- Italy

- /

- Diversified Financial

- /

- BIT:BMED

Here's Why We Think Banca Mediolanum (BIT:BMED) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Banca Mediolanum (BIT:BMED). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Banca Mediolanum

How Quickly Is Banca Mediolanum Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Banca Mediolanum has grown EPS by 37% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

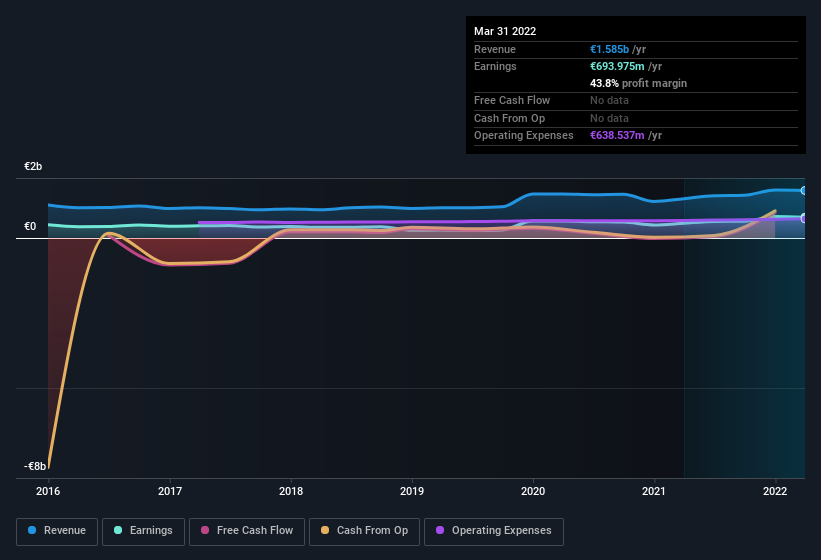

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Banca Mediolanum's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Banca Mediolanum achieved similar EBIT margins to last year, revenue grew by a solid 21% to €1.6b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Banca Mediolanum's forecast profits?

Are Banca Mediolanum Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Banca Mediolanum is the serious outlay one insider has made to buy shares, in the last year. In one big hit, CEO & Director Massimo Doris paid €382k, for shares at an average price of €7.65 per share. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

The good news, alongside the insider buying, for Banca Mediolanum bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth €755m. Coming in at 15% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Does Banca Mediolanum Deserve A Spot On Your Watchlist?

Banca Mediolanum's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Banca Mediolanum belongs near the top of your watchlist. We should say that we've discovered 1 warning sign for Banca Mediolanum that you should be aware of before investing here.

The good news is that Banca Mediolanum is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Banca Mediolanum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BMED

Banca Mediolanum

Provides various banking products and services in Italy.

Solid track record, good value and pays a dividend.