NewPrinces (BIT:NWL) Earnings Surge With EUR 1.3 Billion Sales And EUR 21 Million Income

Reviewed by Simply Wall St

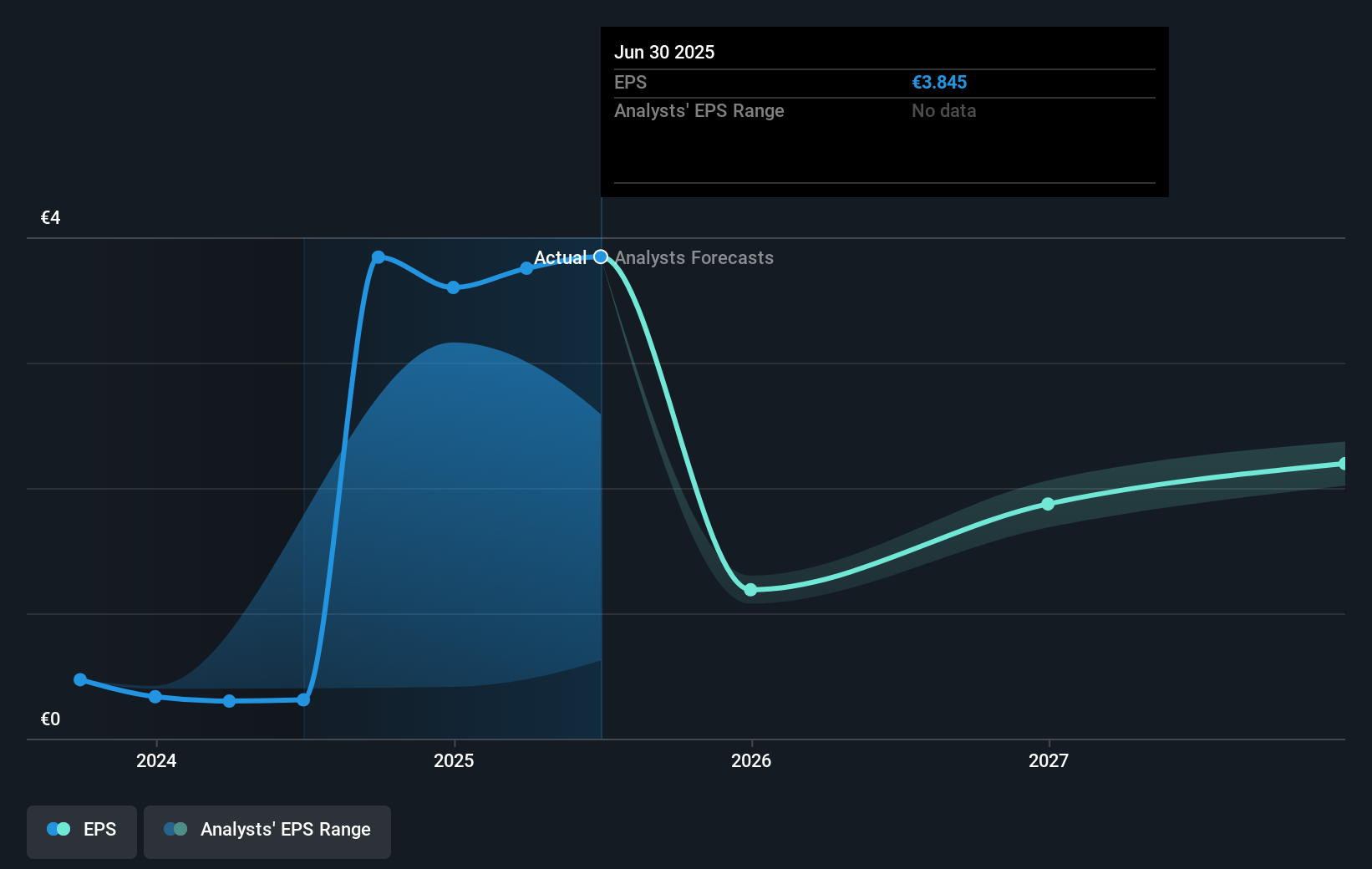

NewPrinces (BIT:NWL) recently announced impressive half-year earnings, with sales soaring to EUR 1,314 million and net income rising to EUR 21 million, significantly up from last year. This strong performance coincided with a notable 32% share price increase over the last quarter. The company's robust growth in earnings per share, reaching EUR 0.48, appears well-aligned with market enthusiasm, as the S&P 500 and Nasdaq hit all-time highs. While these fundamentals likely supported NewPrinces's share rally, broader market trends, such as lower PPI data and ongoing expectations of Federal Reserve rate cuts, provided a favorable backdrop for such gains.

We've spotted 3 risks for NewPrinces you should be aware of, and 1 of them is significant.

The recent impressive earnings report from NewPrinces may have a considerable impact on the company narrative, as it highlights a period of strong financial performance. Sales of €1.31 billion and net income of €21 million in the half-year bolstered investor confidence, reflected by a substantial 32% increase in share price in the last quarter. This positive performance aligns with broader market trends, such as all-time highs in major indices, providing a supportive backdrop for further investor enthusiasm. However, the company's integration efforts following its Princes acquisition remain a concern, potentially affecting future profitability due to anticipated margin pressure and high net debt relative to EBITDA.

Over the past five years, NewPrinces achieved a total return of 357.20%, illustrating robust long-term growth. This performance is particularly impressive compared to the Italian Food industry, which saw a 29.6% increase over the past year. Despite prospective challenges in sustaining high growth rates, the company's strategies, including cost optimization and product diversification, could continue to influence revenue and earnings positively going forward. Nevertheless, the earnings forecast indicates a decline of 20.3% per annum over the next three years, posing challenges to sustaining past growth rates.

On a valuation basis, NewPrinces' current share price of €23.50, with a modest 7.87% discount to the consensus analyst price target of €25.35, suggests that the market may already be pricing in potential headwinds. As analysts predict a profit margin contraction to 2.6% by 2028, this outlook may weigh on future revenue forecasts. Further developing operational initiatives and mitigating integration challenges will be crucial for NewPrinces to align its performance with market expectations and maintain investor confidence.

Click to explore a detailed breakdown of our findings in NewPrinces' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewPrinces might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NWL

NewPrinces

Operates in the agri-food sector in Italy, Germany, the United Kingdom, and internationally.

Good value with proven track record.

Market Insights

Community Narratives