As we navigate through September 2025, the European market is showing signs of resilience, with the pan-European STOXX Europe 600 Index climbing amid expectations of a U.S. Federal Reserve rate cut and steady economic forecasts from the European Central Bank. In this environment, identifying promising small-cap stocks involves looking for companies that can capitalize on stable economic conditions and potential shifts in monetary policy to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Equita Group (BIT:EQUI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equita Group S.p.A. offers sales and trading, investment banking, and alternative asset management services to investors, financial institutions, corporates, and entrepreneurs both in Italy and internationally with a market capitalization of €265.79 million.

Operations: Equita Group generates revenue through sales and trading, investment banking, and alternative asset management services. The company focuses on serving investors, financial institutions, corporates, and entrepreneurs in Italy and internationally. Its market capitalization stands at €265.79 million.

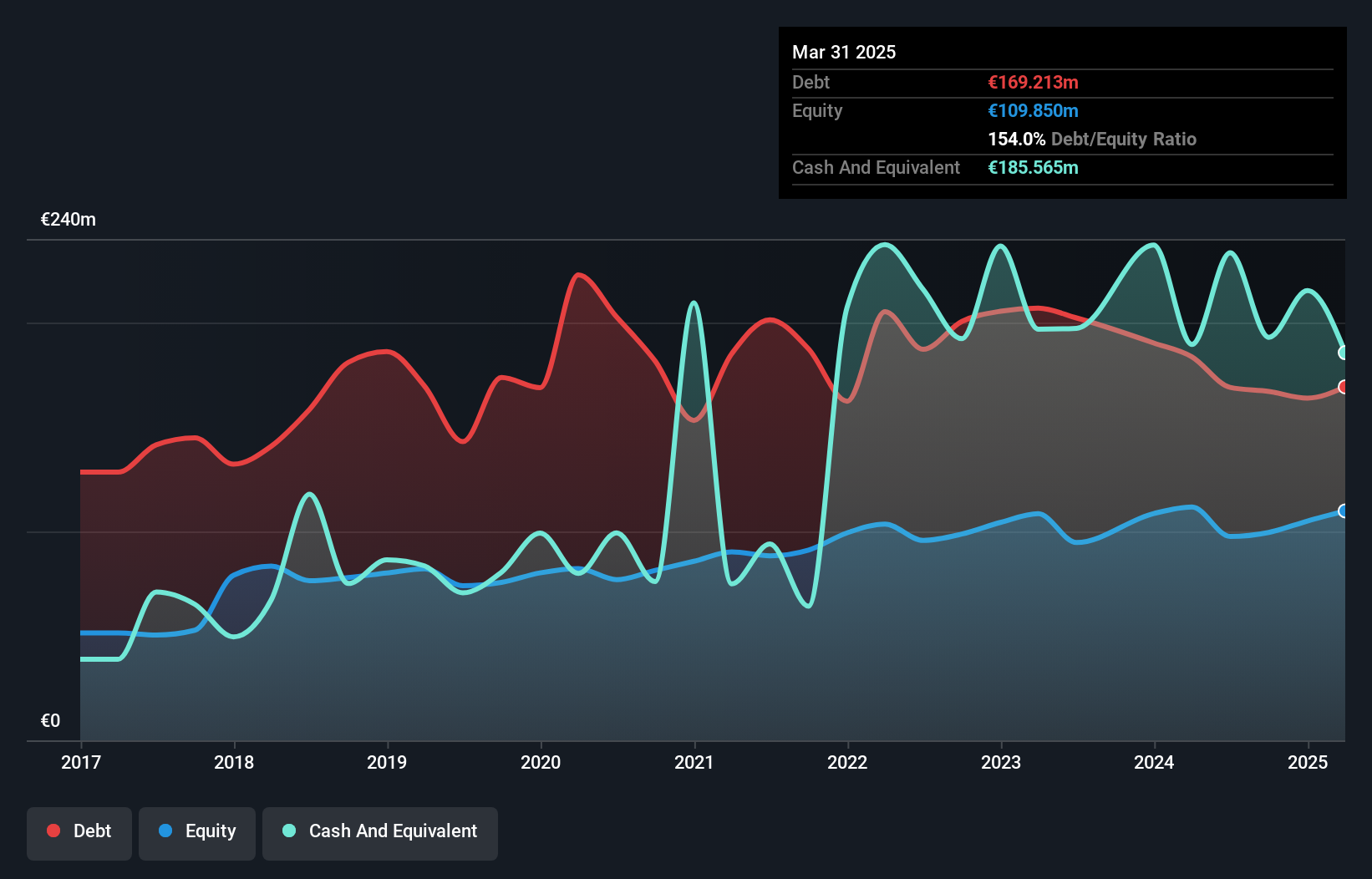

Equita Group, a smaller player in the financial sector, has shown resilience with its net income rising to €12.22 million for the half-year ending June 2025 from €8.11 million previously. Over five years, its debt-to-equity ratio improved significantly from 263.5% to 169.8%, while maintaining high-quality earnings despite not outpacing industry growth rates recently. With a price-to-earnings ratio of 14.6x below Italy's market average of 17.8x and more cash than debt, Equita appears well-positioned financially although free cash flow remains negative, hinting at potential challenges in liquidity management or capital allocation strategies moving forward.

- Navigate through the intricacies of Equita Group with our comprehensive health report here.

Gain insights into Equita Group's historical performance by reviewing our past performance report.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bittium Oyj is a company that offers communication and connectivity solutions, healthcare technology products and services, as well as biosignal measurement and monitoring, operating primarily in Finland, Germany, and the United States with a market cap of €460.29 million.

Operations: Revenue primarily comes from the Defense & Security segment (€55.50 million) and Medical segment (€29.00 million), with additional contributions from Engineering Services (€14.72 million).

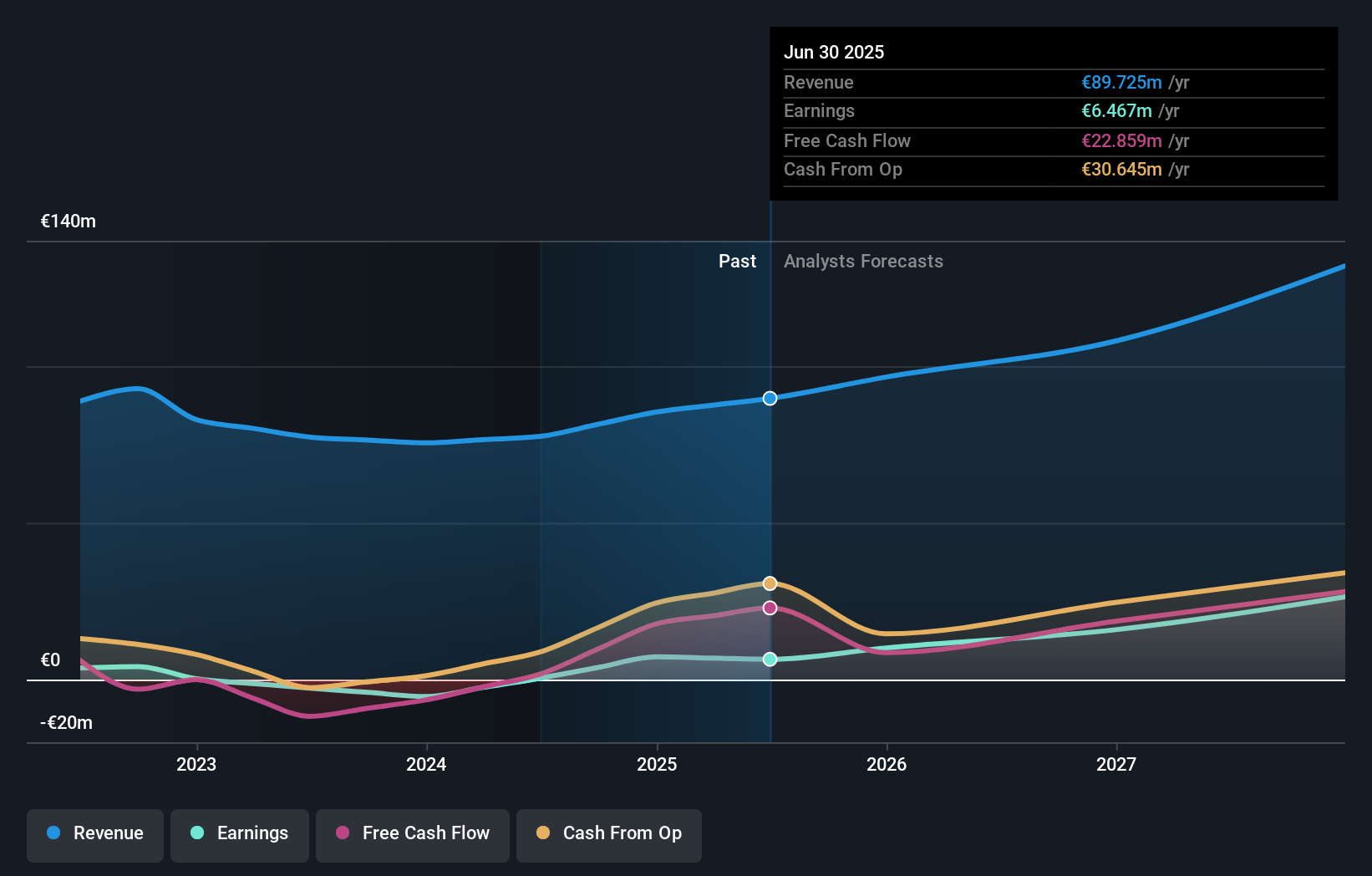

Bittium Oyj, a nimble player in the tech space, has been making waves with its robust earnings growth of 1278.9% over the past year, outpacing the software industry's -1.7%. Despite a volatile share price recently, Bittium's financial health is underscored by having more cash than total debt and EBIT covering interest payments 22.6 times over. The launch of its high-security Tough Mobile 3 smartphone highlights Bittium's focus on secure communications amid rising cybersecurity threats. With projected annual earnings growth of 41.73%, this Finnish company continues to expand its footprint in defense and security sectors globally.

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW Offshore Limited specializes in engineering offshore production solutions across various regions including the Americas, Europe, Africa, Asia, and the Pacific, with a market cap of NOK6.39 billion.

Operations: The company generates revenue primarily from FPSO services, amounting to $564 million, with a smaller contribution from Floating Wind at $3.50 million.

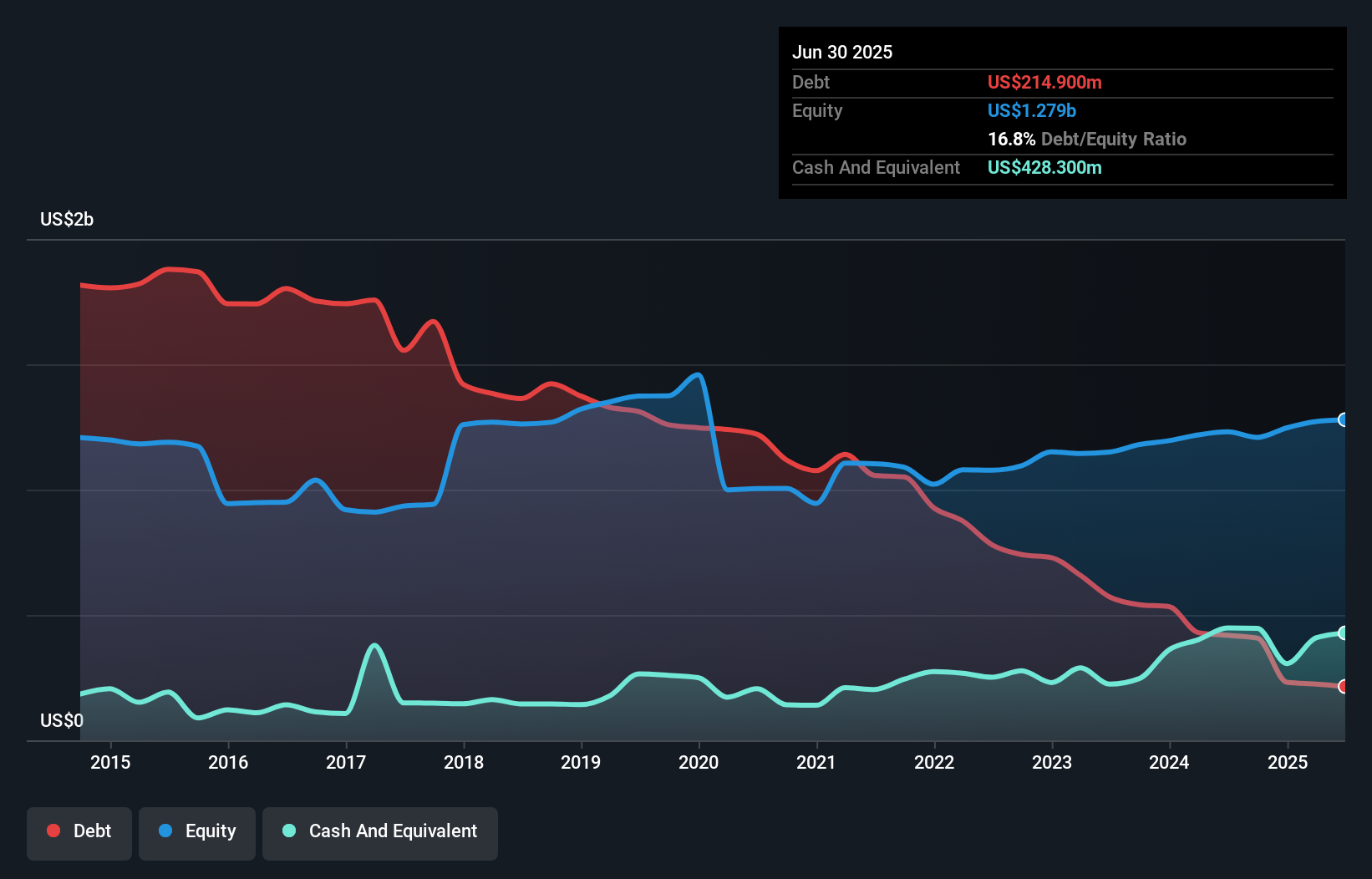

BW Offshore, a nimble player in the energy sector, has seen its earnings grow at an impressive 54% annually over the past five years. Despite this growth, recent figures show sales for the first half of 2025 were US$281 million, down from US$321 million last year. However, net income rose to US$87 million from US$66 million. The company’s debt-to-equity ratio has improved significantly to 17% from 122% over five years. A new USD220 million credit facility and a promising project with Equinor underscore its strategic moves amidst challenges like aging fleet costs and decarbonization pressures.

Taking Advantage

- Embark on your investment journey to our 334 European Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives