- Italy

- /

- Diversified Financial

- /

- BIT:BFF

BFF Bank's (BIT:BFF) Shareholders Will Receive A Smaller Dividend Than Last Year

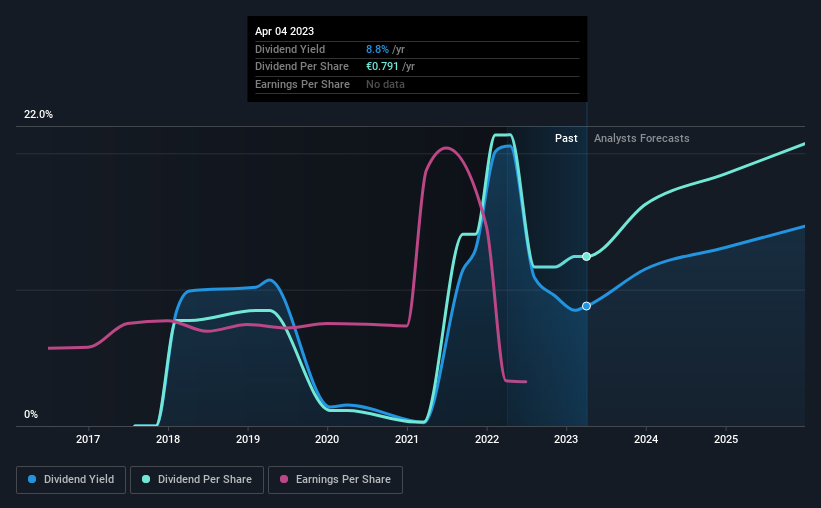

BFF Bank S.p.A. (BIT:BFF) is reducing its dividend from last year's comparable payment to €0.419 on the 26th of April. However, the dividend yield of 8.8% is still a decent boost to shareholder returns.

See our latest analysis for BFF Bank

BFF Bank's Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, BFF Bank's profits didn't cover the dividend, but the company was generating enough cash instead. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Over the next year, EPS is forecast to expand by 5.2%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 70% which brings it into quite a comfortable range.

BFF Bank's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 5 years was €0.492 in 2018, and the most recent fiscal year payment was €0.791. This implies that the company grew its distributions at a yearly rate of about 10.0% over that duration. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

BFF Bank's Dividend Might Lack Growth

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that BFF Bank has been growing its earnings per share at 17% a year over the past five years. However, the payout ratio is very high, not leaving much room for growth of the dividend in the future.

Our Thoughts On BFF Bank's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for BFF Bank that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success