- Italy

- /

- Consumer Finance

- /

- BIT:MOL

Moltiply Group (BIT:MOL) Reports 40% Sales Growth And 7% Net Income Increase

Reviewed by Simply Wall St

Moltiply Group (BIT:MOL) recently announced robust financial results for the first half of 2025, showcasing a rise in sales and net income. Despite this positive performance, the company's stock experienced a 2% decline over the last month. This price movement contrasts with broad market trends, as major indexes like the Dow Jones and S&P 500 reached record highs due to inflation data and expectations of interest rate cuts by the Federal Reserve. The release of impressive earnings did not appear to significantly impact Moltiply's share price, suggesting other factors or investor sentiment might have influenced the outcome.

Every company has risks, and we've spotted 1 risk for Moltiply Group you should know about.

The recent financial results presented by Moltiply Group, highlighting increases in sales and net income, suggest a strong operational performance. However, despite these positive developments, the stock has seen a 2% decline over the past month. This discrepancy may indicate that factors such as investor sentiment or external market conditions might be impacting the stock's performance more than the recent earnings figures. Considering the broader market's upward movement, reflected in record highs for the Dow Jones and S&P 500, Moltiply's short-term price dip is especially intriguing and raises questions about long-term value perceptions among investors.

Over a longer period, the company's total shareholder return was a robust 75.10% over five years, demonstrating strong growth and value creation for shareholders. In contrast, over the past year, Moltiply's performance exceeded the Italian Consumer Finance industry, which returned 24.7%, signaling a competitive edge in a challenging sector.

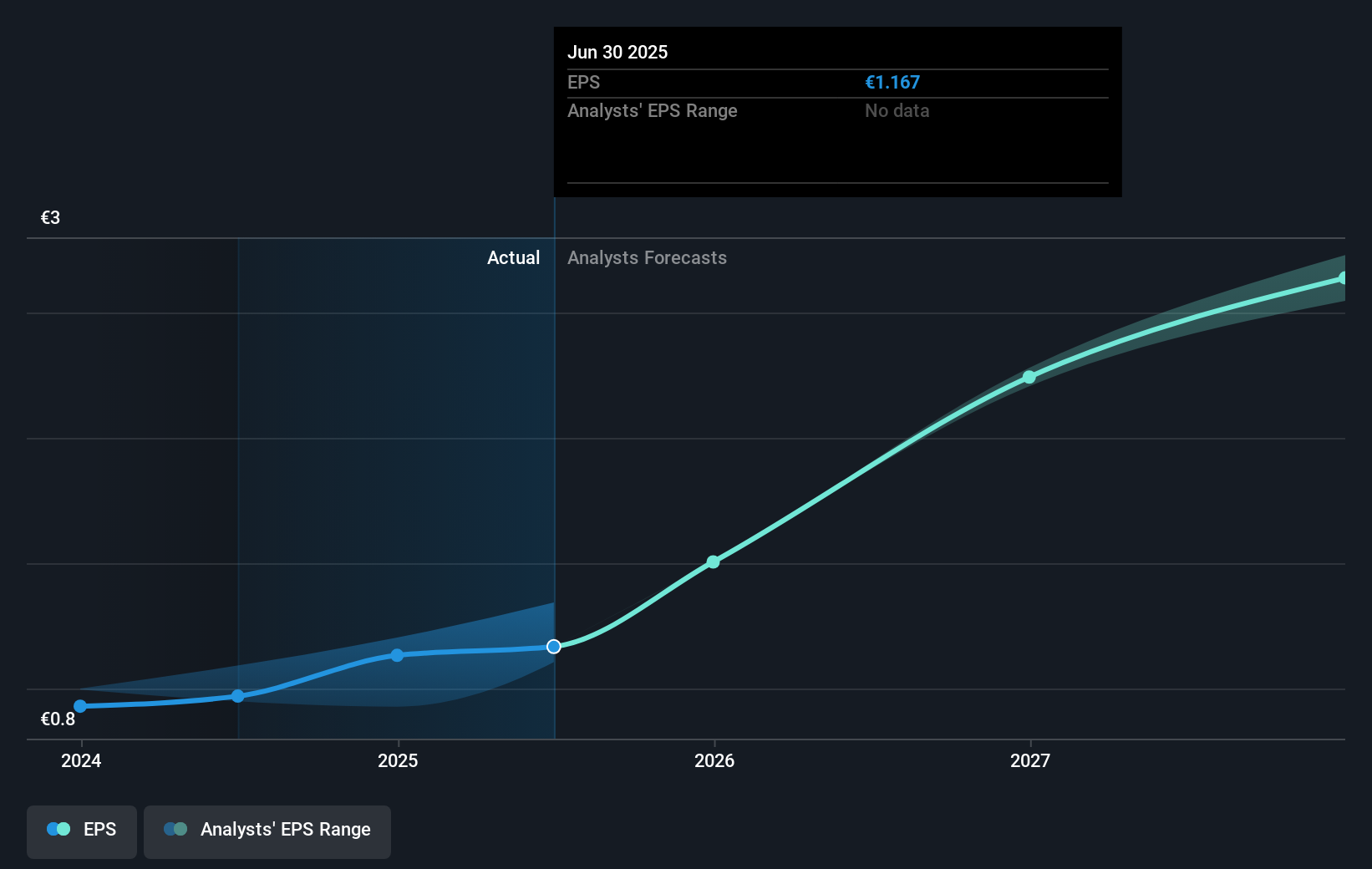

The current share price of €41.60 stands significantly below the analyst consensus price target of €57.33, suggesting a potential upside based on projected revenue and profitability improvements. Analysts foresee annual revenue growth of 21.0%, driving earnings up to €112.8 million by 2028. Assuming these estimates, the company's valuation, with a price-to-earnings ratio projected to decrease from 38.8x to 26.3x by 2028, appears reasonable if market conditions align with expectations. Nevertheless, potential risks could alter these forecasts, such as changes in Google's practices affecting the company's margins or broader economic influences impacting growth sectors, including the E-Commerce Price Comparison and BPO divisions.

Evaluate Moltiply Group's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MOL

Moltiply Group

A holding company that operates in the financial services industry.

High growth potential with questionable track record.

Market Insights

Community Narratives