The Attractive Combination That Could Earn I.M.A. Industria Macchine Automatiche S.p.A. (BIT:IMA) A Place In Your Dividend Portfolio

Dividend paying stocks like I.M.A. Industria Macchine Automatiche S.p.A. (BIT:IMA) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

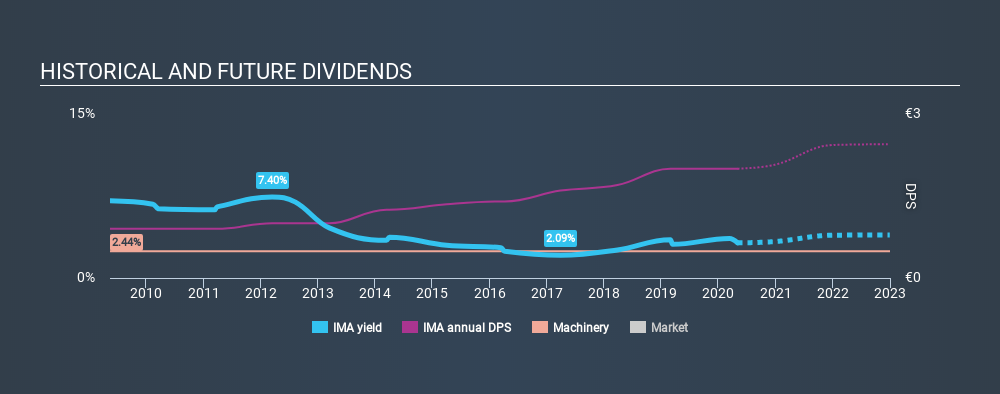

In this case, I.M.A. Industria Macchine Automatiche likely looks attractive to investors, given its 3.2% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on I.M.A. Industria Macchine Automatiche!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, I.M.A. Industria Macchine Automatiche paid out 47% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. I.M.A. Industria Macchine Automatiche paid out 76% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's positive to see that I.M.A. Industria Macchine Automatiche's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Is I.M.A. Industria Macchine Automatiche's Balance Sheet Risky?

As I.M.A. Industria Macchine Automatiche has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 2.47 times its EBITDA, I.M.A. Industria Macchine Automatiche has a noticeable amount of debt, although if business stays steady, this may not be overly concerning.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. I.M.A. Industria Macchine Automatiche has interest cover of more than 12 times its interest expense, which we think is quite strong.

Remember, you can always get a snapshot of I.M.A. Industria Macchine Automatiche's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. I.M.A. Industria Macchine Automatiche has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was €0.90 in 2010, compared to €2.00 last year. Dividends per share have grown at approximately 8.3% per year over this time.

Companies like this, growing their dividend at a decent rate, can be very valuable over the long term, if the rate of growth can be maintained.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see I.M.A. Industria Macchine Automatiche has grown its earnings per share at 25% per annum over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

To summarise, shareholders should always check that I.M.A. Industria Macchine Automatiche's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, we like that I.M.A. Industria Macchine Automatiche pays out a low fraction of earnings. It pays out a higher percentage of its cashflow, although this is within acceptable bounds. Next, growing earnings per share and steady dividend payments is a great combination. Overall we think I.M.A. Industria Macchine Automatiche scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 4 warning signs for I.M.A. Industria Macchine Automatiche (of which 1 is potentially serious!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion