Brunello Cucinelli S.p.A.'s (BIT:BC) Earnings Haven't Escaped The Attention Of Investors

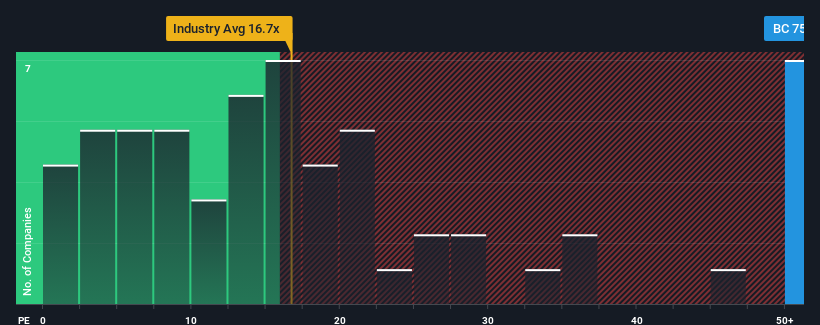

With a price-to-earnings (or "P/E") ratio of 75.4x Brunello Cucinelli S.p.A. (BIT:BC) may be sending very bearish signals at the moment, given that almost half of all companies in Italy have P/E ratios under 14x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Brunello Cucinelli certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Brunello Cucinelli

How Is Brunello Cucinelli's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Brunello Cucinelli's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. The strong recent performance means it was also able to grow EPS by 229% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% each year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 13% per year, which is noticeably less attractive.

In light of this, it's understandable that Brunello Cucinelli's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Brunello Cucinelli maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Brunello Cucinelli with six simple checks on some of these key factors.

If you're unsure about the strength of Brunello Cucinelli's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives