- Italy

- /

- Diversified Financial

- /

- BIT:BMED

New Forecasts: Here's What Analysts Think The Future Holds For Banca Mediolanum S.p.A. (BIT:BMED)

Celebrations may be in order for Banca Mediolanum S.p.A. (BIT:BMED) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

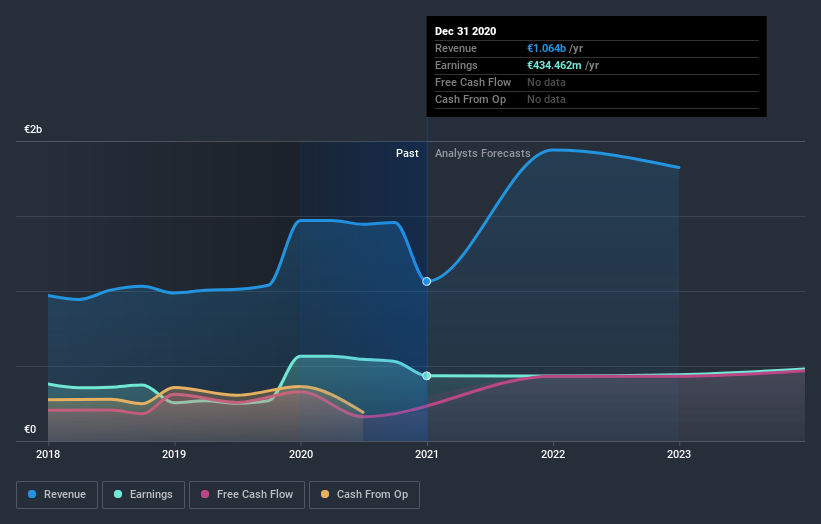

After the upgrade, the eight analysts covering Banca Mediolanum are now predicting revenues of €1.9b in 2021. If met, this would reflect a sizeable 82% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to crater 21% to €0.57 in the same period. Previously, the analysts had been modelling revenues of €1.7b and earnings per share (EPS) of €0.56 in 2021. The forecasts seem more optimistic now, with a nice increase in revenue and a slight bump in earnings per share estimates.

See our latest analysis for Banca Mediolanum

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of €8.61, suggesting that the forecast performance does not have a long term impact on the company's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Banca Mediolanum, with the most bullish analyst valuing it at €9.80 and the most bearish at €7.30 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Banca Mediolanum's rate of growth is expected to accelerate meaningfully, with the forecast 82% revenue growth noticeably faster than its historical growth of 6.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue shrink 31% per year. It seems obvious that as part of the brighter growth outlook, Banca Mediolanum is expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, they also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Banca Mediolanum.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Banca Mediolanum analysts - going out to 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Banca Mediolanum, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Banca Mediolanum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BMED

Banca Mediolanum

Provides various banking products and services in Italy.

Solid track record, good value and pays a dividend.