- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni (BIT:ENI) Valuation: Assessing the Impact of Major Gas Joint Venture and Biorefinery Developments

Reviewed by Simply Wall St

Eni (BIT:ENI) is in the spotlight after a series of strategic moves. These include a $15 billion gas joint venture with Petronas, breaking ground on a major Malaysian biorefinery, and extending Egyptian oil and gas agreements until 2040.

See our latest analysis for Eni.

There’s definitely momentum building for Eni. The share price has climbed 22% year-to-date and recent strategic news, including a large-scale buyback and joint ventures, seems to be driving optimism. Long-term investors are also seeing the effects, with a one-year total shareholder return of 25% and a remarkable 179% five-year return.

If Eni’s global energy moves have sparked your curiosity, now is an ideal moment to broaden your outlook and discover fast growing stocks with high insider ownership

With the share price rallying and big investments on the table, is Eni still trading below its intrinsic value, or has the recent surge already captured all the upside that future growth could bring?

Most Popular Narrative: 2.2% Overvalued

With Eni’s last closing price at €16.47 and the widely followed narrative estimating fair value at €16.12, the stock is being viewed as trading slightly above that level. This prompts a closer look at its underlying business drivers and financial trajectory.

The acceleration of Eni's biorefining and sustainable mobility businesses, including multiple new biorefinery projects and partnerships (for example, Ares in Plenitude and KKR in Enilive), supports growth in lower-carbon, higher-margin revenue streams. Enhanced market demand and supportive regulatory changes, especially in EU and US biofuels, are likely catalysts for margin expansion and improved return on equity.

Want to know why analysts believe these innovative businesses might reshape Eni’s margins and future valuation? The projection banks on a dramatic shift in the company’s mix and profitability. Are the estimates anchored by aggressive expectations or conservative realities? There is a blueprint buried in the financial assumptions, waiting to be unveiled when you read the complete narrative.

Result: Fair Value of €16.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming challenges, including slow progress on renewables and ongoing losses in Eni’s chemicals division, could threaten the optimistic outlook for sustained earnings growth.

Find out about the key risks to this Eni narrative.

Another View: A Discounted Cash Flow Perspective

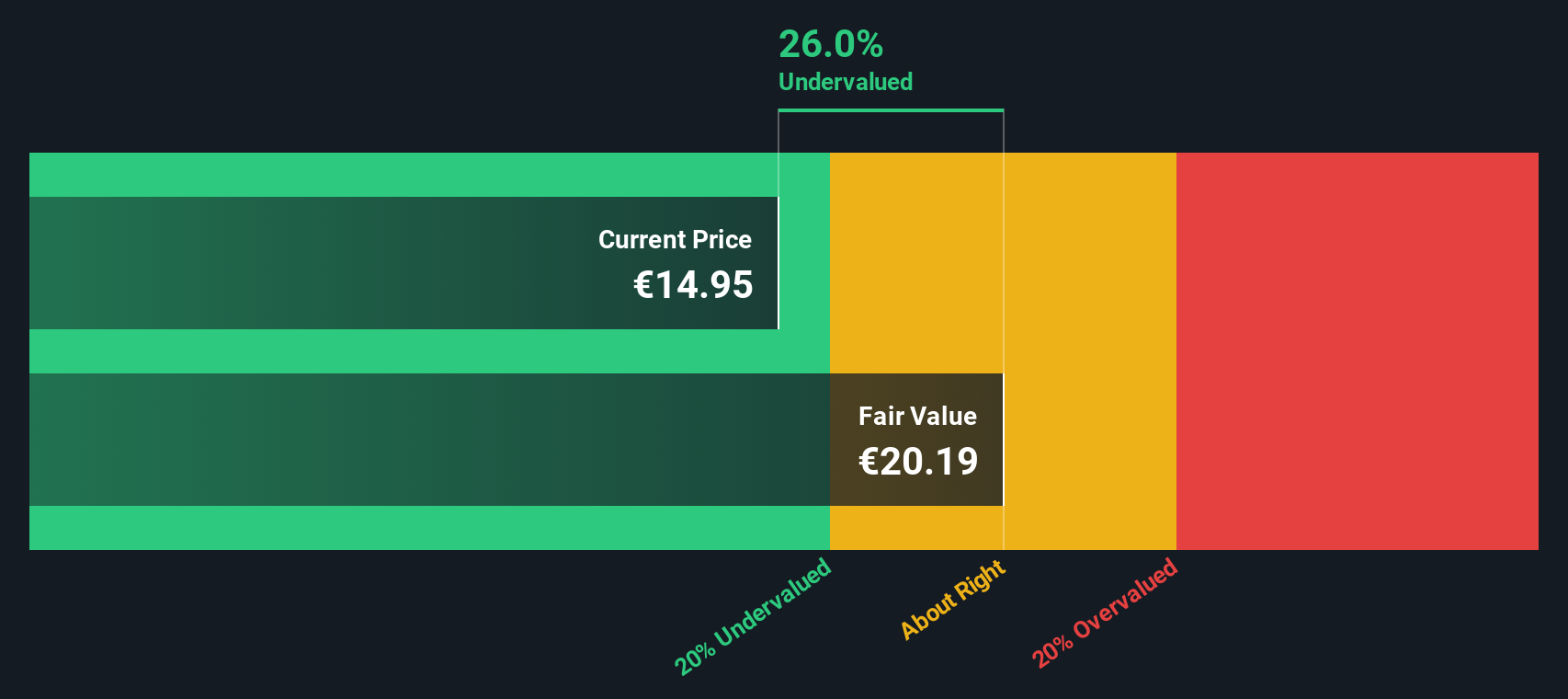

While analysts see Eni as slightly overvalued based on consensus price targets, our SWS DCF model tells a different story. By projecting future cash flows and discounting them to today’s value, the DCF model suggests Eni could actually be undervalued by almost 30% at its current price. Could the market be missing a deeper value opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eni for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eni Narrative

If you want to challenge these perspectives or test your own investment ideas, take a closer look at the numbers and build your own narrative in just a few minutes. Do it your way

A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Every week brings new opportunities. Stay ahead and make your next move; your watchlist is only as strong as the stocks you put in it.

- Tap into future trends by checking out these 25 AI penny stocks, which are powering breakthroughs in artificial intelligence and reshaping how industries operate.

- Unlock the potential for passive returns and steady income when you browse these 16 dividend stocks with yields > 3%, highlighting companies with yields greater than 3%.

- Seize value opportunities by scanning these 879 undervalued stocks based on cash flows, featuring stocks that stand out based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives