- Italy

- /

- Electrical

- /

- BIT:PRY

Assessing Prysmian (BIT:PRY) Valuation Following Strong Earnings and Profit Growth Through September 2025

Reviewed by Simply Wall St

Prysmian (BIT:PRY) just released its earnings for the nine months ending September 2025, showing a jump in both sales and net income compared to the same period last year. Investors are paying close attention to the results.

See our latest analysis for Prysmian.

Prysmian’s strong earnings update comes after a period of robust momentum. Its share price is up 13.2% over the last ninety days and has increased nearly 34% year-to-date. The company’s three-year total shareholder return of 175% and five-year total return topping 260% indicate that long-term holders have been well rewarded. This suggests that fresh growth expectations are helping sustain the rally.

If Prysmian’s impressive run has you interested in what else is gaining, now’s a great chance to discover fast growing stocks with high insider ownership

With strong results and shares near their all-time highs, the critical question now is whether Prysmian’s next growth phase is fully reflected in its price or if investors still have an opportunity to buy in early.

Most Popular Narrative: 5.6% Undervalued

Prysmian’s most closely followed narrative suggests the shares are trading about 5.6% below their estimated fair value compared to the last close. The stage is set for an intriguing debate over whether sector tailwinds and recent growth momentum can fully translate into future gains.

The combination of strong investment trends in electrification, grid modernization, and robust data center buildout, especially in the U.S., is expected to support substantial revenue growth in Prysmian's core Power Grid, Transmission, and Digital Solutions divisions. This is evidenced by accelerating order intake, upgraded guidance, and capacity expansions.

Want to know which bold assumptions drive Prysmian’s potential upside? The narrative is built around a set of aggressive revenue growth and margin expansion forecasts. Curious which catalysts hold the biggest impact? See the full financial thinking behind this price estimate.

Result: Fair Value of €89.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing U.S. trade policies or renewed international competition could quickly impact Prysmian’s pricing power and profitability. This could shift the current growth outlook.

Find out about the key risks to this Prysmian narrative.

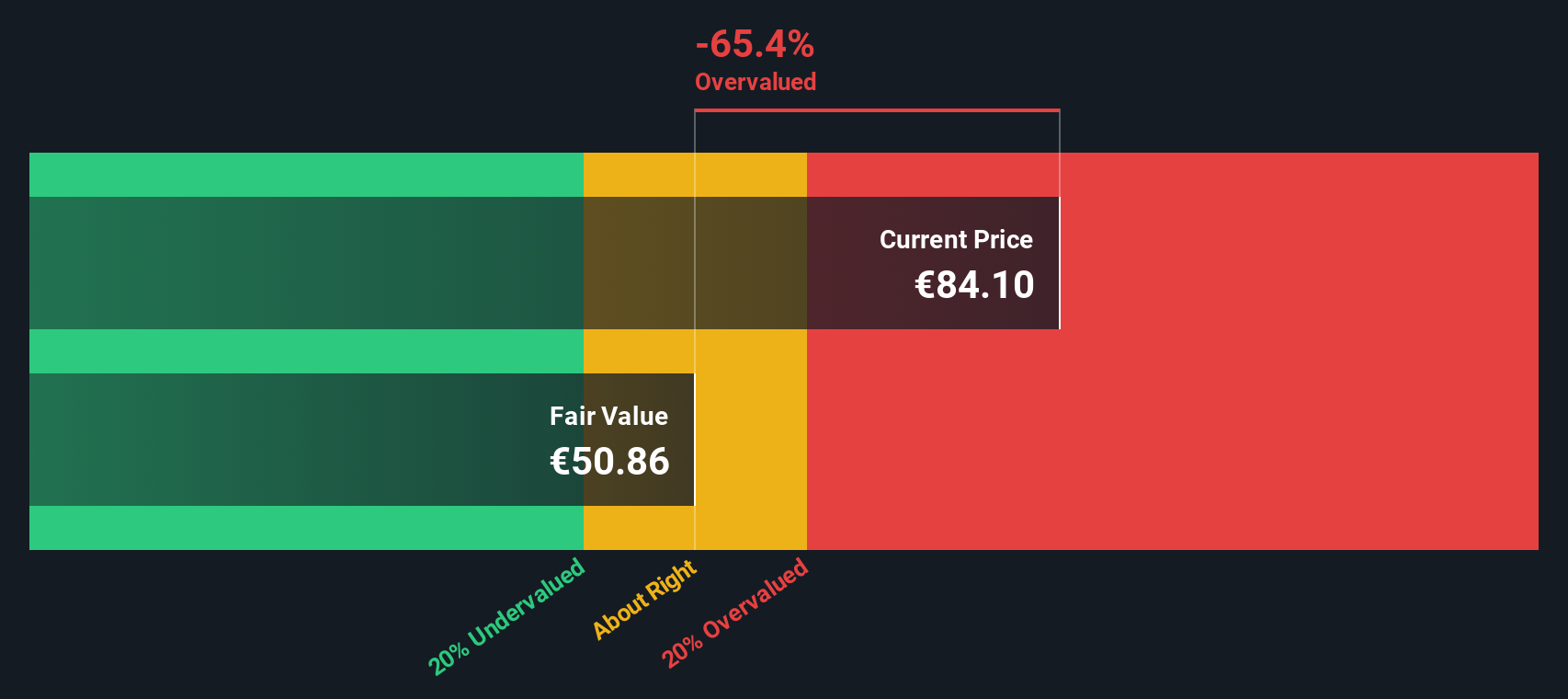

Another View: DCF Tells a Different Story

While analysts see Prysmian as slightly undervalued, our DCF model presents a more conservative perspective. According to this approach, Prysmian’s current share price appears well above its fair value estimate, suggesting it could be overvalued by a significant margin. Is this model too cautious, or identifying risks that others may overlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Prysmian for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Prysmian Narrative

If you’d rather reach your own conclusions or dig deeper than the consensus, there’s nothing stopping you from building a custom narrative yourself in just a few minutes. Do it your way

A great starting point for your Prysmian research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look beyond the obvious. Take action now to find stocks with incredible potential that most people overlook. Don’t let today’s best opportunities slip by.

- Uncover the next big trends in artificial intelligence by tapping into these 27 AI penny stocks, featuring companies poised to transform entire industries.

- Boost your portfolio's income with these 14 dividend stocks with yields > 3%, highlighting businesses offering yields above 3% and strong fundamentals for stability.

- Ride the cryptocurrency wave and get ahead of market shifts by checking out these 82 cryptocurrency and blockchain stocks with leading names in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRY

Prysmian

Produces, distributes, and sells power and telecom cables and systems, and related accessories under the Prysmian, Draka, and General Cable brands worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives