- Italy

- /

- Electrical

- /

- BIT:PRY

Prysmian (BIT:PRY): Examining Valuation as Recycled Copper Strategy Addresses Supply Chain and Tariff Challenges

Reviewed by Simply Wall St

Prysmian (BIT:PRY) is stepping up its use of recycled copper in the U.S. as ongoing trade tensions and tariffs complicate the copper supply landscape. This shift could influence both supply chain resilience and production costs for the company.

See our latest analysis for Prysmian.

Prysmian's latest pivot toward recycled copper comes at a time when momentum behind the shares looks robust. The company’s 1-month share price return of over 10% has helped propel a 36% gain in the last 90 days. The one-year total shareholder return stands at nearly 35%, showing strong follow-through on recent strategic moves.

If shifting supply chains interest you, it could be the perfect moment to go beyond your current watchlist and discover fast growing stocks with high insider ownership.

With shares continuing to surge and strategic shifts gaining attention, investors may wonder if Prysmian is undervalued at current levels, or if future growth is already reflected in the stock's price.

Most Popular Narrative: Fairly Valued

Prysmian's narrative fair value sits very close to its recent closing price, suggesting the consensus sees little gap between market expectations and calculated worth. The narrative weaves together growth potential with current momentum, providing a clear lens for what is driving this alignment.

The combination of strong investment trends in electrification, grid modernization, and robust data center buildout, especially in the U.S., is expected to support substantial revenue growth in Prysmian's core Power Grid, Transmission, and Digital Solutions divisions. This is evidenced by accelerating order intake, upgraded guidance, and capacity expansions. Major changes to U.S. copper import tariffs will penalize imported finished cables and provide a significant competitive advantage to local producers like Prysmian (especially via Encore Wire), supporting higher pricing power and EBITDA margin expansion in the U.S. market.

Want to know which growth levers justify this market-matching valuation? There is a mix of big macro bets and bold profit margin assumptions baked into the numbers. Curious how these drivers shape the price tag analysts have landed on? Dive in to see what is really powering the math.

Result: Fair Value of €89.44 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any rollback of U.S. protective tariffs or renewed currency headwinds could quickly alter Prysmian’s profit outlook and challenge prevailing growth assumptions.

Find out about the key risks to this Prysmian narrative.

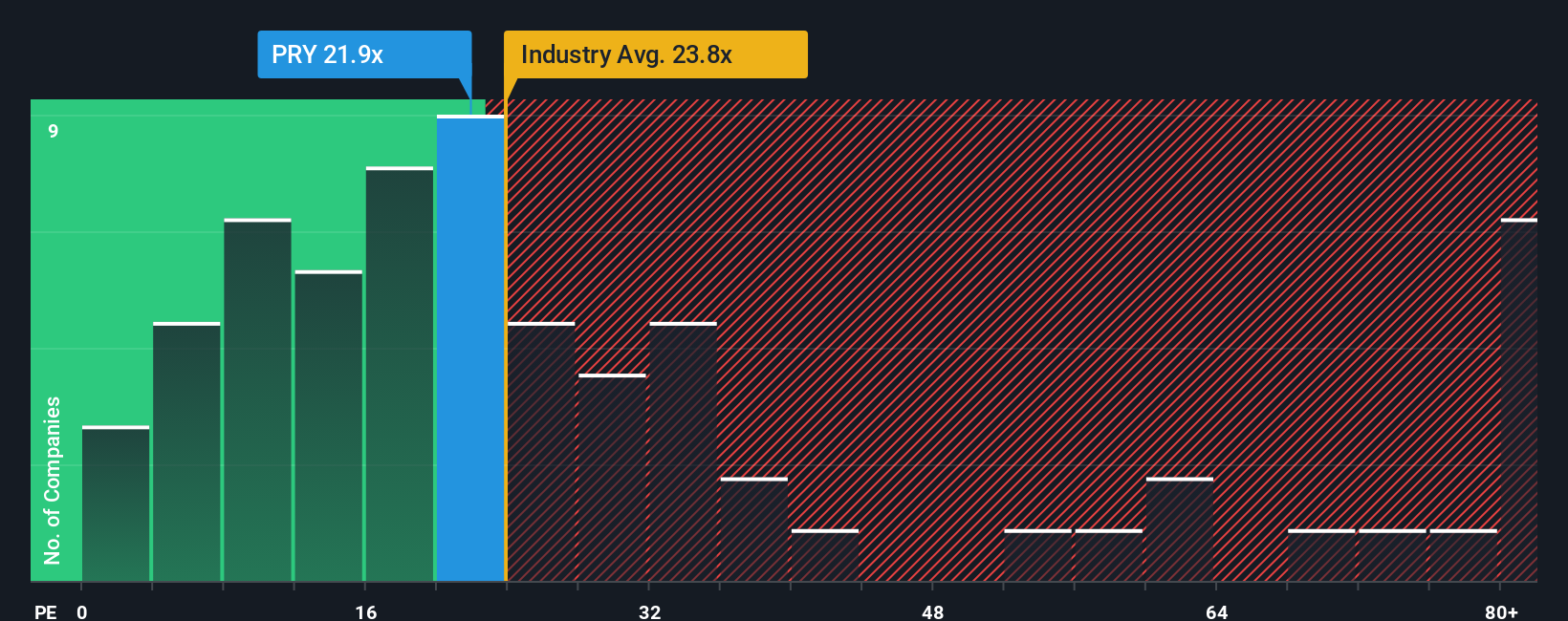

Another View: Peer and Industry Comparisons

Looking at how the company is valued against its peers and the broader industry adds another angle. The current price-to-earnings ratio is 34.4x, which is lower than the peer average of 41.3x, implying good value. However, this still sits notably above the European industry average of 23.6x and above the estimated fair ratio of 30.5x. This higher valuation might signal the market is pricing in a lot of optimism. The key question is whether there is more upside, or if expectations could get ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prysmian Narrative

If you think your viewpoint might differ or you want to run your own analysis, you can quickly build your own narrative and perspective in just a few minutes. Do it your way.

A great starting point for your Prysmian research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Searching for stocks with an edge? Make your next move a smart one by tapping into fresh themes and hidden opportunities across fast-growing companies and sectors.

- Accelerate your hunt for undervalued gems by targeting these 877 undervalued stocks based on cash flows, which the market has yet to fully appreciate.

- Unlock powerful growth themes when you check out these 27 AI penny stocks, leading the way in artificial intelligence and automation.

- Boost your income potential by reviewing these 17 dividend stocks with yields > 3%, offering attractive yields above 3% to strengthen cash flow in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRY

Prysmian

Produces, distributes, and sells power and telecom cables and systems, and related accessories under the Prysmian, Draka, and General Cable brands worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives