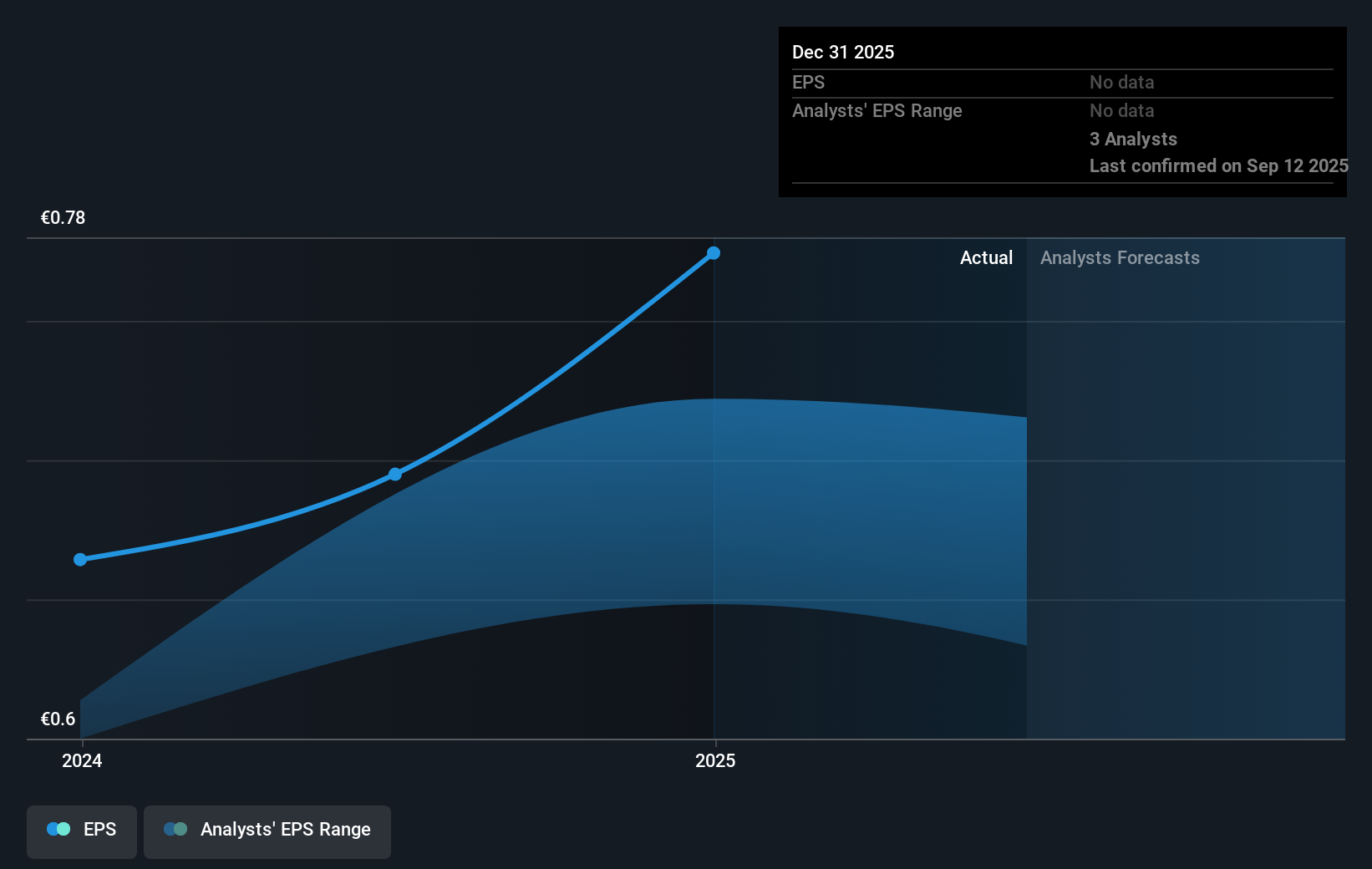

When examining EL.En's relative performance, it matched the Italian market's return of 24.3% over the past year, while surpassing the Italian Medical Equipment industry, which returned a negative 17.5%. The firm's outlook includes revenue and earnings growth, with forecasts suggesting a 4.54% annual earnings increase. Considering analysts' price target of €12.37, slightly above the current share price of €11.60, there is a modest encouragement of upside potential. The latest results and strategic focuses suggest stability may be achievable, although challenges like legal disputes and market performance in China remain pivotal factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the production, research and development, distribution, and sale of laser systems in Italy, rest of Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives