- Italy

- /

- Electrical

- /

- BIT:PRY

Is Surging Net Income and EPS Recasting the Investment Case for Prysmian (BIT:PRY)?

Reviewed by Sasha Jovanovic

- Prysmian S.p.A. recently reported earnings for the nine months ended September 30, 2025, posting sales of €14.68 billion and net income of €1.02 billion, both up from the previous year's results.

- A significant rise in basic earnings per share to €3.50, compared to €2.06 a year ago, highlights improved profitability over this period.

- We'll explore how the strong surge in net income and earnings per share could impact Prysmian's overall investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Prysmian Investment Narrative Recap

To be a shareholder in Prysmian, you need to believe that long-term investment tailwinds like electrification, grid modernization, and telecom expansion will continue driving robust demand for its cables and systems globally. The recent surge in net income and earnings per share reinforces the profit potential, but does not materially reduce the significance of short-term risks such as potential changes in U.S. trade policy, which could alter pricing power, or exposure to currency headwinds that may compress margins in future results.

Among Prysmian's recent announcements, the ongoing share buyback program stands out as particularly relevant to this earnings update. By returning capital to shareholders and supporting share value, the buybacks align with this period of record profits and could help offset market volatility, at least as long as the underlying earnings momentum persists in the face of sector-specific risks.

However, investors should be aware that, if U.S. tariffs were to change or international competitors reenter the market...

Read the full narrative on Prysmian (it's free!)

Prysmian's outlook anticipates €22.3 billion in revenue and €1.4 billion in earnings by 2028. This is based on forecast annual revenue growth of 5.5% and an earnings increase of €651 million from current earnings of €749.0 million.

Uncover how Prysmian's forecasts yield a €89.47 fair value, a 6% upside to its current price.

Exploring Other Perspectives

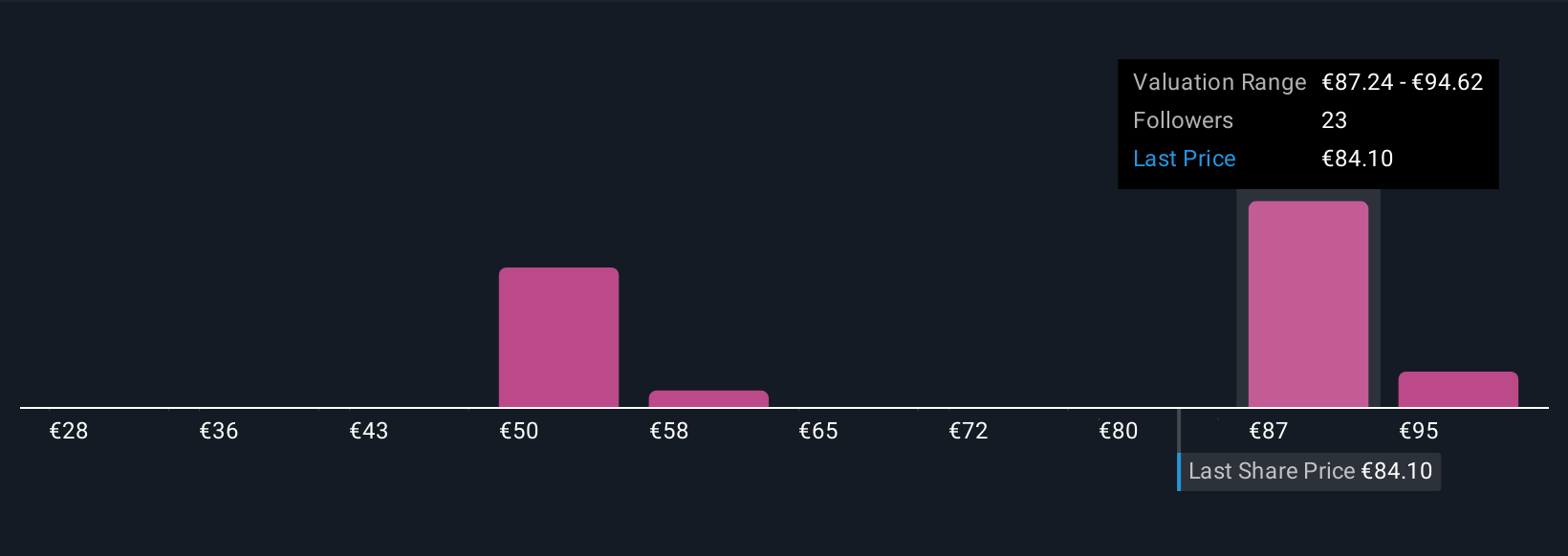

Simply Wall St Community members produced 13 fair value estimates for Prysmian, ranging widely from €28.22 to €102 per share. With ongoing earnings growth partly underpinned by supportive U.S. tariffs, it’s clear that future outcomes could look quite different depending on these external factors, take a look at a range of views and see how perspectives vary.

Explore 13 other fair value estimates on Prysmian - why the stock might be worth as much as 21% more than the current price!

Build Your Own Prysmian Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prysmian research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Prysmian research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prysmian's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRY

Prysmian

Produces, distributes, and sells power and telecom cables and systems, and related accessories under the Prysmian, Draka, and General Cable brands worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives