Moncler (BIT:MONC) Valuation in Focus as Revenue Declines and Management Cautious on Outlook

Reviewed by Simply Wall St

Moncler (BIT:MONC) stock dropped over 4% after the company posted a 1% year-on-year revenue decline for the third quarter. Softer tourist demand in Europe and Japan weighed on overall results.

See our latest analysis for Moncler.

Despite a resilient showing earlier this year, Moncler’s latest results and yesterday’s 3.75% drop in share price highlight how investor sentiment has cooled after a solid run. While revenue growth in China and the Americas added a boost, European and Japanese tourist softness has taken the shine off recent momentum. Over the past year, the stock has delivered a 2.7% total shareholder return, and its 54.5% return over five years reflects the brand’s long-term appeal. However, near-term price momentum appears to be fading.

If you’re curious where else to find strong growth stories with an edge, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With performance trailing some luxury peers and management guiding cautiously for the rest of the year, the key question is whether Moncler’s valuation offers real upside or if the market has already priced in future growth.

Most Popular Narrative: 8% Undervalued

According to the most widely followed analyst consensus narrative, Moncler's estimated fair value stands at €56.37, about 8% above its last close of €51.84. This suggests that, even after the recent pullback, the prevailing narrative still sees upside anchored in the group’s strategy and future profit potential.

Moncler's continued brand elevation efforts (such as high-profile collaborations, new category launches like footwear, and increased activity in the U.S. through targeted campaigns and celebrity partnerships) are expected to reinforce brand desirability and pricing power. These factors may support above-market revenue growth and potential gross margin expansion.

Want to know the catalyst behind that premium? Analysts believe Moncler’s future earnings and margins could set a new benchmark for the sector. Uncover which bold growth levers are fueling this valuation and decide if the narrative’s bet on luxury resilience stands up to scrutiny.

Result: Fair Value of €56.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in European tourism and weaker store traffic could undermine Moncler’s earnings recovery and challenge the upbeat consensus.

Find out about the key risks to this Moncler narrative.

Another View: Market Ratios Paint a Cautious Picture

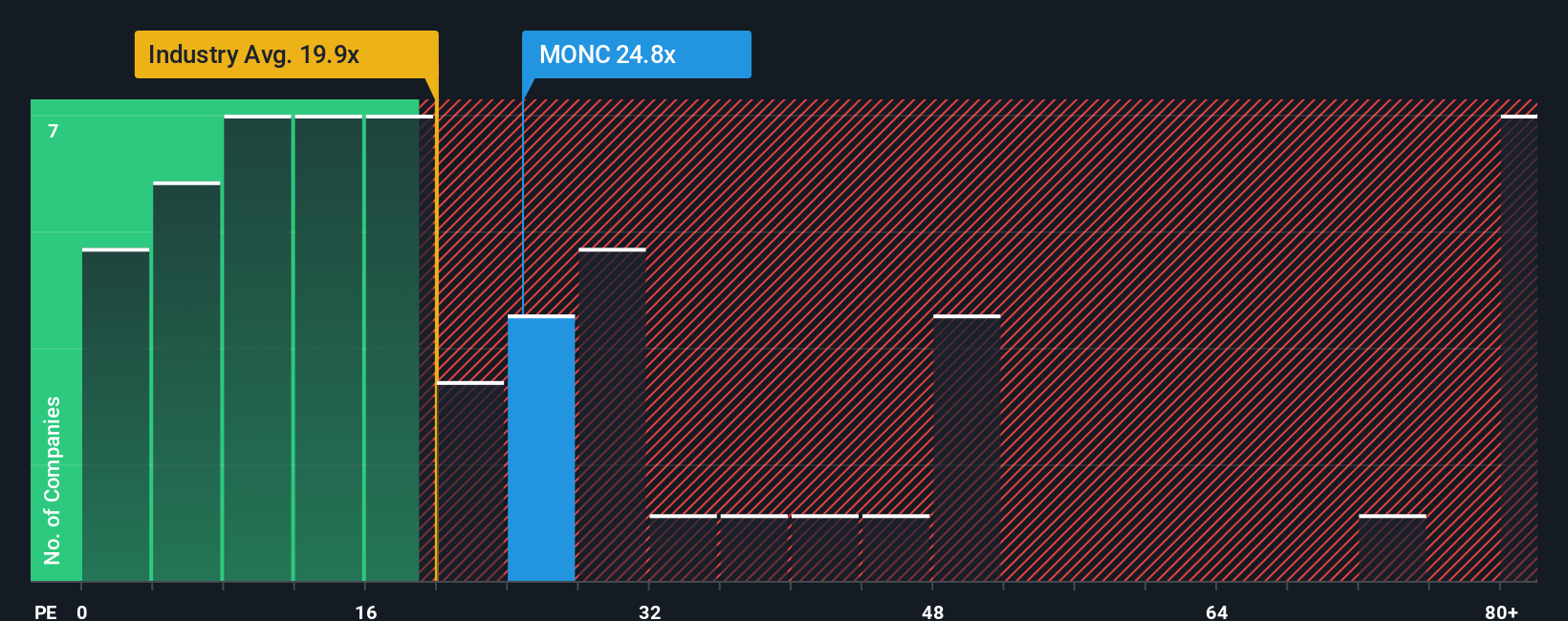

Looking at Moncler’s valuation through the lens of its price-to-earnings ratio, the stock trades at 23 times earnings, which is higher than the European luxury average of 20.2x and also above its own fair ratio of 22.3x. While it appears slightly cheaper than its closest peers at 25.4x, this premium pricing suggests investors are already paying up for future growth. This adds a layer of valuation risk if those expectations waver.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moncler Narrative

If these narratives don't quite fit your take, you can dive into the numbers yourself and craft your own story about Moncler's outlook in just a few minutes, Do it your way

A great starting point for your Moncler research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Put yourself ahead of the crowd and spot tomorrow's winners before everyone else. Three unique opportunities are just a click away, so don't miss out:

- Uncover powerful yield potential by checking out these 21 dividend stocks with yields > 3% selected for consistent and robust returns above 3%.

- Ride the AI innovation surge by exploring these 26 AI penny stocks that are shaping the next wave of intelligent automation and disruption.

- Tap into the upside of digital transformation with these 81 cryptocurrency and blockchain stocks that bridge blockchain technology and future finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MONC

Moncler

Produces and distributes clothing for men, women and children, footwear, glasses, and other accessories under the Moncler and Stone Island brands in Italy, rest of Europe, Asia, the Middle East, Africa, and the Americas.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion