- Italy

- /

- Capital Markets

- /

- BIT:TIP

European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and economic uncertainties, European markets have faced recent declines, with indices such as the STOXX Europe 600 and Germany's DAX reflecting these challenges. In this environment, growth companies with strong insider ownership can offer unique insights into potential resilience and commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| VusionGroup (ENXTPA:VU) | 13.4% | 71.2% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 58.6% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's review some notable picks from our screened stocks.

Tamburi Investment Partners (BIT:TIP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tamburi Investment Partners S.p.A. is a private equity firm that specializes in direct and secondary direct investments, with a market cap of €1.28 billion.

Operations: The company's revenue primarily comes from its Investment Banking and Merchant Banking Activities, amounting to €1.04 billion.

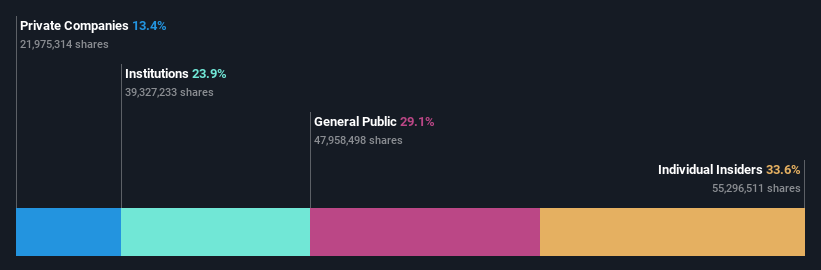

Insider Ownership: 33.7%

Earnings Growth Forecast: 22.1% p.a.

Tamburi Investment Partners shows strong growth potential with earnings and revenue expected to grow significantly faster than the Italian market. Despite a recent decline in profit margins, insider confidence remains high with substantial share purchases over the past three months. The company has initiated a share buyback program aimed at strategic investments and liquidity improvement. However, its €1 million revenue is not considered meaningful, and its dividend is not well covered by free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Tamburi Investment Partners.

- Insights from our recent valuation report point to the potential overvaluation of Tamburi Investment Partners shares in the market.

Andfjord Salmon Group (OB:ANDF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Andfjord Salmon Group AS focuses on land-based farming of Atlantic salmon in Norway, with a market cap of NOK2.91 billion.

Operations: Andfjord Salmon Group AS generates its revenue from the land-based farming of Atlantic salmon in Norway.

Insider Ownership: 24.1%

Earnings Growth Forecast: 61.5% p.a.

Andfjord Salmon Group is poised for substantial growth, with revenue expected to increase by 57.3% annually, outpacing the Norwegian market. Despite a current net loss of NOK 18.03 million, the company anticipates becoming profitable within three years. Recent infrastructure developments at its Kvalnes facility will boost production capacity by approximately 20%. Although past shareholder dilution occurred, insider ownership remains significant and analysts predict a potential stock price rise of 56.8%.

- Dive into the specifics of Andfjord Salmon Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility Andfjord Salmon Group's shares may be trading at a premium.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB operates in the global animal health industry and has a market capitalization of SEK21.15 billion.

Operations: The company's revenue segments include Medtech (€133 million), Diagnostics (€21.70 million), Specialty Pharma (€176.60 million), and Veterinary Services (€60 million).

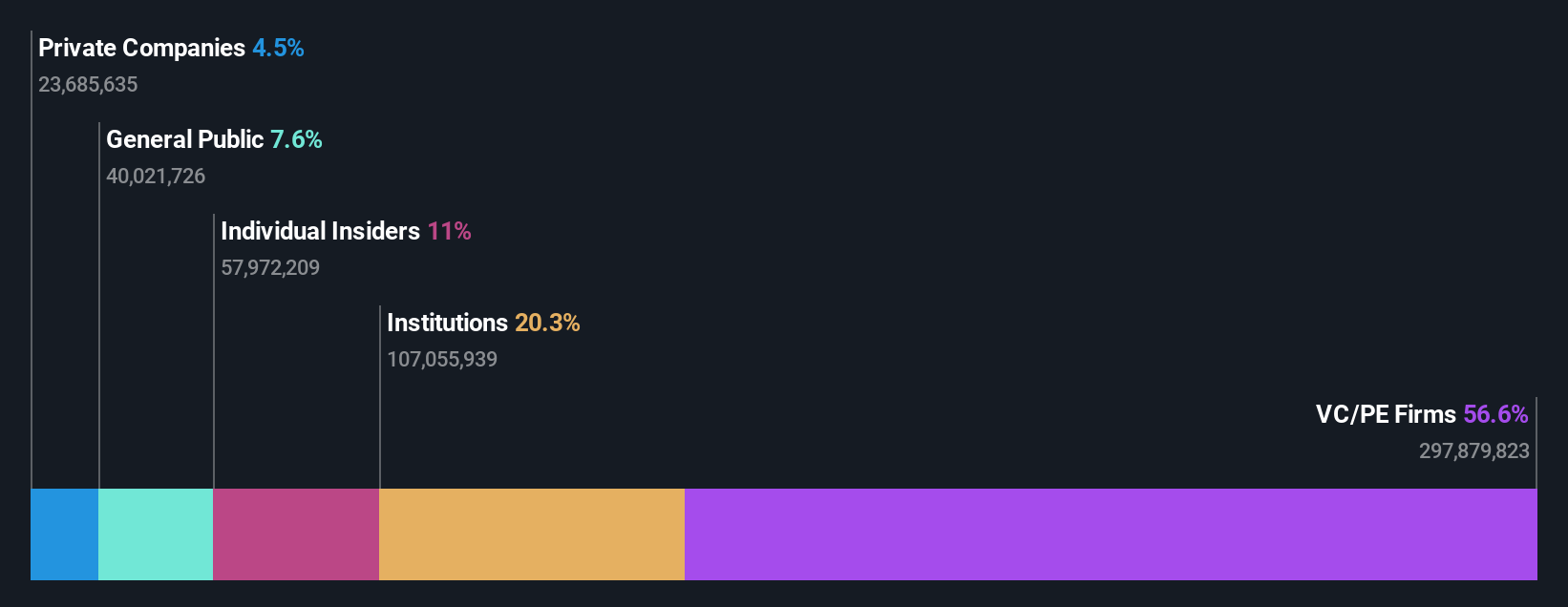

Insider Ownership: 11.1%

Earnings Growth Forecast: 46.8% p.a.

Vimian Group demonstrates strong growth potential, with projected annual earnings growth of 46.8%, surpassing the Swedish market. Revenue is expected to grow at 10.8% annually, supported by substantial insider buying. Recent changes in company bylaws introduced new share classes for incentive programs, potentially aligning management interests with shareholders. The company's Q1 earnings showed sales of €107.5 million and net income of €4.3 million, reflecting solid financial performance despite a forecasted low return on equity in three years.

- Get an in-depth perspective on Vimian Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Vimian Group's current price could be inflated.

Next Steps

- Navigate through the entire inventory of 208 Fast Growing European Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tamburi Investment Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TIP

Tamburi Investment Partners

Tamburi Investment Partners S.p.A. is private equity firm specializing in direct and secondary direct investments.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives