As European markets continue to show resilience with the STOXX Europe 600 Index gaining 1.68% and major indexes like Germany’s DAX and the UK’s FTSE 100 seeing notable increases, investors are increasingly focusing on dividend stocks as a potential source of steady income amidst economic fluctuations. In this environment, a good dividend stock is typically characterized by its ability to maintain consistent payouts, supported by strong fundamentals and a stable business model that can weather varying market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.76% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.54% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.94% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.77% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.66% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.12% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.55% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

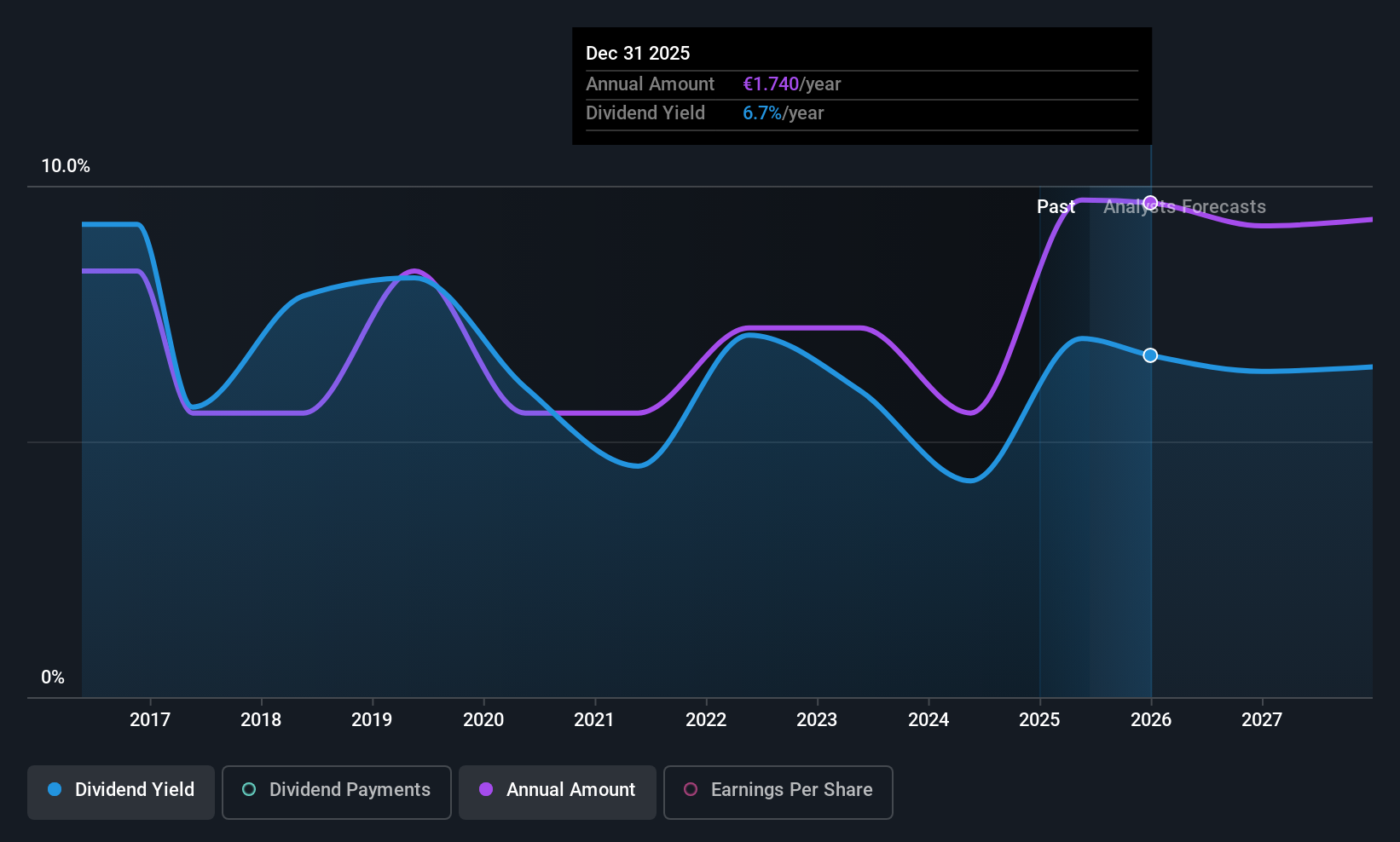

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market cap of €4.89 billion.

Operations: Azimut Holding S.p.A.'s revenue primarily comes from its asset management segment, which generated €1.43 billion.

Dividend Yield: 5.1%

Azimut Holding's dividend, yielding 5.09%, is among the top 25% in Italy, though it faces sustainability challenges due to a lack of free cash flow coverage and volatile past payments. Despite a reasonable payout ratio of 51%, earnings have not consistently supported dividends, with recent net income showing a decline. The company trades at good value compared to peers and industry standards, yet its high non-cash earnings suggest caution for long-term dividend reliability. Recent executive changes aim to bolster growth in Asia.

- Delve into the full analysis dividend report here for a deeper understanding of Azimut Holding.

- Our expertly prepared valuation report Azimut Holding implies its share price may be lower than expected.

ZCCM Investments Holdings (ENXTPA:MLZAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZCCM Investments Holdings Plc is a diversified mining investment and operations company with activities in Zambia and internationally, holding a market cap of €363.52 million.

Operations: ZCCM Investments Holdings Plc generates revenue through its diverse mining investment and operational activities both within Zambia and on an international scale.

Dividend Yield: 5.7%

ZCCM Investments Holdings offers a dividend yield in the top 25% of the French market, supported by a low payout ratio of 1.3%, ensuring coverage by earnings and cash flows. However, dividends have been historically volatile with recent financial performance showing significant losses. The company's recent amendments to its Articles of Association aim to improve governance and shareholder engagement, potentially impacting future dividend stability positively despite current challenges in operational performance.

- Unlock comprehensive insights into our analysis of ZCCM Investments Holdings stock in this dividend report.

- The valuation report we've compiled suggests that ZCCM Investments Holdings' current price could be inflated.

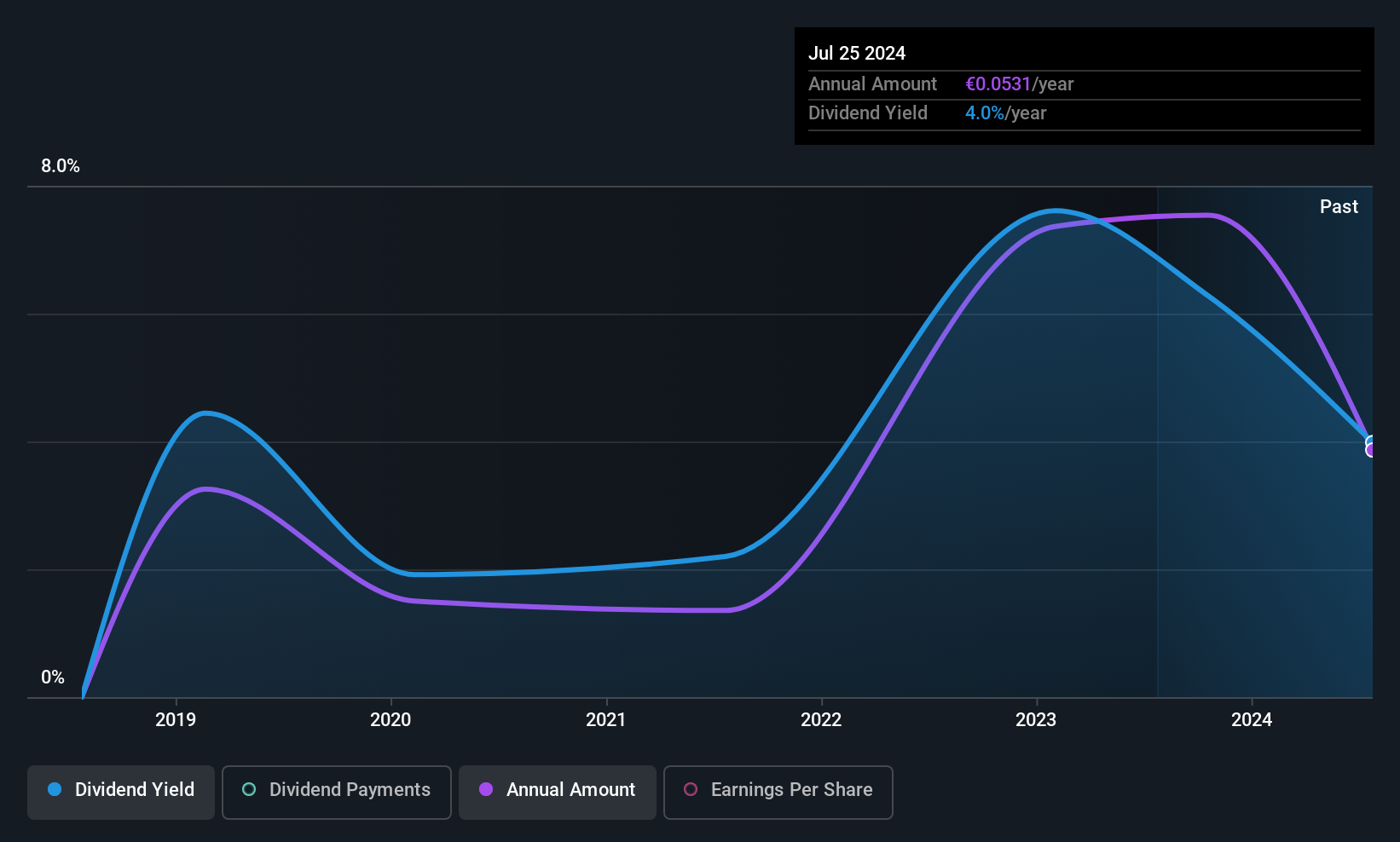

NOTE (OM:NOTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOTE AB (publ) is an electronics manufacturing services provider operating in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China and internationally with a market cap of SEK5.31 billion.

Operations: NOTE AB (publ) generates revenue primarily from its operations in Western Europe, amounting to SEK2.89 billion, and the Rest of World segment, contributing SEK995.31 million.

Dividend Yield: 3.8%

NOTE AB's dividend payments are covered by earnings and cash flows, with a payout ratio of 74.4% and a cash payout ratio of 40.9%. Despite this coverage, the dividends have been volatile over the past decade, impacting reliability. Recent earnings growth and strategic management changes aim to support long-term expansion and customer value enhancement. However, its dividend yield remains slightly below top-tier levels in Sweden, trading at good value compared to industry peers.

- Click to explore a detailed breakdown of our findings in NOTE's dividend report.

- Our valuation report unveils the possibility NOTE's shares may be trading at a discount.

Turning Ideas Into Actions

- Dive into all 224 of the Top European Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives