Interpump Group S.p.A. (BIT:IP) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Unfortunately for some shareholders, the Interpump Group S.p.A. (BIT:IP) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

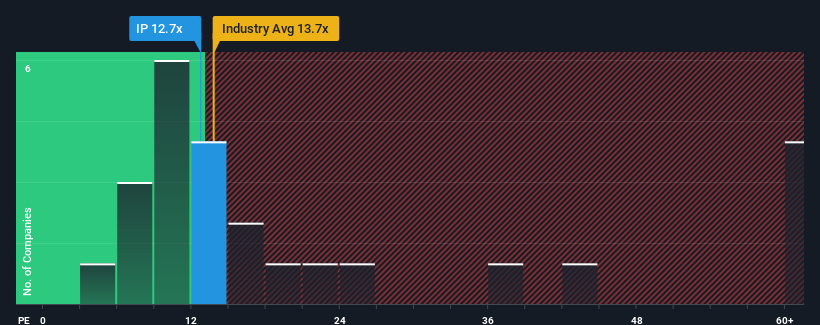

Although its price has dipped substantially, there still wouldn't be many who think Interpump Group's price-to-earnings (or "P/E") ratio of 12.7x is worth a mention when the median P/E in Italy is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Interpump Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Interpump Group

What Are Growth Metrics Telling Us About The P/E?

Interpump Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 6.0% per year over the next three years. That's shaping up to be materially lower than the 13% per annum growth forecast for the broader market.

With this information, we find it interesting that Interpump Group is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Interpump Group's P/E

Following Interpump Group's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Interpump Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Interpump Group that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IP

Interpump Group

Engages in the manufacturing and selling of high-pressure pumps in Italy, rest of Europe, North America, Far East and Pacific Area, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives