The Market Lifts Centrale del Latte d'Italia S.p.A. (BIT:CLI) Shares 26% But It Can Do More

Centrale del Latte d'Italia S.p.A. (BIT:CLI) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 39%.

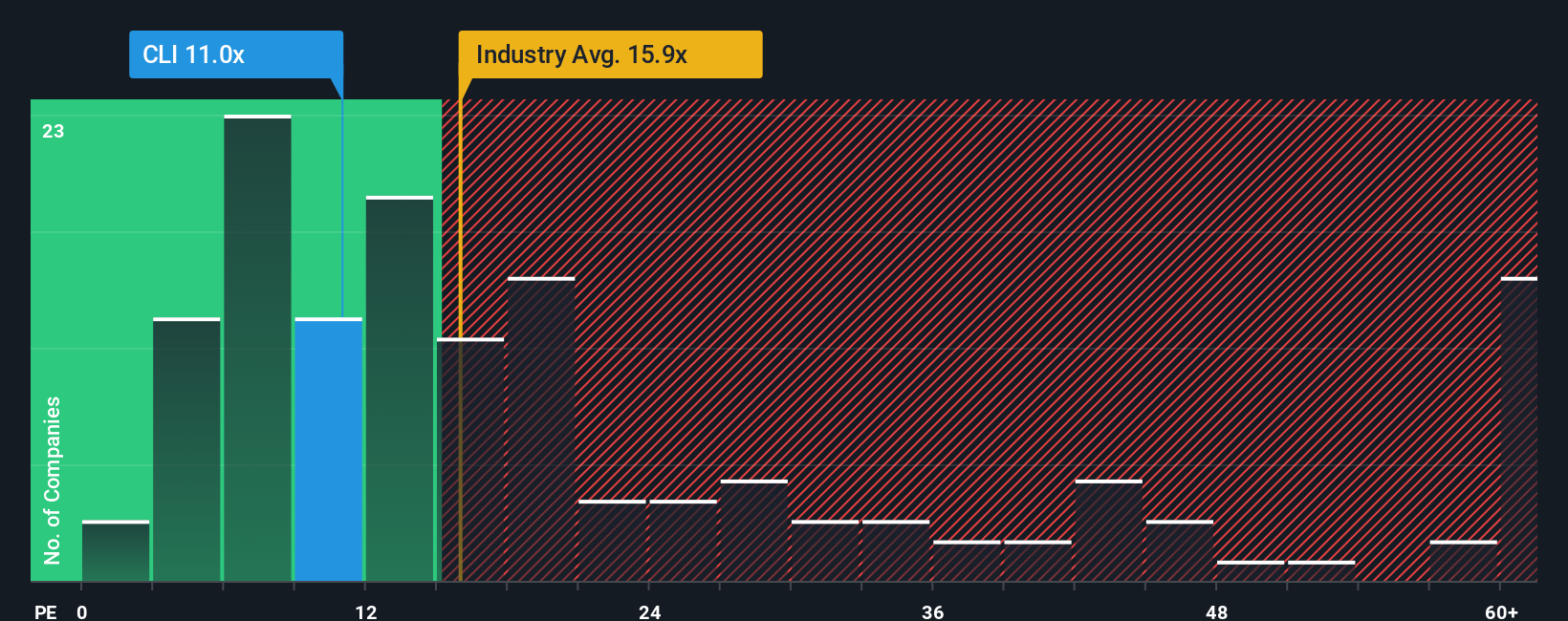

In spite of the firm bounce in price, Centrale del Latte d'Italia's price-to-earnings (or "P/E") ratio of 11x might still make it look like a buy right now compared to the market in Italy, where around half of the companies have P/E ratios above 18x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Centrale del Latte d'Italia certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Centrale del Latte d'Italia

How Is Centrale del Latte d'Italia's Growth Trending?

In order to justify its P/E ratio, Centrale del Latte d'Italia would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 49% last year. Pleasingly, EPS has also lifted 134% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% per annum, which is noticeably less attractive.

With this information, we find it odd that Centrale del Latte d'Italia is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Centrale del Latte d'Italia's P/E?

Despite Centrale del Latte d'Italia's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Centrale del Latte d'Italia currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Centrale del Latte d'Italia that you need to be mindful of.

If these risks are making you reconsider your opinion on Centrale del Latte d'Italia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CLI

Centrale del Latte d'Italia

Engages in the production, treatment, processing, and sale of milk, dairy, and food products in Italy, Germany, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success