- Italy

- /

- Medical Equipment

- /

- BIT:DIA

DiaSorin (BIT:DIA): Is the Diagnostics Leader Undervalued After Latest Share Price Moves?

Reviewed by Simply Wall St

Most Popular Narrative: 21% Undervalued

According to the most widely followed narrative, DiaSorin is currently trading at a 21% discount to its estimated fair value, reflecting a potentially compelling opportunity for investors if the underlying assumptions play out.

Continued rollout and growth of high-value specialty and multiplex molecular panels (such as LIAISON PLEX and targeted MDX) enable DiaSorin to capture higher-margin, differentiated segments aligned with the global trend toward advanced, personalized, and preventive diagnostics. This trend is expected to drive both top-line growth and profitability.

Eager to discover what’s fueling this potential upside? The underlying projections are built on ambitious targets for future growth, margin expansion, and industry-beating metrics. The real story is in the numbers. Find out how bold profit expectations and revenue forecasts could make or break this valuation thesis.

Result: Fair Value of €103.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing global price competition and exposure to currency swings could pose significant challenges. These factors could potentially limit DiaSorin’s ability to deliver on growth expectations.

Find out about the key risks to this DiaSorin narrative.Another View: Discounted Cash Flow Perspective

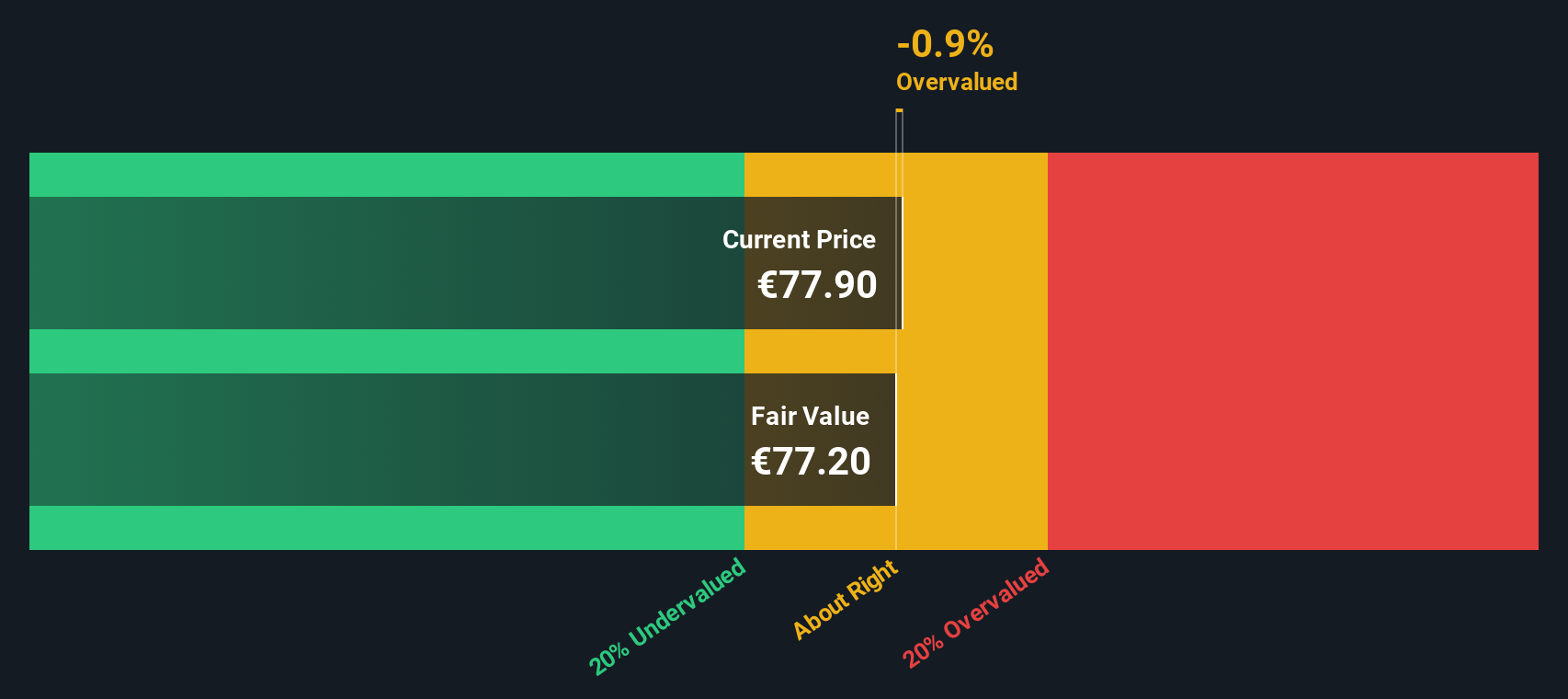

Looking at things through the lens of our DCF model gives a different result. This approach suggests DiaSorin could be overvalued and indicates a disconnect with the earlier optimism. Which method really reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DiaSorin Narrative

If you’re not convinced or prefer to dig deeper, you can analyze the latest figures and shape your own story in just a few minutes, Do it your way.

A great starting point for your DiaSorin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Broaden your horizons, find your next big opportunity, and see what others might miss by checking these handpicked strategies:

- Unlock growth with companies positioned to benefit from the surge in artificial intelligence by checking out AI penny stocks.

- Zero in on reliable income streams with stocks offering attractive yields above 3 percent by exploring dividend stocks with yields > 3%.

- Tap into value by seeking out businesses currently priced well below their cash flow potential using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:DIA

DiaSorin

Engages in research and development, manufacture, and distribution of immunodiagnostics and molecular diagnostics testing kits in Europe, North America, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives