- Italy

- /

- Energy Services

- /

- BIT:SPM

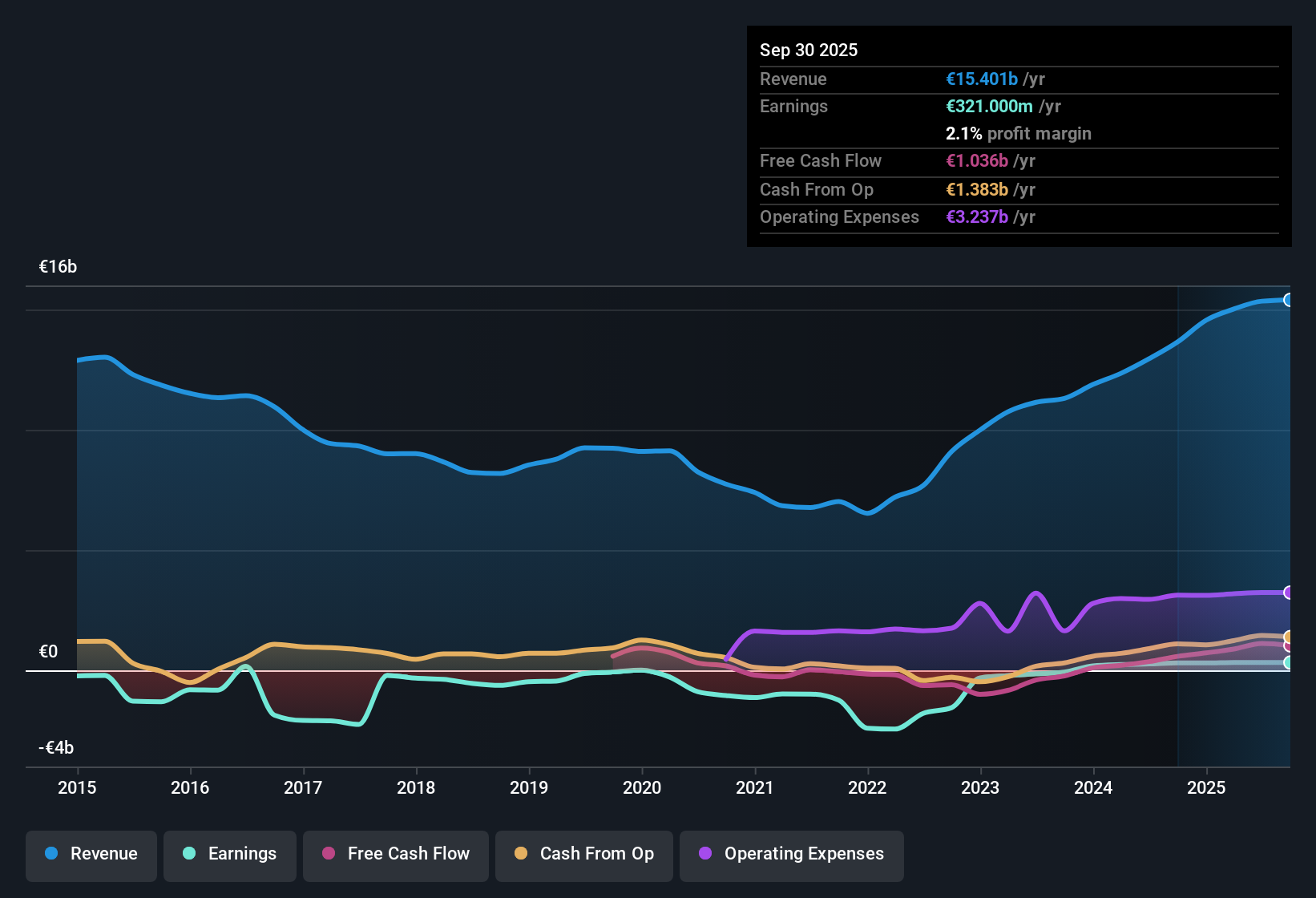

Saipem (BIT:SPM) Earnings Growth of 24.7% Reinforces Bullish Sentiment Despite Declining Revenue Outlook

Reviewed by Simply Wall St

Saipem (BIT:SPM) posted earnings growth of 24.7% year-over-year, driven by net profit margins of 2.1%, just above last year's 2%. While the company is forecast to see its earnings rise 14.6% per year, outpacing the Italian market rate of 9.7%, revenue is expected to decline slightly by 0.1% annually over the next three years. This sets a mixed tone for growth prospects. With profitability momentum clear but modest revenue expectations ahead, investors will be weighing these results against valuation and the sustainability of Saipem’s dividend.

See our full analysis for Saipem.The next section will break down how these results compare with the consensus narratives for Saipem, pinpointing where the latest data confirms or takes issue with the market’s big-picture view.

See what the community is saying about Saipem

Margin Expansion Driven by Energy Transition and Digitalization

- Saipem's EBITDA margins are now consistently above 11%, reflecting improved operational efficiency and cost containment initiatives in recent periods.

- The analysts' consensus narrative notes that ongoing digitalization, combined with a shift toward energy transition projects and engineering services, is driving better net margins as these segments deliver higher returns than traditional contracts.

- Strategic expansion in carbon capture and energy transition segments totals €2 billion in new projects, directly lifting average margins as these services command premium rates.

- This shift also helps counterbalance profitability pressures from legacy contracts and a more competitive bidding environment for traditional oil and gas projects.

€53 Billion Order Backlog Provides Multi-Year Visibility

- Saipem's record-high commercial pipeline and order backlog, totaling €53 billion, gives revenue visibility deep into 2025 and 2026. This is a key difference from industry peers that depend on shorter-term awards.

- According to the consensus narrative, this robust backlog heavily supports long-term top-line stability, even against declining hydrocarbon demand, by anchoring growth in infrastructure and energy security-driven segments.

- The move to reimbursable frameworks and selective project bidding has reduced legacy burdens to below €100 million, improving backlog quality and earnings predictability.

- Despite fierce competition and market cyclicality, high backlog coverage mitigates the risk of abrupt revenue shocks or order book gaps over the next couple of years.

DCF Fair Value Suggests Deep Discount Versus Market and Sector

- At a share price of €2.35, Saipem trades meaningfully below both analysts' consensus price target (€3.09) and the DCF fair value of €4.80. This highlights a perceived undervaluation relative to peer and sector averages.

- Analysts' consensus view argues that this discount is justified only if you expect margins and earnings to lag forecasts, since the current P/E of 14x is well under the peer average of 18.2x, but still above the broader European Energy Services industry at 9.9x.

- The split between analysts' most bullish (€3.54) and most bearish (€2.00) price targets underscores considerable debate about Saipem's ability to hit margin targets and sustain growth beyond 2026.

- Still, the fair value gap offers substantial upside if management continues to convert backlog into high-margin revenue streams.

Curious how the latest earnings data stacks up against what other investors and analysts are saying? Dive into the full consensus narrative for Saipem and see where you agree or disagree. 📊 Read the full Saipem Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Saipem on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your unique view and craft a narrative in just a few minutes. Do it your way

A great starting point for your Saipem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Saipem’s steady margins are balanced by muted revenue growth forecasts and uncertainty about sustaining expansion beyond the current backlog.

If you want greater consistency, check out stable growth stocks screener (2090 results) for companies that deliver stable revenue and earnings performance no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SPM

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion