- Italy

- /

- Diversified Financial

- /

- BIT:MET

Met.Extra Group S.p.A. (BIT:MET) Held Back By Insufficient Growth Even After Shares Climb 35%

The Met.Extra Group S.p.A. (BIT:MET) share price has done very well over the last month, posting an excellent gain of 35%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

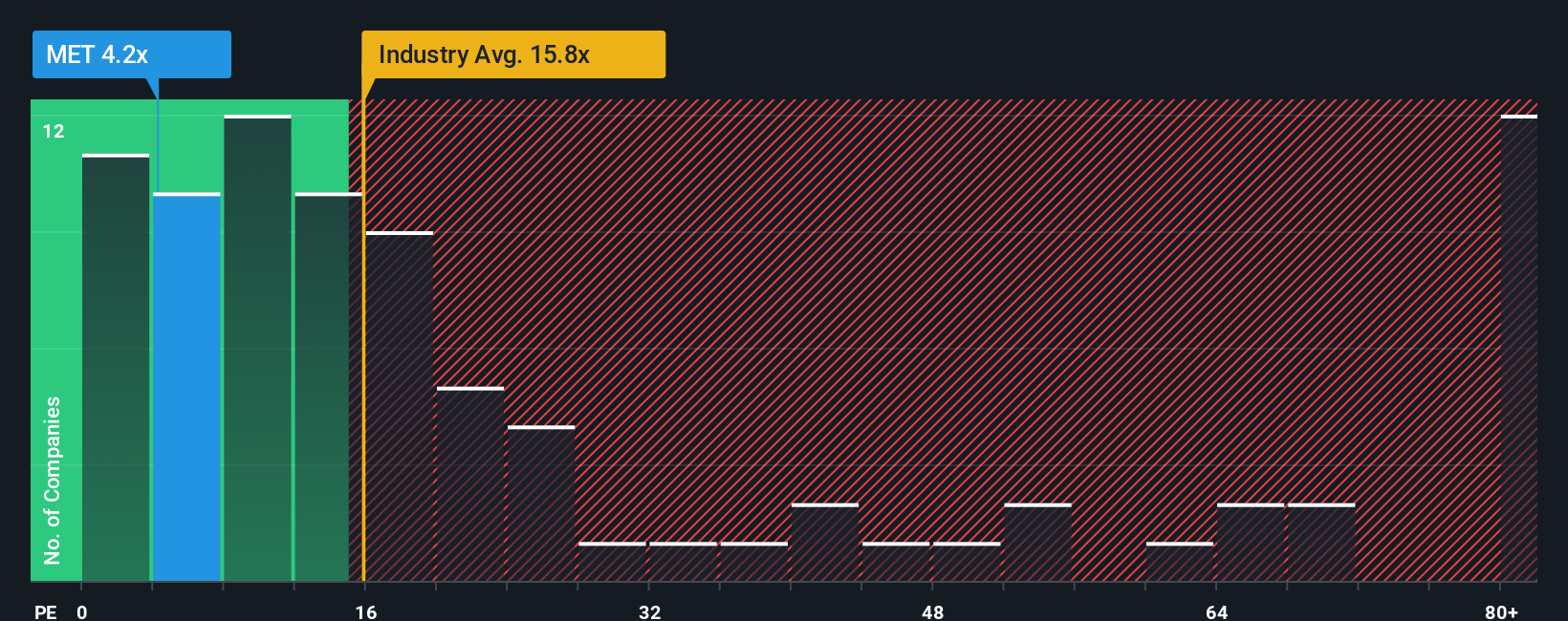

In spite of the firm bounce in price, given about half the companies in Italy have price-to-earnings ratios (or "P/E's") above 18x, you may still consider Met.Extra Group as a highly attractive investment with its 4.2x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, Met.Extra Group's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Met.Extra Group

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Met.Extra Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 19%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Met.Extra Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Even after such a strong price move, Met.Extra Group's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Met.Extra Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Met.Extra Group you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:MET

Met.Extra Group

Processes and markets ferrous and non-ferrous materials used in the production of stainless steel in Italy and Europe.

Excellent balance sheet and good value.

Market Insights

Community Narratives