If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Exor N.V. (BIT:EXO) share price is up 12% in the last year, clearly besting than the market return of around 1.9% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Exor for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Exor

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

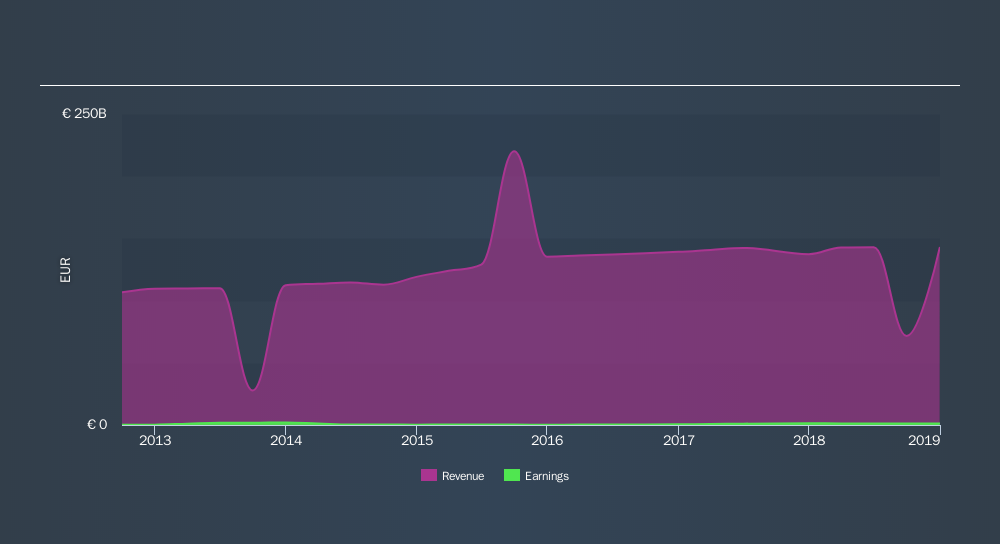

Over the last twelve months, Exor actually shrank its EPS by 5.2%. Given the share price gain, we doubt the market is measuring progress with EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 0.7% dividend yield is doing much to support the share price. However the year on year revenue growth of 3.7% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Exor

A Different Perspective

Exor boasts a total shareholder return of 13% for the last year(that includes the dividends). And the share price momentum remains respectable, with a gain of 7.7% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Exor is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:EXO

Exor

Engages in the automotive, agriculture and construction, sports car, commercial vehicle, and powertrain businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives