- Italy

- /

- Electric Utilities

- /

- BIT:EVISO

3 European Stocks Estimated To Be Up To 35.6% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets experience a downturn, with the STOXX Europe 600 Index falling by 2.57% amid dissatisfaction over trade negotiations with the U.S., investors are keenly searching for opportunities that might be undervalued amidst this market turbulence. In such an environment, identifying stocks trading below their intrinsic value could offer potential value to investors looking to navigate these challenging market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.46 | €6.88 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK176.50 | NOK348.17 | 49.3% |

| Qt Group Oyj (HLSE:QTCOM) | €57.40 | €113.83 | 49.6% |

| Profoto Holding (OM:PRFO) | SEK21.60 | SEK42.40 | 49.1% |

| Pluxee (ENXTPA:PLX) | €17.33 | €33.98 | 49% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.80 | €23.21 | 49.2% |

| Hanza (OM:HANZA) | SEK108.40 | SEK213.64 | 49.3% |

| Green Oleo (BIT:GRN) | €0.835 | €1.63 | 48.6% |

| Diagnostyka (WSE:DIA) | PLN184.80 | PLN362.30 | 49% |

| Camurus (OM:CAMX) | SEK675.00 | SEK1344.78 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

eVISO (BIT:EVISO)

Overview: eVISO S.p.A. develops an artificial intelligence platform for the commodities market in Italy and has a market cap of €220.65 million.

Operations: The company's revenue segments are not provided in the available text.

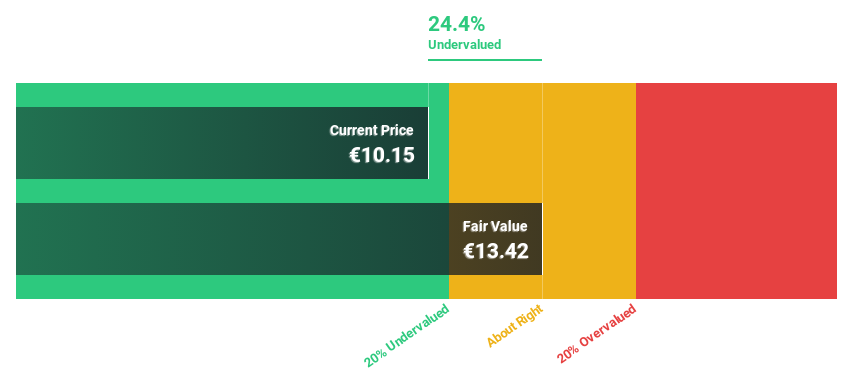

Estimated Discount To Fair Value: 25.7%

eVISO is trading at €9.92, significantly below its estimated fair value of €13.36, indicating it may be undervalued based on cash flows. Analysts expect the stock price to rise by 21%, supported by robust revenue growth forecasts of 20.3% annually and earnings growth of 32% per year, outpacing the Italian market's average. The company's Return on Equity is projected to reach a high level of 31.7% in three years, reinforcing its potential for value investors.

- The growth report we've compiled suggests that eVISO's future prospects could be on the up.

- Get an in-depth perspective on eVISO's balance sheet by reading our health report here.

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of a wide range of vehicles and propulsion systems across various regions including Europe and the Americas, with a market cap of €4.87 billion.

Operations: The company's revenue segments include Financial Services, which generated €498 million.

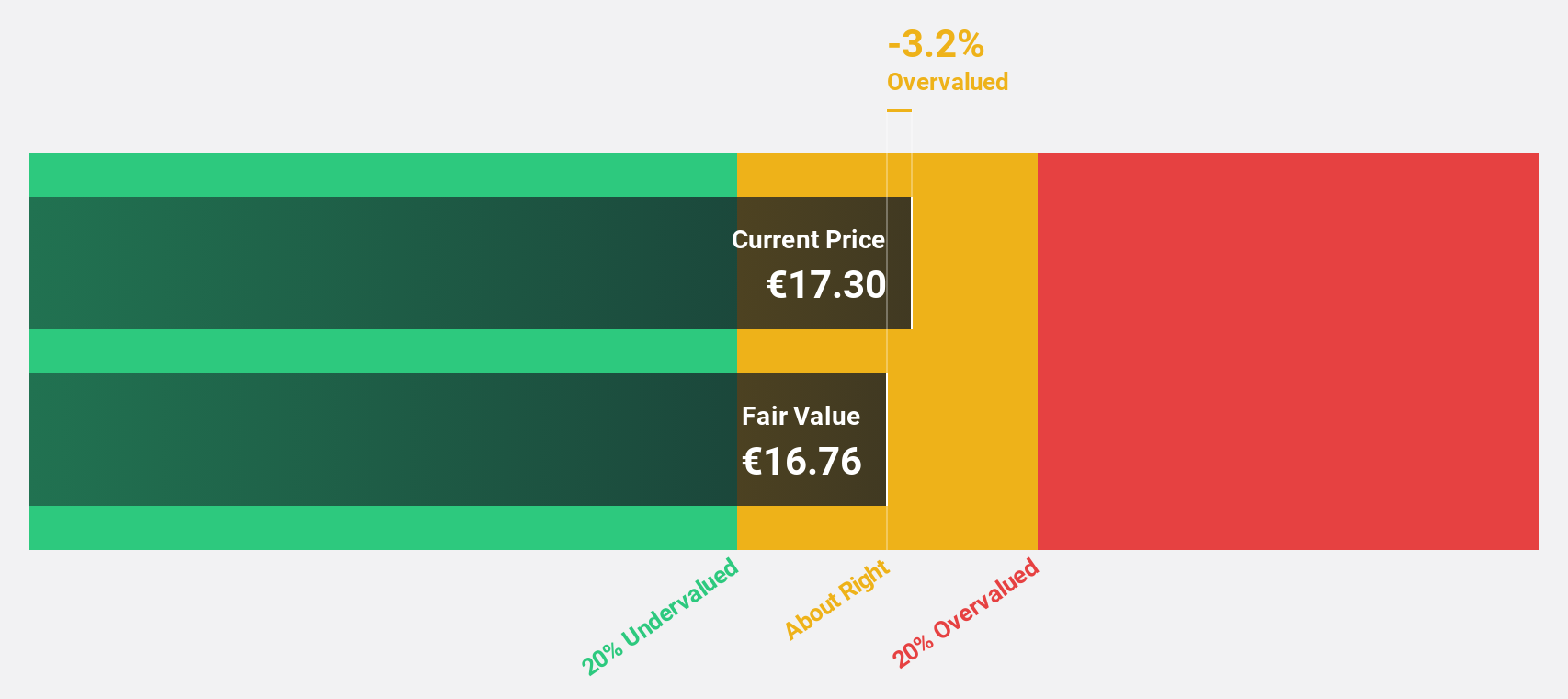

Estimated Discount To Fair Value: 29.9%

Iveco Group is trading at €18.3, below its estimated fair value of €26.09, suggesting potential undervaluation based on cash flows. Despite a volatile share price, earnings are projected to grow significantly at 21.5% annually, outpacing the Italian market's average growth rate. However, revenue growth is expected to be slower at 5.4% per year compared to broader expectations and Return on Equity is forecasted to be relatively low at 19.1%.

- In light of our recent growth report, it seems possible that Iveco Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Iveco Group.

TF Bank (OM:TFBANK)

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK8.87 billion.

Operations: TF Bank generates revenue through its segments: Credit Cards (SEK745.39 million), Consumer Lending (SEK602.84 million), and Ecommerce Solutions excluding Credit Cards (SEK396.96 million).

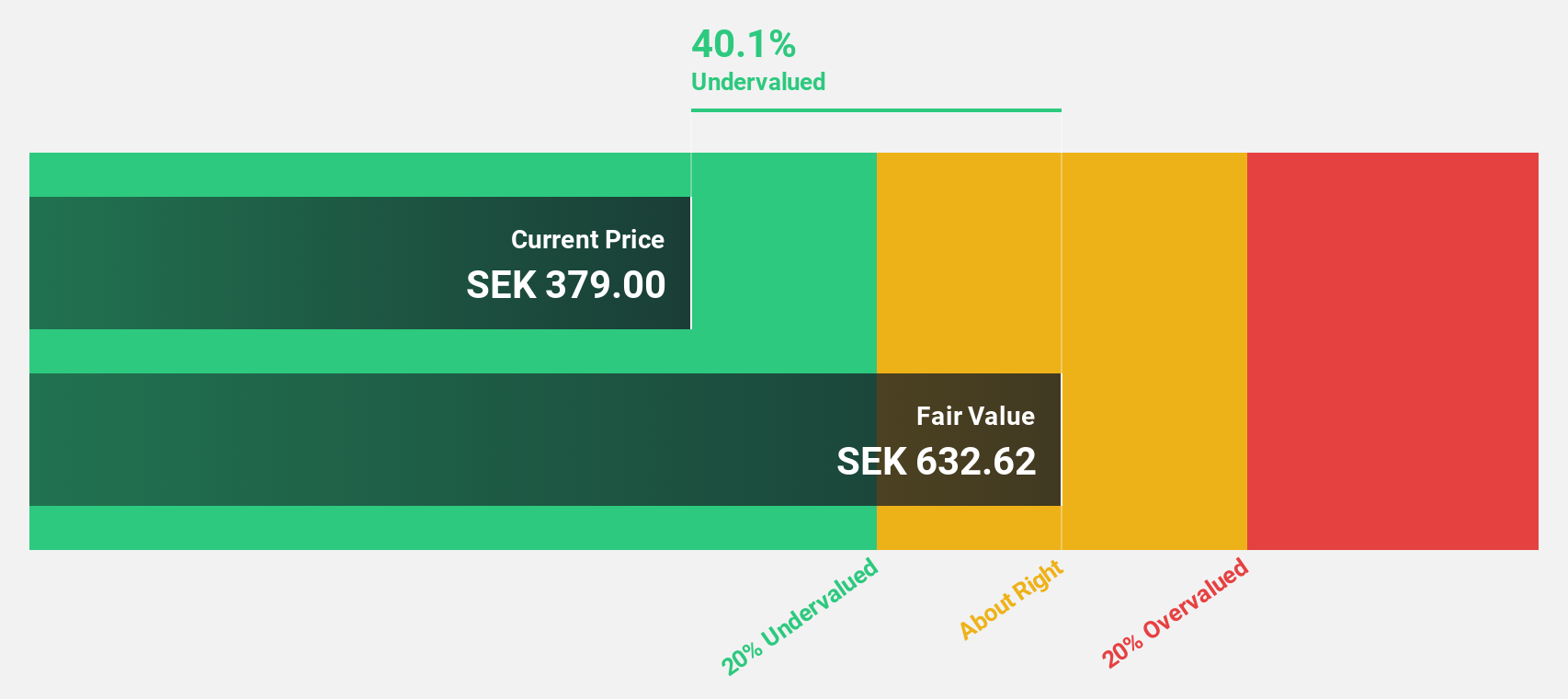

Estimated Discount To Fair Value: 35.6%

TF Bank, trading at SEK137.2, is valued 35.6% below its estimated fair value of SEK213.06, highlighting potential undervaluation based on cash flows. Despite a high level of bad loans at 4.5%, the bank's revenue growth forecast outpaces the Swedish market significantly at 34.2% annually, while earnings are expected to grow by 19.1%. Recent results show improved net income and earnings per share compared to last year, although insider selling remains a concern.

- Upon reviewing our latest growth report, TF Bank's projected financial performance appears quite optimistic.

- Navigate through the intricacies of TF Bank with our comprehensive financial health report here.

Next Steps

- Dive into all 193 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:EVISO

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026