- Italy

- /

- Hospitality

- /

- BIT:LON

Market Cool On Longino & Cardenal S.p.A.'s (BIT:LON) Revenues Pushing Shares 26% Lower

Longino & Cardenal S.p.A. (BIT:LON) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 3.6% over that longer period.

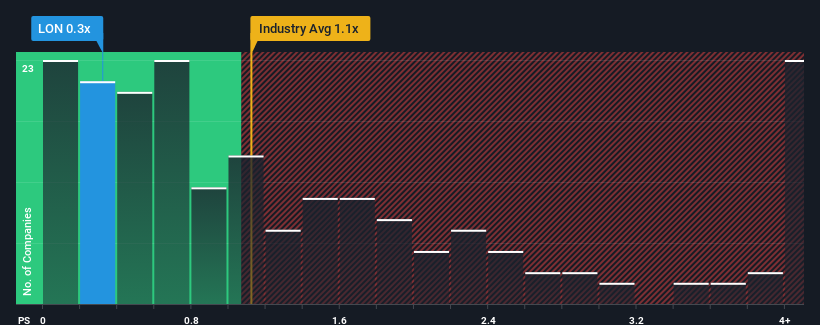

Although its price has dipped substantially, there still wouldn't be many who think Longino & Cardenal's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Italy's Hospitality industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Longino & Cardenal

How Has Longino & Cardenal Performed Recently?

With revenue growth that's inferior to most other companies of late, Longino & Cardenal has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Longino & Cardenal's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Longino & Cardenal?

Longino & Cardenal's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 6.6% gain to the company's revenues. The latest three year period has also seen an excellent 72% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 14% per annum over the next three years. With the industry only predicted to deliver 7.5% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that Longino & Cardenal's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Longino & Cardenal's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Longino & Cardenal's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Longino & Cardenal that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:LON

Longino & Cardenal

Provides catering services to the hotel, restaurant, catering, and gastronomy sectors in Italy, rest of the European Union, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success