- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni (BIT:ENI): Assessing Valuation After Recent Share Price Strength and Dividend-Fuelled Returns

Reviewed by Simply Wall St

Eni (BIT:ENI) has quietly outperformed many European energy peers lately, and that strength is starting to catch investors attention. With the share price trending higher, the key question now is whether the current valuation still looks appealing.

See our latest analysis for Eni.

That strength is not just a blip either, with the stock posting a solid year to date share price return, while a much stronger one year total shareholder return suggests dividends have been a big part of the story.

If Eni’s momentum has you thinking about where else capital might work hard for you, it could be worth exploring aerospace and defense stocks as another hunting ground for resilient plays.

With earnings growing faster than revenue and the shares still trading at a noticeable discount to some value estimates, the debate now is clear: is Eni still a buy, or is the market already pricing in its future growth?

Most Popular Narrative: 3.9% Undervalued

With Eni last closing at €15.90 against a most popular narrative fair value near €16.54, the story leans toward modest upside grounded in fundamentals.

The acceleration of Eni's biorefining and sustainable mobility businesses, including multiple new biorefinery projects and partnerships (e.g., Ares in Plenitude, KKR in Enilive), supports growth in lower carbon, higher margin revenue streams. Enhanced market demand and supportive regulatory changes, especially in EU and US biofuels, are likely catalysts for margin expansion and improved return on equity.

Curious how steady revenues, rising margins, shrinking share count and a disciplined discount rate combine into that value gap? The narrative’s math might surprise you.

Result: Fair Value of €16.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real risks, from delayed cash neutrality in Plenitude to prolonged losses at Versalis, that could challenge this undervaluation thesis.

Find out about the key risks to this Eni narrative.

Another View: Market Multiple Sends A Different Signal

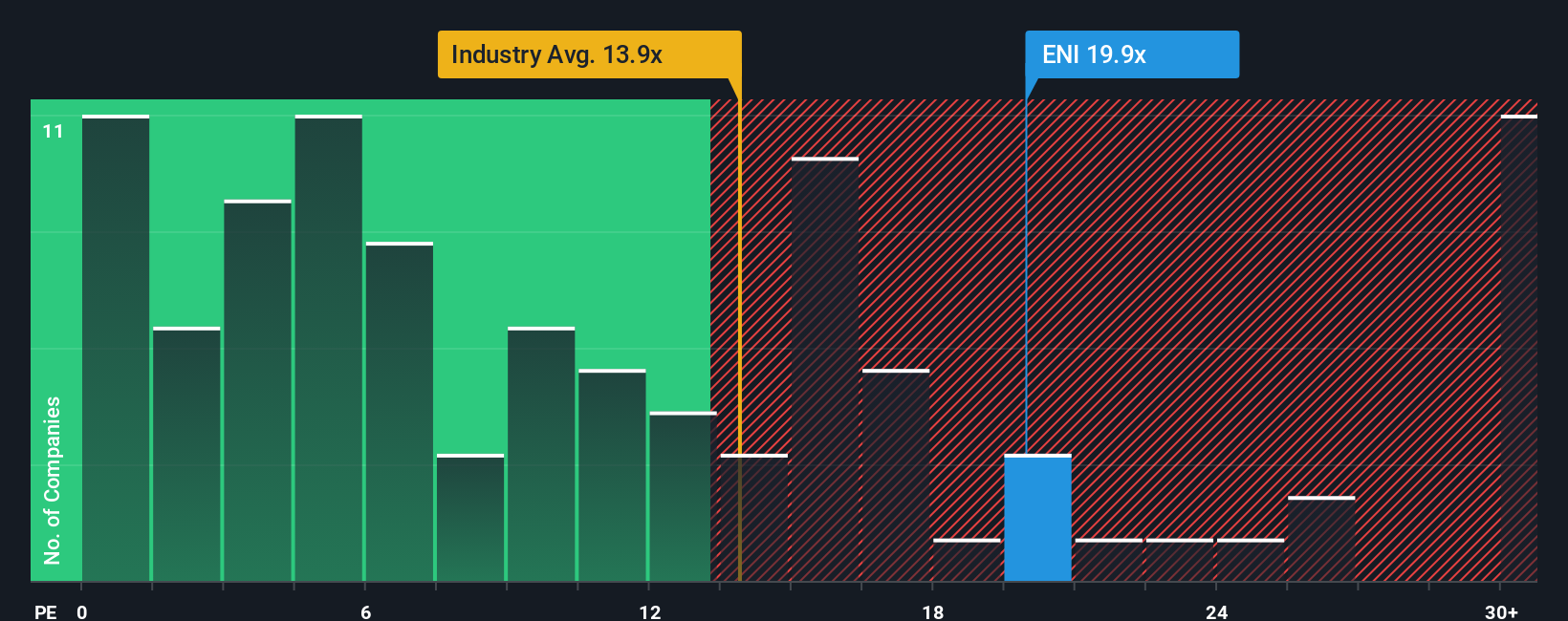

While the narrative points to modest undervaluation, the market’s own yardstick tells a more cautious story. Eni trades on a price to earnings ratio of 18.4 times, which is well above both peers at 12.4 times and the European Oil and Gas average at 11.4 times, even though our fair ratio is higher at 20.7 times.

That gap suggests today’s price already bakes in a lot of optimism, and any slip in execution could compress the multiple more quickly than the fair ratio moves closer. Is this an opportunity with some valuation cushion, or a premium that leaves little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one strong thesis when you can uncover fresh opportunities on Simply Wall Street’s Screener that match your style, goals, and risk comfort.

- Supercharge your hunt for potential bargains by targeting companies that appear mispriced on cash flow metrics through these 914 undervalued stocks based on cash flows.

- Capitalize on the growth potential of cutting edge innovation by scanning these 25 AI penny stocks for businesses building the next generation of intelligent tools.

- Strengthen your income stream by zeroing in on established payers with attractive yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion