- Italy

- /

- Hospitality

- /

- BIT:IGV

Bearish: This Analyst Is Revising Their iGrandiViaggi S.p.A. (BIT:IGV) Revenue and EPS Prognostications

Today is shaping up negative for iGrandiViaggi S.p.A. (BIT:IGV) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

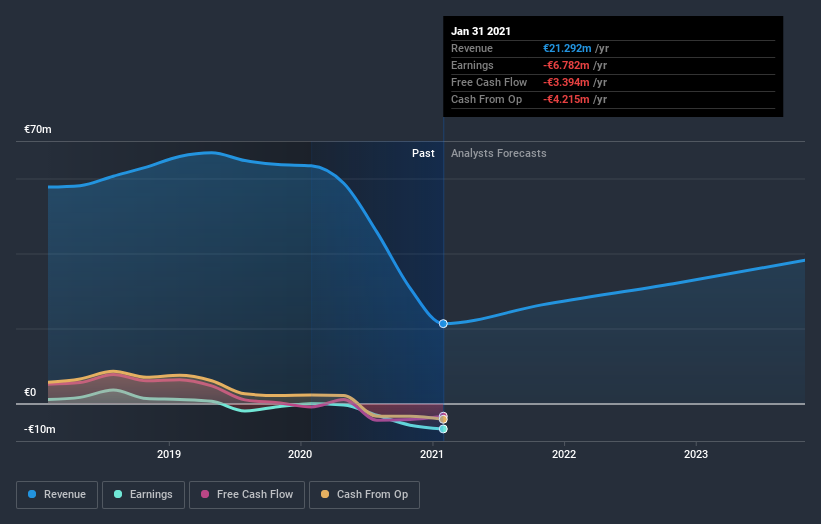

After this downgrade, iGrandiViaggi's solo analyst is now forecasting revenues of €26m in 2021. This would be a sizeable 24% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 27% to €0.10. However, before this estimates update, the consensus had been expecting revenues of €36m and €0.07 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for iGrandiViaggi

There was no major change to the consensus price target of €1.02, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that iGrandiViaggi's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 24% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 5.9% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 15% annually. Not only are iGrandiViaggi's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at iGrandiViaggi. While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of iGrandiViaggi.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for iGrandiViaggi going out as far as 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade iGrandiViaggi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:IGV

I Grandi Viaggi

Engages in the travel and tourism business in Italy, rest of Europe, and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success