Is Now The Time To Look At Buying Seri Industrial S.p.A. (BIT:SERI)?

Seri Industrial S.p.A. (BIT:SERI), might not be a large cap stock, but it received a lot of attention from a substantial price increase on the BIT over the last few months. As a small cap stock, hardly covered by any analysts, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Let’s examine Seri Industrial’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Check out our latest analysis for Seri Industrial

What's the opportunity in Seri Industrial?

Great news for investors – Seri Industrial is still trading at a fairly cheap price. My valuation model shows that the intrinsic value for the stock is €8.07, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. Another thing to keep in mind is that Seri Industrial’s share price may be quite stable relative to the rest of the market, as indicated by its low beta. This means that if you believe the current share price should move towards its intrinsic value over time, a low beta could suggest it is not likely to reach that level anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range again.

What does the future of Seri Industrial look like?

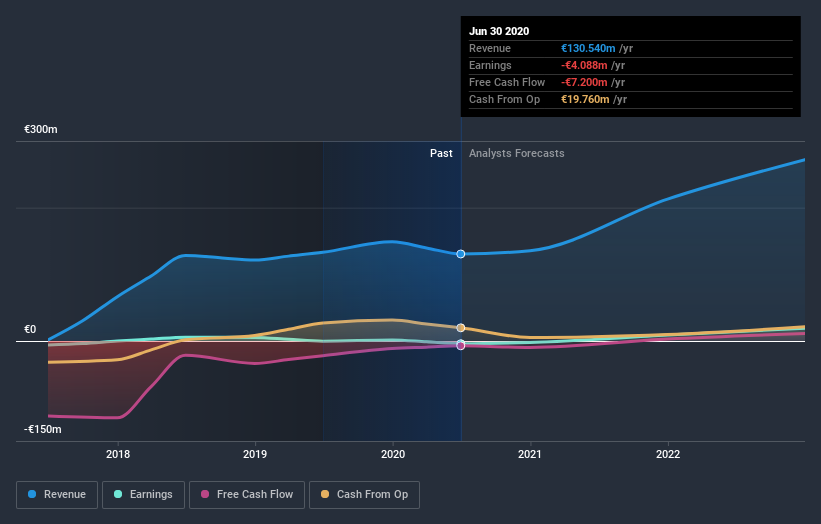

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. In Seri Industrial's case, its revenues over the next few years are expected to grow by 86%, indicating a highly optimistic future ahead. If expense does not increase by the same rate, or higher, this top line growth should lead to stronger cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? Since SERI is currently undervalued, it may be a great time to increase your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on SERI for a while, now might be the time to make a leap. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy SERI. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 1 warning sign with Seri Industrial, and understanding it should be part of your investment process.

If you are no longer interested in Seri Industrial, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade Seri Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:SERI

Seri Industrial

Through its subsidiaries, engages in the production and recycling of plastic materials for battery, automotive, hydro-thermo-sanitary, civil, and shipbuilding markets.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026