- Poland

- /

- Healthcare Services

- /

- WSE:VOX

Undiscovered European Gems To Explore In June 2025

Reviewed by Simply Wall St

As European markets experience a boost from easing inflation and supportive monetary policies, the pan-European STOXX Europe 600 Index has risen by 0.90%, reflecting a cautiously optimistic sentiment among investors. With this backdrop of economic growth and low interest rates, identifying promising small-cap stocks can offer unique opportunities for those looking to diversify their portfolios in an environment where strong fundamentals and innovative potential are increasingly valued.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Powersoft (BIT:PWS)

Simply Wall St Value Rating: ★★★★★☆

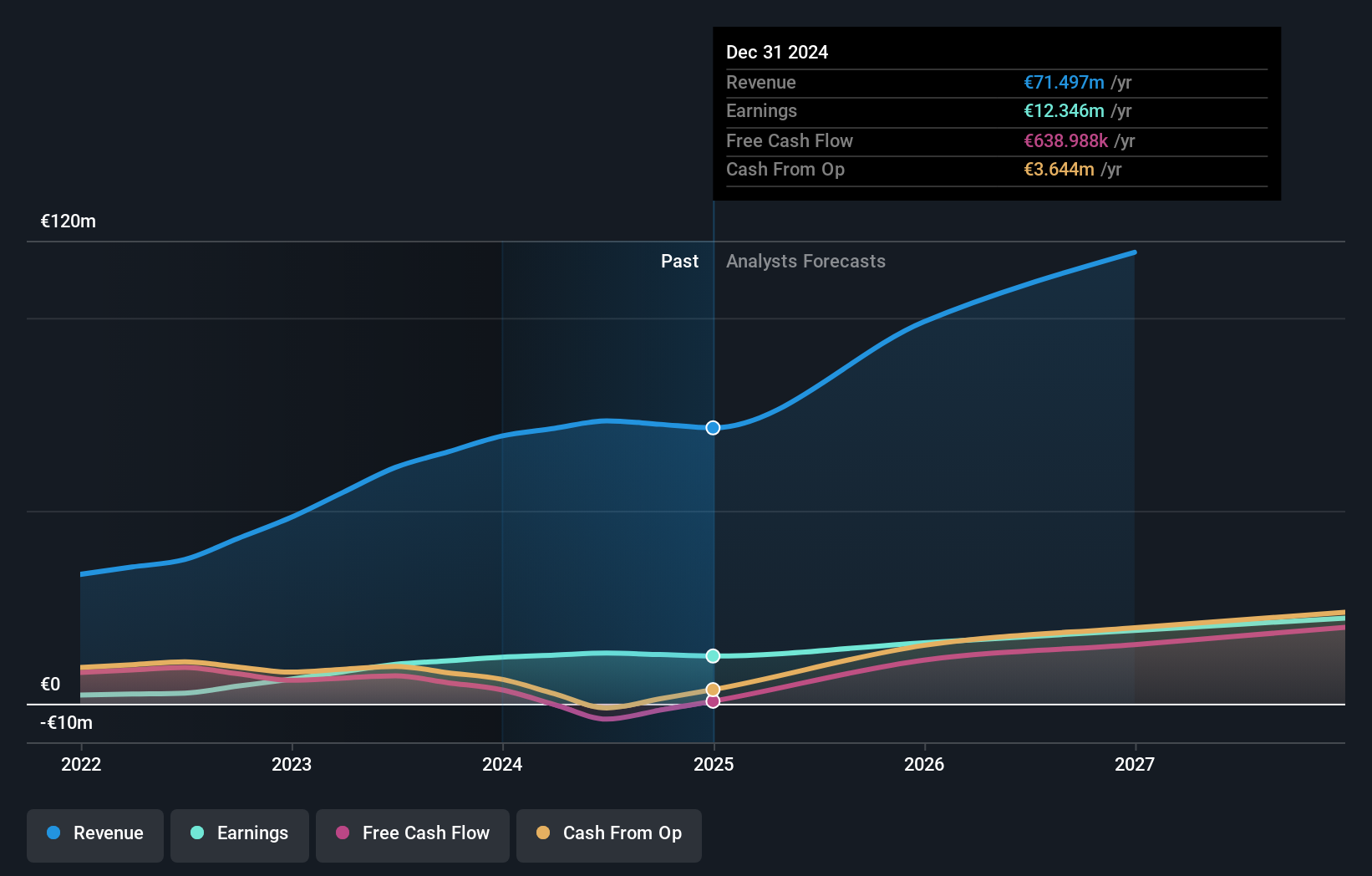

Overview: Powersoft S.p.A. designs, produces, and markets power amplifiers, loudspeaker components, and software both in Italy and internationally with a market cap of €240.78 million.

Operations: Powersoft generates revenue primarily from audio amplifiers for professional applications, amounting to €71.50 million.

Powersoft, a promising player in the audio technology sector, has demonstrated a consistent growth trajectory with earnings rising by 2.4% over the past year, outpacing its industry peers. Trading at nearly 25% below estimated fair value, it offers potential upside for investors. The company's debt to equity ratio has increased from 0.4 to 5.6 over five years, yet its interest payments are well covered by EBIT at an impressive 414 times coverage. Recent financials reveal net income of €12.35 million for the last fiscal year and a slight increase in basic earnings per share from €1.02 to €1.04.

COLTENE Holding (SWX:CLTN)

Simply Wall St Value Rating: ★★★★★★

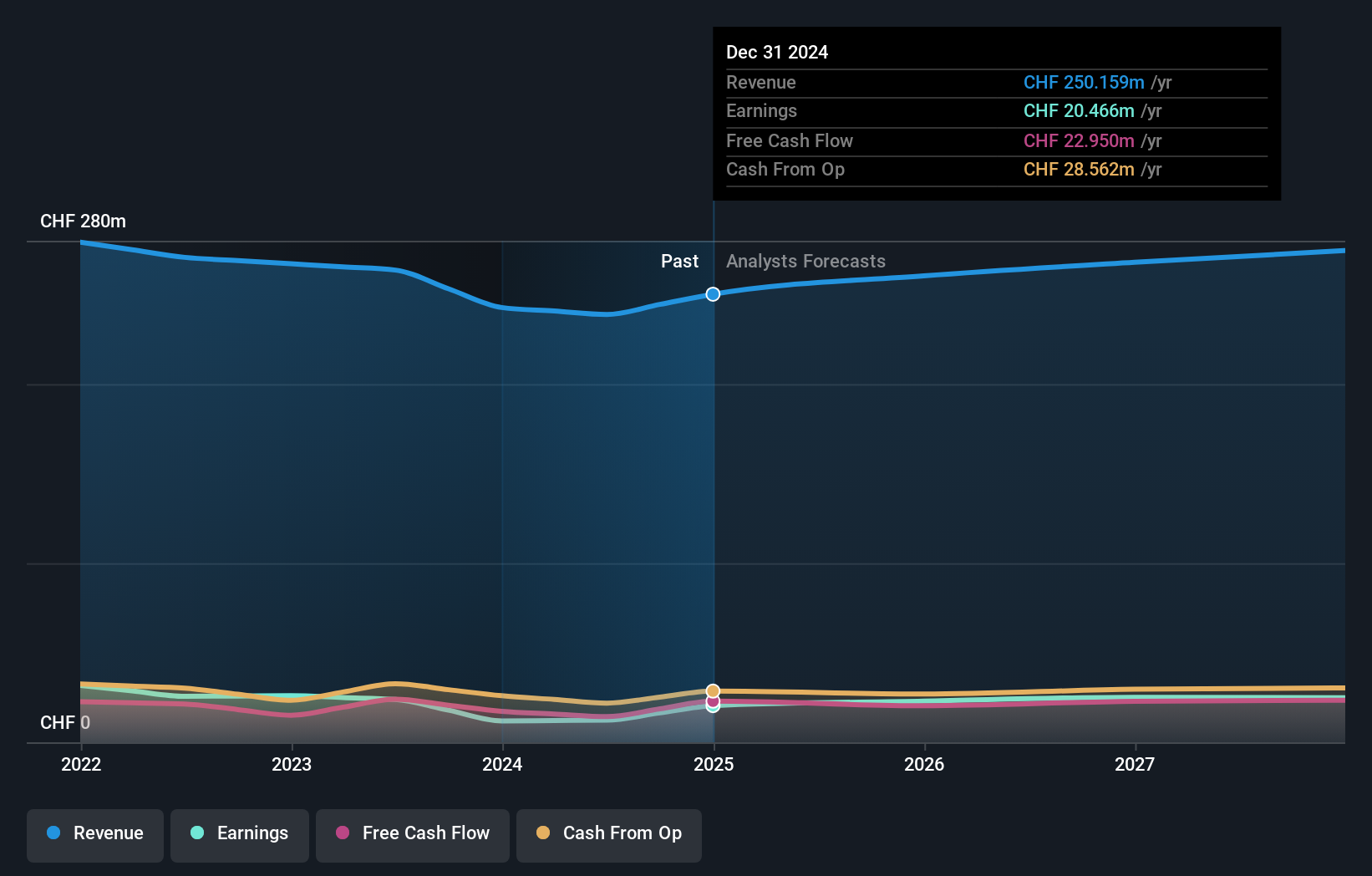

Overview: COLTENE Holding AG is a company that specializes in the development, manufacturing, and sale of dental disposables, tools, and equipment across various global regions with a market capitalization of CHF421.26 million.

Operations: The company generates revenue of CHF250.16 million from the sale of dental disposables, tools, and equipment across multiple regions.

Coltene Holding, a nimble player in the medical equipment sector, showcases impressive earnings growth of 71% over the past year, outpacing industry peers. Trading at 23% below its estimated fair value, it offers potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 16.6%, down from 64.9% five years ago, indicating prudent financial management. With interest payments well covered by EBIT (32x), Coltene demonstrates robust fiscal health. As it remains free cash flow positive and profitable, future prospects appear promising with earnings forecasted to grow annually by 7%.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

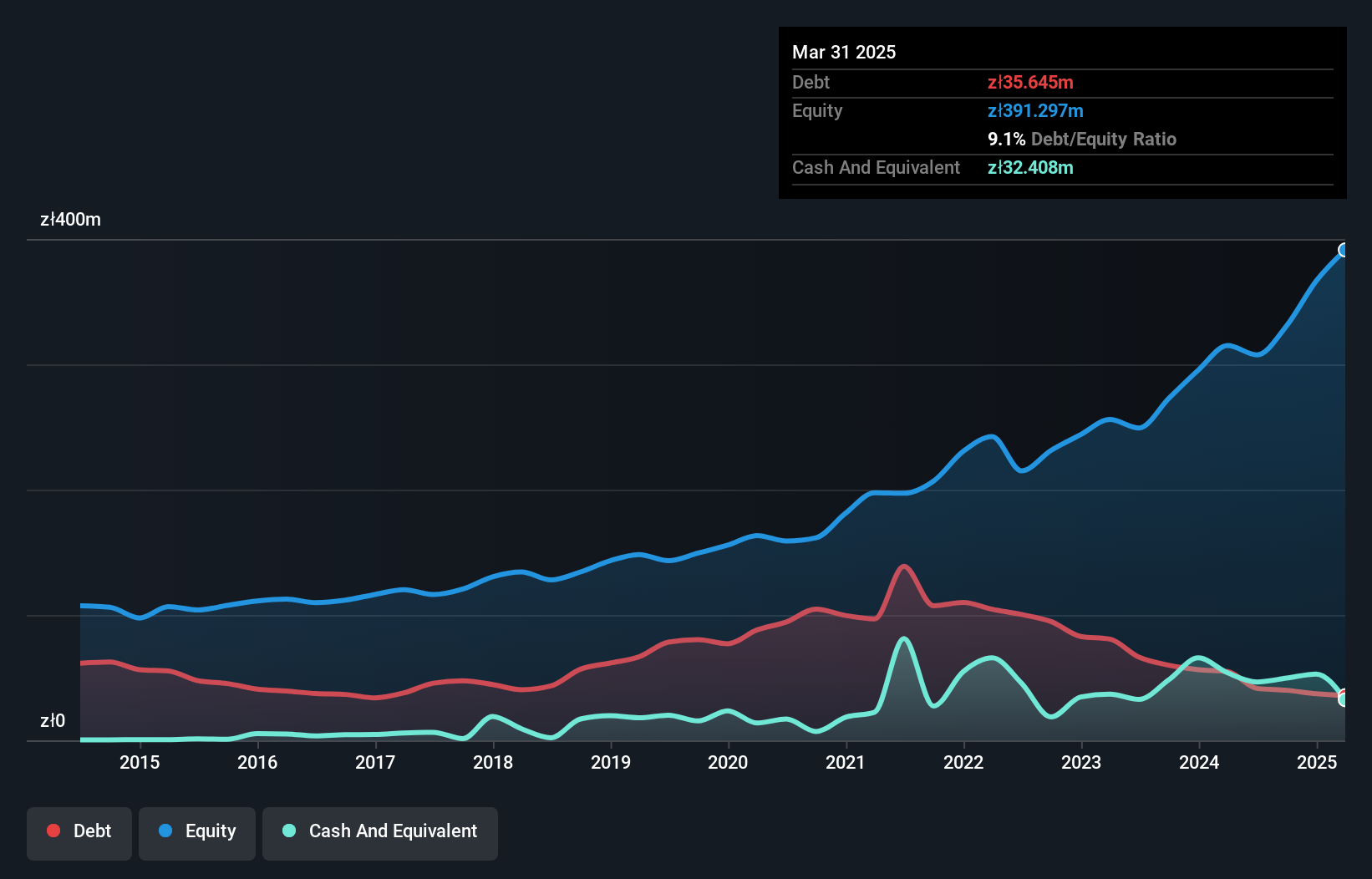

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland, with a market capitalization of PLN1.70 billion.

Operations: Voxel generates revenue primarily from diagnostics, specifically medical services and sales of radiopharmaceuticals, totaling PLN398.28 million. Additional revenue comes from IT products and laboratory equipment at PLN171.92 million, along with a smaller contribution from therapy in neuroradiosurgery at PLN13.99 million.

Voxel S.A. presents an intriguing opportunity with its high-quality earnings and a notable reduction in debt to equity ratio from 53.9% to 9.1% over five years. Trading at 43.9% below estimated fair value, it seems undervalued given its consistent earnings growth of 23.2% annually over the past five years, despite not outpacing industry growth last year at 17.6%. Recent financials show sales climbing to PLN 157.85 million in Q1 2025 from PLN 108.64 million a year prior, and net income rising to PLN 24.27 million from PLN 19.22 million, indicating robust performance amidst industry challenges.

- Get an in-depth perspective on Voxel's performance by reading our health report here.

Review our historical performance report to gain insights into Voxel's's past performance.

Make It Happen

- Explore the 329 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VOX

Flawless balance sheet and good value.

Market Insights

Community Narratives