- Italy

- /

- Food and Staples Retail

- /

- BIT:MARR

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating inflation and record-high stock indexes, small-cap stocks have been underperforming, with the Russell 2000 Index trailing behind larger benchmarks. In this environment of economic uncertainty and shifting trade policies, identifying promising small-cap opportunities requires a keen eye for companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Powertip Image | 0.57% | 10.95% | 29.26% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Fauji Foods | 62.10% | 30.05% | 58.43% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

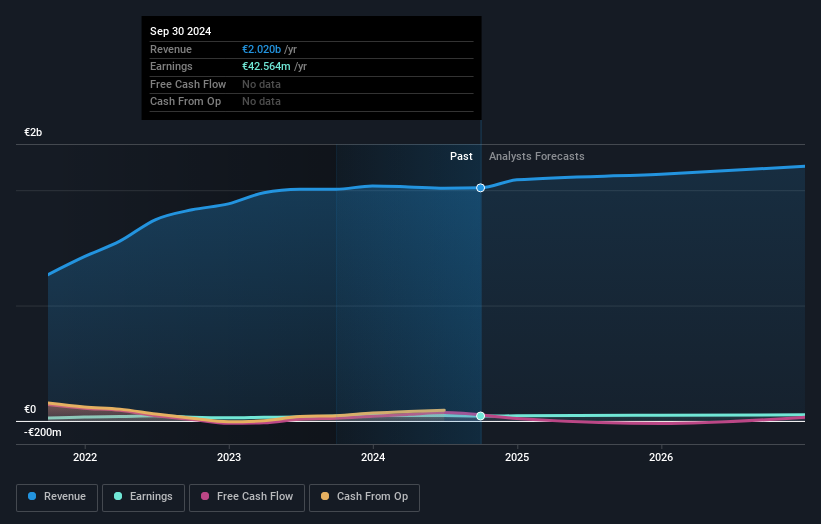

MARR (BIT:MARR)

Simply Wall St Value Rating: ★★★★★★

Overview: MARR S.p.A. specializes in the marketing and distribution of fresh, dried, and frozen food products for catering across Italy, the European Union, and internationally with a market capitalization of €675.89 million.

Operations: MARR generates revenue primarily from the distribution of food products, amounting to approximately €2.02 billion. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability after accounting for all expenses.

MARR, a smaller player in the consumer retailing sector, has shown resilience with its earnings growing 0.5% over the past year, outpacing the industry average of -3.6%. The company seems to manage its debt well, reducing its debt-to-equity ratio from 113.5% to 83.1% over five years and maintaining a satisfactory net debt-to-equity ratio of 37.2%. Trading at nearly 89% below estimated fair value suggests potential undervaluation. With interest payments covered by EBIT at a healthy 4.2x and positive free cash flow, MARR appears poised for steady growth amidst industry challenges.

- Click to explore a detailed breakdown of our findings in MARR's health report.

Gain insights into MARR's historical performance by reviewing our past performance report.

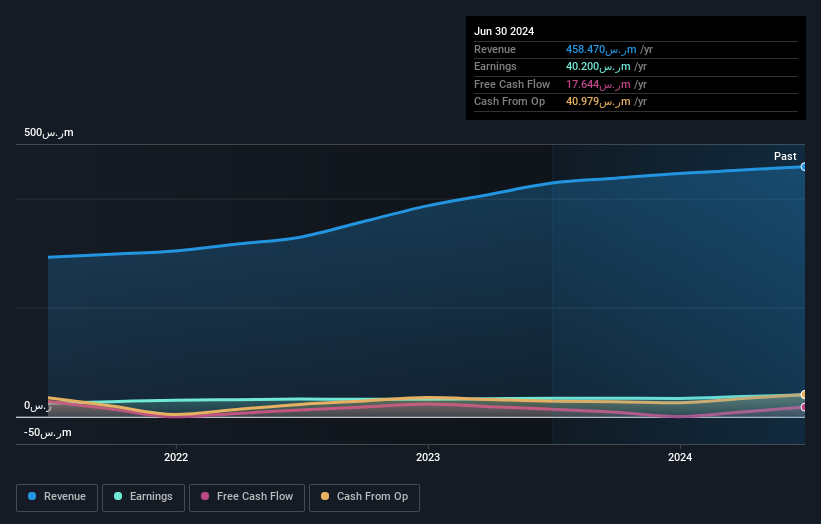

Alwasail Industrial (SASE:9525)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alwasail Industrial Company specializes in the manufacturing and sale of polyethylene pipes and fittings across Saudi Arabia, Egypt, Oman, and the UAE, with a market capitalization of SAR945 million.

Operations: Alwasail Industrial generates its revenue primarily from the Plastics & Rubber segment, amounting to SAR458.47 million. The company has a market capitalization of SAR945 million.

Alwasail Industrial, a smaller player in its field, has shown robust financial health with earnings growth of 18.9% over the past year, surpassing the building industry's -12.6%. The company's price-to-earnings ratio stands at 23.5x, slightly undercutting the SA market's 24.5x, suggesting potential value for investors. Despite a highly volatile share price recently, Alwasail benefits from well-covered interest payments with an EBIT coverage of 44.8 times its debt obligations and more cash than total debt on hand. A notable SAR9.6M one-off gain impacted its recent financial results positively as it navigates new leadership appointments to drive future strategies forward.

- Get an in-depth perspective on Alwasail Industrial's performance by reading our health report here.

Assess Alwasail Industrial's past performance with our detailed historical performance reports.

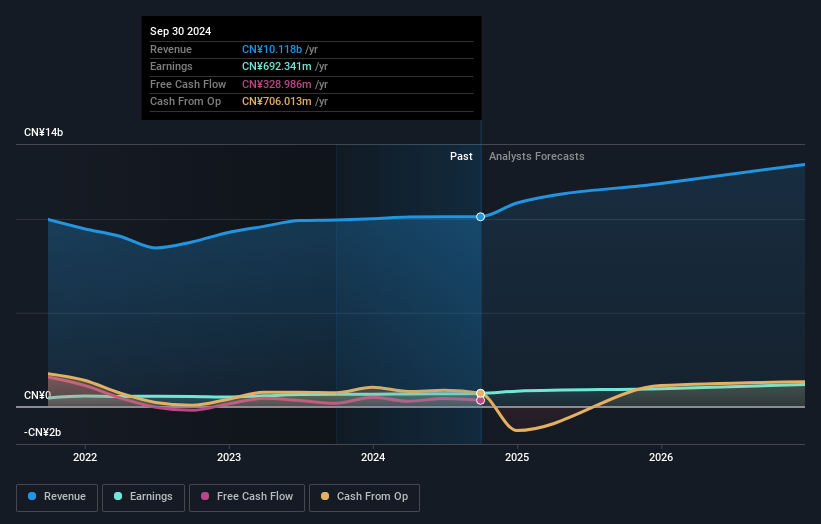

Shinva Medical InstrumentLtd (SHSE:600587)

Simply Wall St Value Rating: ★★★★★★

Overview: Shinva Medical Instrument Co., Ltd. operates in the People's Republic of China, offering a range of medical devices, pharmaceutical equipment, and related services with a market capitalization of CN¥10.12 billion.

Operations: Shinva generates revenue primarily from medical devices, pharmaceutical equipment, and medical services. The company's financial performance includes a net profit margin that indicates its efficiency in converting revenue into profit.

Shinva Medical, a nimble player in the medical equipment sector, boasts a Price-To-Earnings ratio of 14.6x, notably below the CN market's 36.6x, suggesting it trades at an appealing value compared to peers. Over the past year, earnings grew by 5.1%, outpacing the industry average of -8.8%, indicating robust performance despite broader challenges. The firm's debt-to-equity ratio has impressively decreased from 82.5% to just 13.5% over five years, reflecting prudent financial management and reduced leverage risk. With high-quality earnings and positive free cash flow, Shinva appears well-positioned for future growth prospects in its field.

- Delve into the full analysis health report here for a deeper understanding of Shinva Medical InstrumentLtd.

Gain insights into Shinva Medical InstrumentLtd's past trends and performance with our Past report.

Key Takeaways

- Reveal the 4713 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MARR

MARR

Engages in marketing and distribution of fresh, dried, and frozen food products for catering in Italy, the European Union, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion