- Italy

- /

- Construction

- /

- BIT:NXT

European Market Insights: Next Geosolutions Europe Among 3 Stocks Possibly Priced Below Estimated Fair Value

Reviewed by Simply Wall St

Amidst a challenging landscape marked by political instability and renewed tariff uncertainties, European markets have recently experienced a downturn, with the pan-European STOXX Europe 600 Index falling nearly 2% as concerns weigh on investor sentiment. In this environment, identifying stocks that may be undervalued can present opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKAN Group (SWX:SKAN) | CHF61.40 | CHF120.15 | 48.9% |

| SBO (WBAG:SBO) | €27.30 | €54.56 | 50% |

| Robit Oyj (HLSE:ROBIT) | €1.155 | €2.26 | 49% |

| Pluxee (ENXTPA:PLX) | €17.40 | €34.03 | 48.9% |

| Norconsult (OB:NORCO) | NOK46.15 | NOK90.70 | 49.1% |

| Hanza (OM:HANZA) | SEK113.60 | SEK221.31 | 48.7% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 49% |

| dormakaba Holding (SWX:DOKA) | CHF744.00 | CHF1452.75 | 48.8% |

| Camurus (OM:CAMX) | SEK720.00 | SEK1416.78 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK84.90 | NOK169.50 | 49.9% |

Let's dive into some prime choices out of the screener.

Next Geosolutions Europe (BIT:NXT)

Overview: Next Geosolutions Europe SpA offers marine geoscience and offshore construction support services across Europe, Asia, and North America with a market cap of €580.80 million.

Operations: The company generates revenue from its Engineering Services segment, totaling €304.99 million.

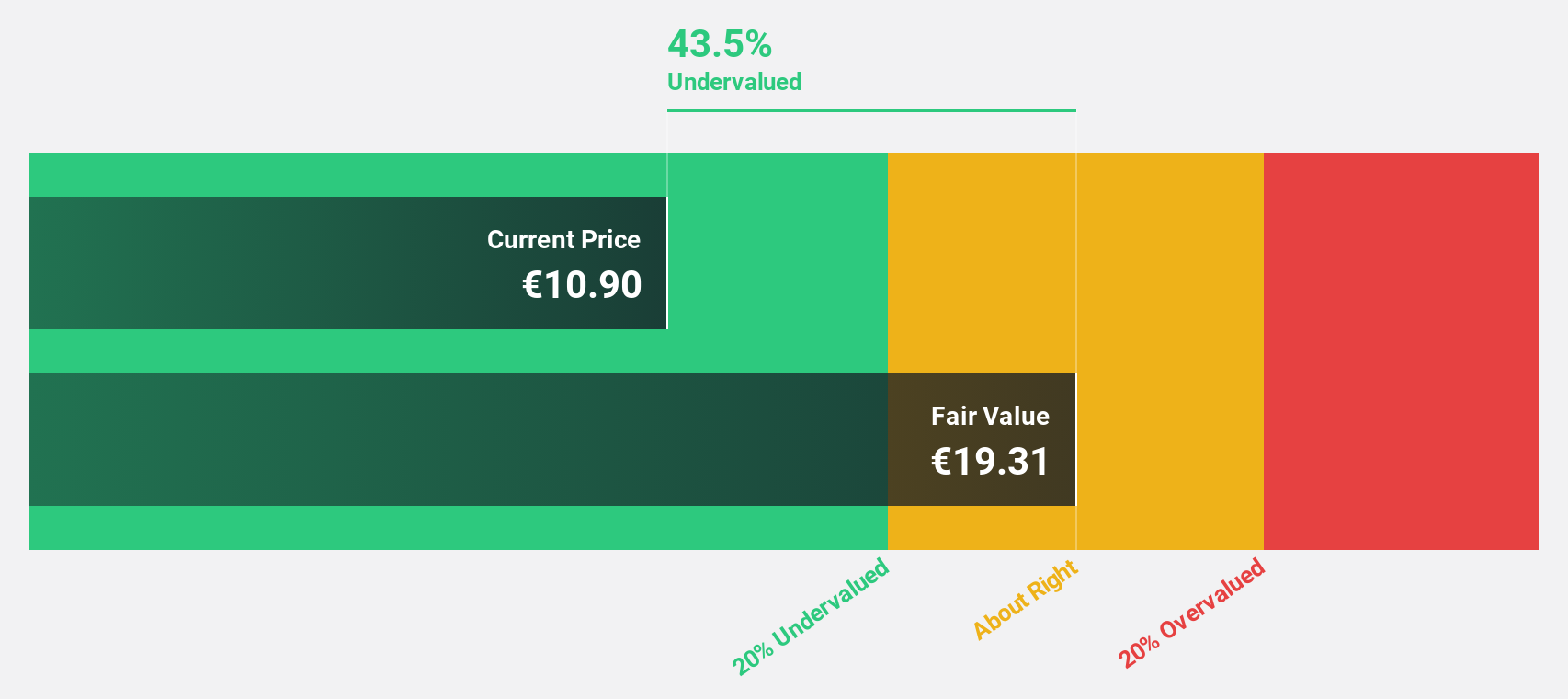

Estimated Discount To Fair Value: 37.5%

Next Geosolutions Europe is trading at €12.1, significantly below its estimated fair value of €19.36, suggesting it may be undervalued based on cash flows. Despite recent share price volatility and a decline in profit margins from 35.8% to 14.1%, the company's earnings are expected to grow substantially at 20.72% annually over the next three years, outpacing the Italian market's growth rate and reflecting potential for strong future performance relative to peers and industry standards.

- Our earnings growth report unveils the potential for significant increases in Next Geosolutions Europe's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Next Geosolutions Europe.

Aker BioMarine (OB:AKBM)

Overview: Aker BioMarine ASA is a biotech innovator that develops and supplies krill-derived products for consumer health and wellness worldwide, with a market cap of NOK7.45 billion.

Operations: Aker BioMarine generates revenue from its consumer health products segment, contributing $112.40 million, and human health ingredients segment, adding $105.30 million, along with emerging businesses bringing in $8.60 million.

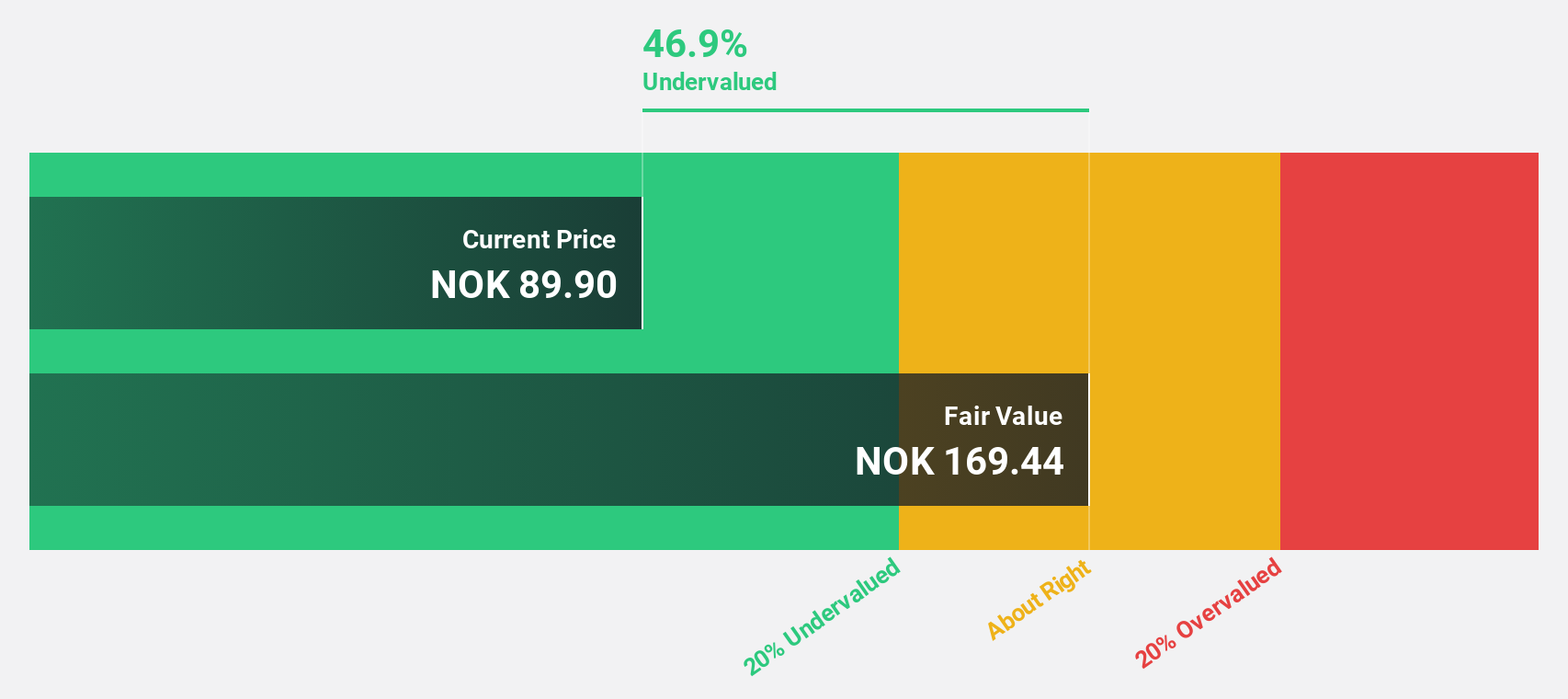

Estimated Discount To Fair Value: 49.9%

Aker BioMarine is trading at NOK84.9, well below its estimated fair value of NOK169.5, highlighting potential undervaluation based on cash flows. Although the company reported a net loss of US$17.6 million for the first half of 2025, earnings are projected to grow annually by 100.01%, with profitability expected within three years. While revenue growth is slower than desired at 13% per year, it still surpasses the Norwegian market's average growth rate.

- The analysis detailed in our Aker BioMarine growth report hints at robust future financial performance.

- Dive into the specifics of Aker BioMarine here with our thorough financial health report.

Diagnostyka (WSE:DIA)

Overview: Diagnostyka S.A. operates as a medical laboratory and has a market cap of PLN6.84 billion.

Operations: The company generates revenue from its Medical Labs & Research segment, amounting to PLN2.06 billion.

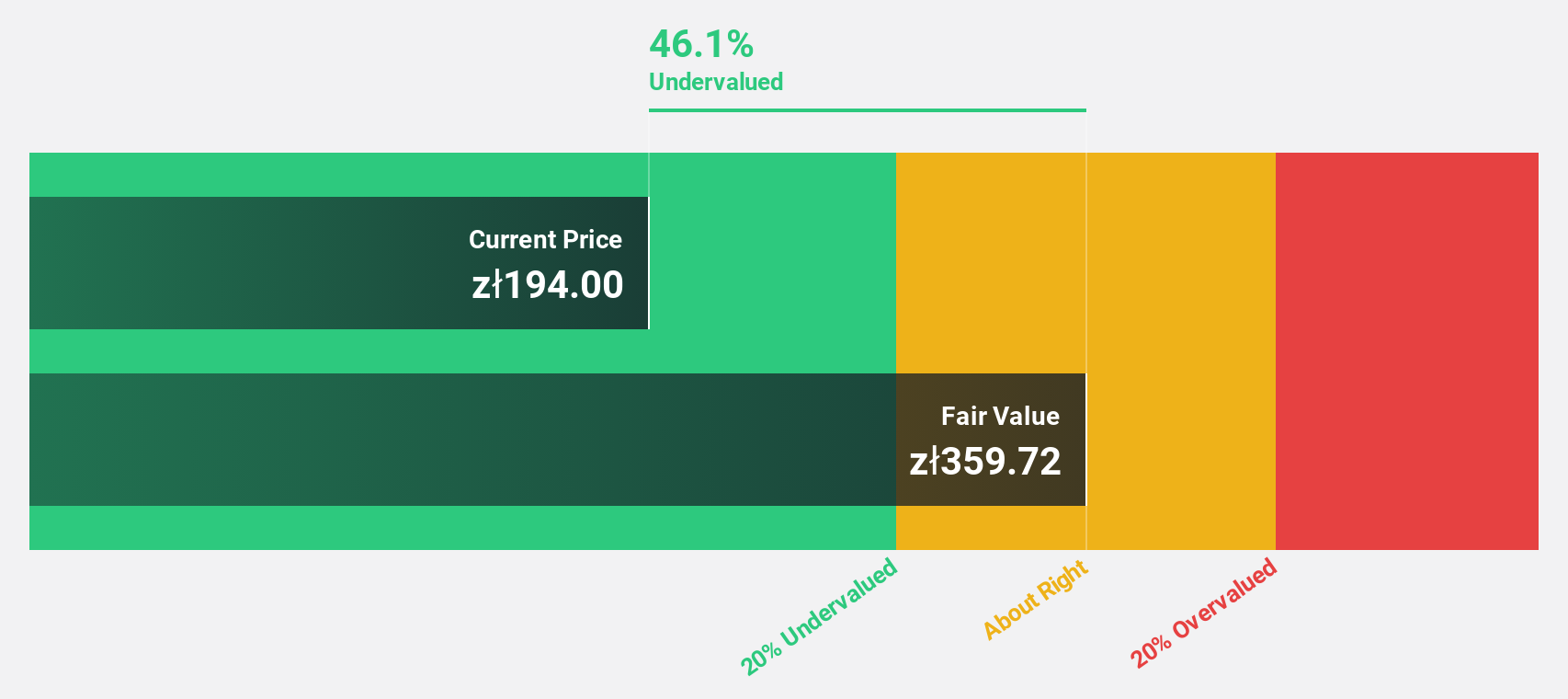

Estimated Discount To Fair Value: 37.4%

Diagnostyka is trading at PLN202.5, significantly below its estimated fair value of PLN323.25, suggesting undervaluation based on cash flows. Earnings grew by 56.2% last year and are forecast to grow annually by 16.87%, outpacing the Polish market's growth rate of 13.9%. Despite a high level of debt, revenue is expected to increase at 11.1% per year, faster than the market average of 4.6%. Recently added to the S&P Global BMI Index, Diagnostyka shows promising potential amidst financial challenges.

- The growth report we've compiled suggests that Diagnostyka's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Diagnostyka.

Next Steps

- Click this link to deep-dive into the 214 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next Geosolutions Europe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NXT

Next Geosolutions Europe

Provides marine geoscience and offshore construction support services in Europe, Asia, and North America.

Undervalued with high growth potential.

Market Insights

Community Narratives